Taking tax free cash from a pension fund

One of the benefits of having a pension is that you can choose to take a tax free amount (usually 25% of the pot) from age 55 (57 from 6 April 2028). There are four ways of doing this:

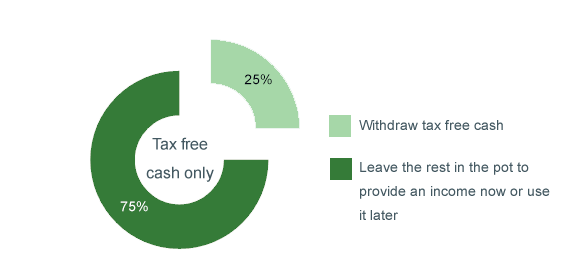

1. Take the tax free cash only

When you take the remaining amount it will be taxed as income in the year you take it. This could be taken as drawdown or the fund can be used to purchase an annuity. This is a popular option and is a good way to provide any cash you need. However, the cash you withdraw will no longer get the benefit of tax free investment growth and income.

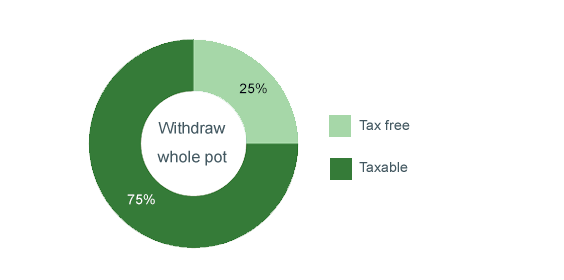

2. Take your whole pension fund including the tax free cash

Only 25% of the amount withdrawn will be tax free and you will have to pay tax on the rest, this might mean that it is taxed at a higher rate of income tax.

If you take your pension in one go you need to consider whether you have enough money left to provide an income as you grow older. However, if you need the cash and have retirement income from other sources this may work for you. Alternatively you could take the tax free cash and use the balance to purchase an annuity.

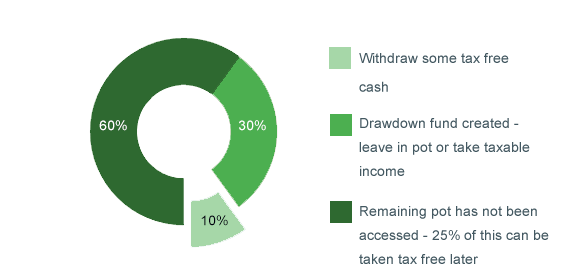

3. Take part of the tax free cash

In this example, you access 40% of your pension fund and withdraw 25% of the amount accessed (10% of the total pension). A drawdown fund is created and you can take a taxable income from this at any time.

This could be a good option if you need some cash but not as much as 25% of the whole fund. The amount not withdrawn is left in the pot to benefit from investment growth and income.

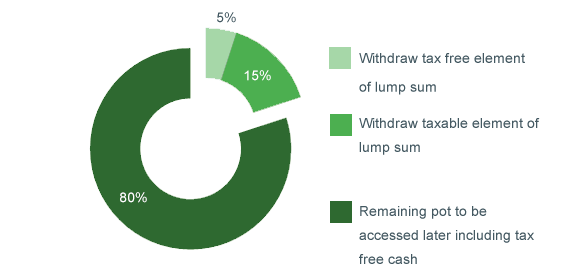

4. Take a lump sum including tax free element

Here 25% of the amount you withdraw is tax free and the remaining 75% is subject to income tax. By taking a pension lump sum and leaving the rest of your self-invested personal pension (SIPP) in the fund, you'll still have unused tax free cash to take in the future. This will allow you to spread the tax free benefit over several payments.

You’ll also need to be aware that if you decide to take a lump sum like this from your SIPP the amount you can continue to pay into it will reduce as you have flexibly accessed your SIPP. ‘Flexibly accessing’ your SIPP means, taking an income via flexi-access drawdown, taking pension lump sums or buying a flexible annuity.

Before you flexibly access your SIPP, you can contribute up to £60,000 annually. But after you flexibly access your SIPP, the amount you can pay into a money purchase pension (such as your SIPP) drops to £10,000 a year.

There’s no limit on further contributions if you access your SIPP non-flexibly, i.e. by only taking a tax free lump sum, or taking an income from non-drawdown funds.

Watch out for pension scams

Be aware if you are approached by email, phone, text or in person about withdrawing your pension pot.

Find out more