Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

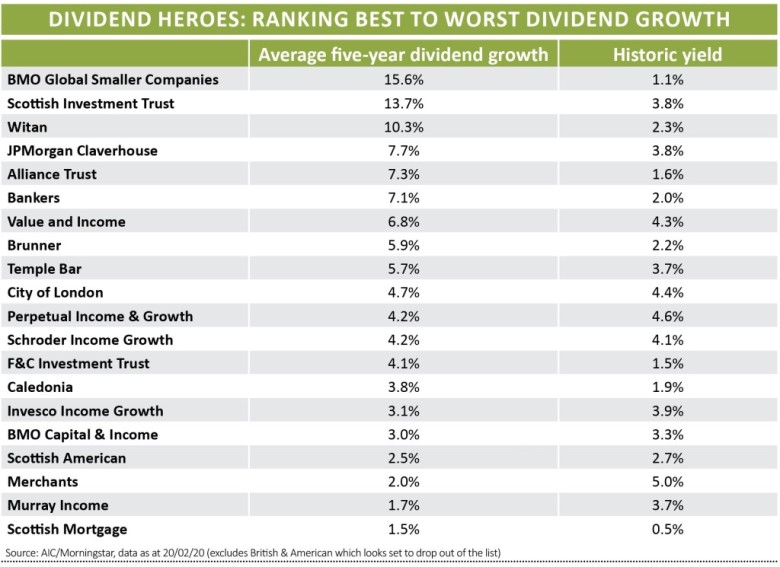

Dividend Hero investment trusts with the best and worst dividend growth

Investment trust ‘Dividend Heroes’ are those which have increased their dividends every year for at least 20 years in a row.

Published by the Association of Investment Companies (AIC), this list reveals those closed-ended funds with the most formidable dividend growth records, although it doesn’t tell you the level of growth and what it would be in real terms when adjusted for inflation.

This is important, because UK inflation jumped to 1.8% in January, up from 1.3% a month earlier, and if a trust’s dividend growth fails to keep pace with the cost of living then the ‘real’ value of these dividends will be eroded.

Given the appetite for income from yield-starved investors, classification as a ‘Dividend Hero’ is a valuable marketing tool for investment trusts and is among the reason they pull out all the stops to stay in the index.

However, all they need to do is raise the dividend by a very small amount to keep ‘Dividend Hero’ status. So which trusts are pushing through miniscule dividend increases and which ones are more generous?

WHO IS COMING UP SHORT?

Data compiled for Shares by the AIC shows the average annualised dividend growth ‘heroes’ have delivered over the past five years.

The least generous payers, according to this data, include Murray Income (MUT) which has chalked up a dividend increase in every one of the past 46 years. But average dividend growth over the past five years amounts to a meagre 1.7%.

The data also shows subdued 1.5% growth on average over five years from retail investor favourite Scottish Mortgage (SMT), which delivered a 2% total dividend increase to 3.13p for the year to March 2019. Yet the important point here is few investors own Scottish Mortgage for yield; this is first and foremost a long-term capital appreciation vehicle.

Merchants (MRCH) has amassed 37 consecutive years of dividend increases, although the AIC data reveals average five year dividend growth amounting to less than 2%.

The positive news going forward is that, helped by a refinancing of high-cost, long-term debt, the annual dividend for the year to January 2020 is set to be at least 4.2% higher year-on-year and extend Merchants’ dividend growth record to 38 years.

As its manager Simon Gergel argues, Merchants has a long history of rising dividends. He says: ‘This is supported by the investment trust structure which allows money to be placed in reserves in good years to support dividends in tougher years. At the end of last year, Merchants had a whole year’s dividend in reserves.’

Gergel’s investment approach emphasises buying well-positioned businesses that can continue to generate cash and pay dividends into the future, ‘not simply buying lowly priced, high yielding shares’.

He insists the underlying portfolio is generally performing well, with many companies posting healthy dividend increases and only one or two dividend cuts.

DEBT REFINANCING BOOSTS DIVIDEND GROWTH

Gergel also explains that strong performance over recent months is also allowing him to recycle money from shares that have performed well and offer lower dividend yields, towards cheaper shares with higher yields, ‘thus improving the portfolio’s income generation’.

He points out that recent debt refinancings have reduced the interest cost significantly and enhanced earnings per share, which is supporting dividend growth in the near term.

WHO ELSE HAS LOW DIVIDEND GROWTH?

Others with relatively modest five year growth rates include Scottish American (SAIN), and British & American (BAF) which looks set to drop off the list of ‘Dividend Heroes’ following the collapse in value of a major investment.

Scottish American’s 2019 dividend of 11.875p was 3.3% higher than the 2018 payout, and represented an increase more than twice the rate of UK CPI inflation over the same period. Yet the five year growth record is pegged back by skinny increases of 2.5% for 2017, 1.9% in 2015 and 1.2% for 2016.

These 2016 and 2017 increases were actually slightly below the annual rate of CPI inflation and followed a shift in allocation away from dependable fixed income investments and towards ‘real assets’, from which income was expected to grow in the future, as well as a deliberate decision to top up the trust’s revenue reserves.

INFLATION BUSTERS

By contrast inflation-busting payout progression has been delivered by the likes of global fund trio Bankers (BNKR), Alliance Trust (ATST) and Witan (WTAN), the latter having lavished five-year average dividend growth of 10.3% on shareholders.

Also meriting mention are BMO Global Smaller Companies (BGSC) with an average dividend growth of 15.6% and JPMorgan Claverhouse (JCH), which has racked up a 46-year record of rising payouts and impressive five year average dividend growth of 7.7%.

The well-regarded fund continues to benefit from a relatively high level of revenue reserves. This cash cushion gives its managers confidence future dividend increases will continue to beat the rate of inflation.

Elsewhere, Scottish Investment Trust’s (SCIN) five year average dividend growth of 13.7% reflects a step change increase in the regular dividend in recent years. Following a contrarian approach, ‘The Scottish’ raised its regular dividend for the year to October 2019 by 7.5% to 22.8p, marking its 36th year of regular dividend increase on the spin, topping this up with a 7.45p special dividend.

HOW BANKERS’ DIVIDEND GROWTH IS ACHIEVED

Global equities fund Bankers has the stated objective of achieving long-term capital growth in excess of the FTSE World index and annual dividend growth greater than RPI inflation. According to manager Alex Crooke, being a global investment trust and having revenue reserves are ‘great advantages’ to maintain and continue the legacy of The Bankers Investment Trust’s 53 years of consecutive dividend growth.

‘Our global reach means access to more areas of growth when certain sectors or countries stumble and the revenue reserve enables the trust to hold back some income in the strong years of corporate dividend growth to pay out in leaner ones.’

Crooke recognises the importance of delivering a reliable and growing income to shareholders and over recent years has built the revenue reserves to cope with the fluctuations of currencies or the need to prioritise asset allocation decisions towards lower yielding markets.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine