Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

SSE offers much more than decent dividends

In recent years utility SSE (SSE) has reduced its reliance on fossil fuels and become a developer, operator and owner of low-carbon, renewable energy assets and businesses.

As a result, SSE has become an increasingly popular stock among those looking for ‘green’ or environmental investments, especially with the UK having committed to bringing its greenhouse gas emissions to ‘net zero’ by 2050.

SSE, or Scottish and Southern Electricity, is one of Britain’s biggest electricity generators and distributors with operations across the UK and Ireland.

The firm is involved in the generation, transmission, distribution and supply of electricity, the production, storage, distribution and supply of gas, and the provision of energy-related services.

MARKET BACKGROUND

The UK electricity market is divided into two parts, wholesale and retail. Wholesale customers buy their electricity from generators and traders either directly or through exchanges, and contracts can range from a single day to several years.

In the retail market, domestic customers choose a supplier who then buys energy directly from a generator or from the wholesale market and arranges for it to be delivered to the consumer.

Total electricity demand in 2018, the last year for which the Government has published the data, was 352 terawatt-hours (TWh). Around 30% of demand came from domestic users, 26% came from industrial users like manufacturers, and 21% came from commercial users.

Public bodies made up 5% of demand, fuel industries accounted for another 7% and shockingly 8% went in transmission losses.

A LOW-CARBON GENERATOR

With the energy industry going through a period of rapid transformation, SSE has moved to make both its generating and its distribution assets as ‘clean’ as possible from an environmental perspective.

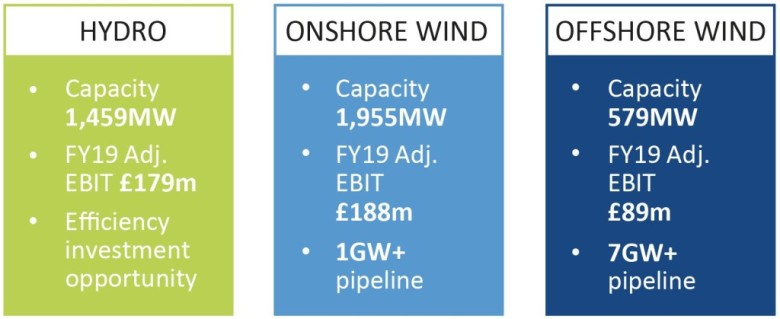

It is already the UK’s leading renewable generator with nearly 7,000 gigawatt-hours (GWh) of production, having invested heavily in recent years in onshore and offshore wind, as well as operating conventional hydro-electric and pumped-storage generation.

In the nine months to 31 December, renewable power accounted for 34% of the company’s electricity output.

Most of the rest came from gas and oil-fired generation, which while it isn’t as clean as renewables produces fewer emissions than the limited remaining coal-fired generating capacity.

SSE has committed to trebling its renewables output by the end of this decade, including more than doubling its UK wind capacity by 2025.

Analysts at Jefferies believe that the pipeline of wind projects alone will translate into an increase in shareholder value of 200p per share given current tariffs and recent deal multiples.

At the same time its transmission network has a key role to play in the ‘decarbonising’ of transport and the shift to electric vehicles. Despite pressure from the regulator to keep prices low, analysts see operating profits remaining flat in electricity transmission and gas distribution.

MORE STREAMLINED BUSINESS

In order to focus more on its core generation and distribution businesses, SSE sold its UK household energy and services business to OVO Energy for £500m in January, with most of the £400m cash component going towards paying down group debt.

This month, the last of its coal-fired plants – which generates less than 5% of the group’s energy output – will cease production, to be replaced by the cleanest and most efficient gas-fired power station in Europe, and later this year the firm aims to sell off its gas production assets as well.

This will leave the group focused on gas and oil-fired generation, hydro-electric power and onshore and offshore wind, which is where the future value of the business lies.

At the same time SSE is also exploring opportunities to cut emissions further through hydrogen technology, which will allow flexible power stations to provide large-scale generation in a ‘net zero world’.

NOT WITHOUT RISK

Buying a regulated business does come with risks. It’s possible that subsidies for renewable energy may change, for example, or that energy prices could be capped further.

Also renewable energy is weather-dependant, although SSE’s gas-fired plants are flexible and always there as a back-up

if needed.

Renewable energy prices could fall. For example, we note there is a glut of supply coming on stream with solar energy in mainland Europe which is pushing down prices, yet this is not SSE’s focus.

Finally the dividend – typically a reason for investors choosing a utility stock for their portfolio – could be at risk if earnings fall short of estimates, as cover is marginal at best even on Jefferies’ upbeat forecasts. Though this is not unusual in the utilities sector thanks to the relatively predictable revenue streams.

Not everyone thinks a dividend cut would be cause for concern. Ed Legget, manager of the Artemis UK Select Fund (B2PLJG0), believes that if SSE can make a convincing enough case around future growth through investing in renewable energy then investors might actually approve of a cut to the dividend.

In the last 12 months SSE shares have gained more than 50%, from a low of just over £10 to £15.32, and have outperformed the market during the coronavirus melt-down. If investors can appreciate the longer-term transformation story at play here, there is scope for the shares to keep outperforming.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine