New to investing?

Take it easy with AJ Bell Dodl

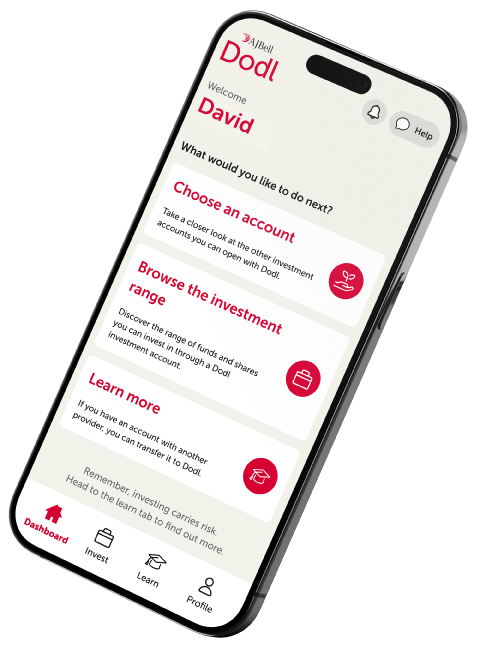

Never invested before? Or just know a good deal when you see one? Look no further than AJ Bell Dodl - your low-cost, little-effort investment app.

Scan your QR code, download Dodl and sign up for free.

Download Dodl and sign up for free.

AJ Bell Dodl offers a range of investment products but not advice. And remember, investments can rise and fall in value and you could end up with less than you originally invested. Learn more about the risks of investing.

How does Dodl work?

The clue's in the name! With your phone in your hand and AJ Bell Dodl app at the ready, you can start your investing journey in three quick and easy steps.

1

Open an accountDownload the app, sign up and open your Dodl account for free - all in a few short minutes.

2

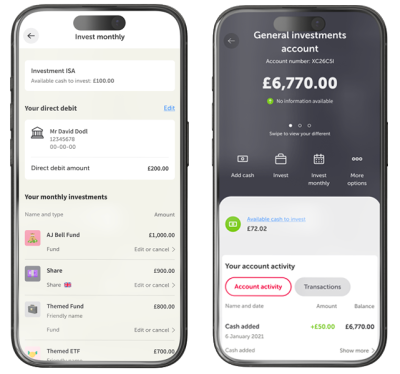

Add cash to itYou don't need much to get going on your investing journey. Start with as little as £25 a month.

3

Start investing!With cash in your account you can invest in anything from Dodl's streamlined investment range.

The accounts

Simple as Dodl is, you've still got a great range of investment accounts to choose from, with something for most financial goals.

And with an annual charge of just 0.15% of your investments, per account (minimum £1 per month), easy investing is easily affordable.

Is Dodl right for you?

It's a fuss-free, friendly place to start your investing journey, but Dodl may not be right for every investor. It all depends on what you're looking for.

Dodl could work for you if you're looking...

To manage your investments in app

For straightforward, standard investment options

To invest for yourself only (not a child)

Looking for something more?

No problem! You've got the whole range of AJ Bell accounts - including children's accounts - and investment options to explore. Just bear in mind, because of the wider range of investment options and advanced features, it costs more to invest with AJ Bell than AJ Bell Dodl.

Why choose AJ Bell Dodl?

When you choose Dodl, you're investing with AJ Bell - a Which? recommended investment platform five years running and home to over 490,000 people's investments.

AJ Bell's listed in the FTSE 250. Plus, your cash and eligible investments are also covered by the Financial Services Compensation Scheme (FSCS) up to £85,000.

Dodl's account charge is one of the lowest for any investment app. You'll never pay more than 0.15% to hold your investments, with no dealing charges.

Whether you reach our lovely Team Dodl through the speedy in-app chat or via email, they'll be there to lend a hand at every step of your investing journey.