Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

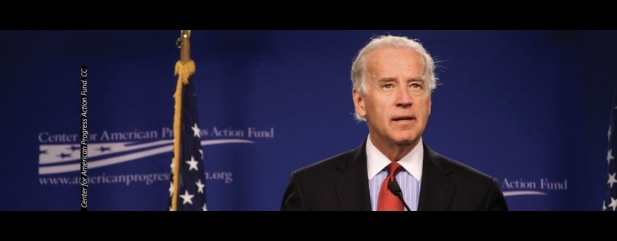

Strong Biden support brings relief for Wall Street

US stock markets may have avoided a major headwind as former vice president Joe Biden took the lead in the race to battle Donald Trump in November’s presidential election.

Democrat-voting Americans in several states voted on ‘Super Tuesday’ for the candidate they want to take on Republican president Trump.

Veteran left-wing politician Bernie Sanders, who shares similar views to Labour’s Jeremy Corbyn, had been considered the favourite going into the polls but a series of wins in key states, including Texas, has left the more moderate Biden as the frontrunner.

That will come as a relief to markets, which analysts had predicted would ‘panic’ if Sanders stormed into a strong lead, affecting major indices like the S&P 500, Dow Jones and Nasdaq.

The race between Sanders and Biden could stretch all the way to the Democratic National Convention in July.

A popular politician, particularly in Middle America, with a highly extroverted personality, Biden appeals to liberal voters in the States who want higher taxes on the rich but eschew the more radical socialist policies of Sanders.

For example, Sanders wants to make university tuition free and write off all $1.6tn of student debt, arguing that this is a key pillar of reducing income inequality, something modern scholars agree is one of the big issues of our time.

To fund this he plans to tax Wall Street ‘gambling’ by placing a levy, similar to stamp duty in the UK when buying shares, on all financial transactions – 0.5% on stock trades, 0.1% on bond trades and 0.005% on derivatives.

Biden is a lot more moderate on such policies, calling for lower interest rates on federal loans and an extension of the student debt forgiveness program currently in place.

He too likes the idea of a financial transaction tax, though his tax plan would mainly involve higher rates of capital gains tax.

Another radical Sanders policy not shared by other Democrat candidates is to give 20% of a company’s shares to employees and put workers on the board of directors in public companies and those that have over $100m in annual revenue.

However, legendary investor Warren Buffett – who revealed he usually votes for the Democrats – thinks such a plan is a ‘particularly bad idea’.

He told CNBC: ‘I’m very much in sympathy with the fact senator Sanders believes that a lot of people are getting left behind through no fault of their own. There’s all kinds of capitalism that need in some ways to be regulated, but I don’t believe in giving up the capitalist system.’

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine