Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

From optimism to fear: how investors’ mindset has changed

An 11% decline in the FTSE 100 over a single week, and similar losses in many other markets around the world, has led to a change in investor mindset.

There are now widespread concerns about where markets go next and large numbers of investors want to now what everyone else is thinking to help shape their own views.

While global stock markets began to rebound at the start of this week (2 March), this rally didn’t feel like investors regaining confidence. Instead, it was a small pick-up in stock prices as markets reacted to central banks indicating they will do everything they can to support the economy – which is essentially interest rate cuts, and that is generally good for stocks.

The shift in how people currently feel about investing is perfectly natural when you consider the scale of the markets sell-off. It has been a terrifying time and really put a dent in portfolios.

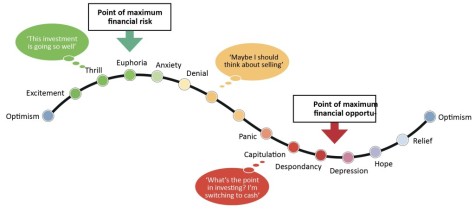

The accompanying graphic shows how people behave during different stages of the stock market cycle and it feels like we’re now around the ‘desperation’ stage.

Interestingly, social media was awash last week with many experienced investors saying they weren’t buying on the dip because we hadn’t reached the ‘capitulation’ stage. ‘People aren’t running around like headless chickens selling everything they can’ was the gist of their comments.

There is a big risk to corporate earnings if world trade is affected by borders being closed and the supply chain being interrupted. On one hand the market is correct to be factoring this risk into company valuations. On the other, when companies say they no longer have visibility over earnings it makes them very tricky to value.

Markets are likely to remain volatile in the coming weeks and there may well be another lurch down in share prices. That’s scary but now isn’t the time to turn your back on risk assets.

Rather than trying to time the markets, the lesson from previous sell-offs is anyone with a long-term view should stick to their current investment plan and keep investing money on a regular basis. Look for quality companies that have strong balance sheets and the ability to weather the coronavirus-related storm, or funds that seek such companies.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine