Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Cut price stocks and funds for your ISA

Investing is about putting your money to work in the markets over a long period. So while markets are presently experiencing large share price movements up and down, it is important to look beyond the current volatility and continue to feed money into your investment account.

As well as remaining invested through periods of volatility the looming end of the tax year provides an opportunity to make use of any of your remaining annual ISA allowance, should you have the means to do so.

If you do, you will be adding to your portfolio at a time when markets are close to their lowest levels in more than a decade. You would be getting considerably more shares or fund units compared to the same amount of money one year ago.

We believe the indiscriminate selling has created an opportunity to buy some excellent companies and funds at attractive prices. The Shares team has identified six of our best ideas

to help fill your ISA before the end of the tax year on 5 April.

Given the scale of the economic hit from measures taken to contain the virus, we accept it may not be smooth sailing for all of these selections in the short-term. We also cannot rule out the possibility you might soon be able to buy at even lower prices, but we think over time our picks are well placed to trade materially higher than they do today.

They are therefore well suited to people making use of a standard Stocks & Shares ISA (£20,000 allowance) or a Junior ISA (£4,368 allowance this tax year, rising to £9,000 from next tax year) to invest for long term.

They are less suitable for someone using a Liifetime ISA to save for a deposit on a house in the next one to three years or indeed anyone who might need to access their cash in the near future. We discussed the different ISA products in this in-depth article.

While the world, economy and markets will recover from coronavirus we do think there could be changes in the way we interact with each other and the way businesses operate. We have tried to factor these potential changes into our picks.

For the individual companies we have also taken a close look at their balance sheets to ensure they are well placed to withstand any near-term strain on their finances.

OUR ISA PICKS

Alliance Trust (ATST) 572.6p

This investment trust provides access to top-notch fund managers via a single product. Investors benefit from accessing the skills of many different experts, meaning they not only spread risks around approximately 200 different companies in the portfolio but they also aren’t reliant on a single manager.

Alliance Trust (ATST) is run by a panel of nine asset managers, each of whom have one or more fund managers picking 10 to 20 stocks to go into the trust’s portfolio. The panel is chosen by investment management group Willis Towers Watson (WTW) and the choice of managers is reviewed on an ongoing basis.

The portfolio features a range of sectors including tech, healthcare and financials. The shares are currently trading on a 17% discount to net asset value, compared to a 12-month average of 5.9%.

The trust’s charges are relatively low at 0.64% and it has 53 years of consecutive dividend growth. It declared 13.96p in dividends for the 2019 financial year, equal to a 2.6% yield on the current price.

The aim is to outperform a basket of 3,000 global stocks – as measured by the MSCI All Country World index – by 2% a year over rolling three-year periods. In 2019, it achieved 23.1% total return on a net asset value basis versus 21.7% for its benchmark.

The panel of managers have different styles, providing investors with further diversification. For example, panel member SGA seeks global businesses with strong pricing power, recurring revenue and plenty of growth opportunities.

In contrast, panel member Vulcan Value looks for high quality businesses that have the ability to compound in value over the long term, and only buys when the share price is discounted. A good example is Google’s parent company Alphabet whose shares temporarily sold off last year.

‘Vulcan looks for growth companies it would be comfortable owning for the next 10 years, yet only buys the shares when they are trading below intrinsic value. Such opportunities may only happen when you get sell-offs across the market,’ says Craig Baker, global chief investment officer of WTW. ‘That’s why some of the managers on Alliance Trust are currently seeing opportunities caused by coronavirus market disruption.’

Interestingly, WTW will allocate a greater portion of the Alliance Trust pot to managers who are underperforming because their style might be out of favour, rather than giving more to ones doing really well. But if they are just picking the wrong stocks, they’ll be shown the door.

Hilton Food (HFG) 945p

Investors seeking a resilient, cash generative and progressive dividend-paying ISA selection should consider Hilton Food (HFG), a global food packing business whose robust balance sheet should help it navigate the coronavirus crisis.

Floated in 2007 at 150p, Hilton Food forged its reputation by packaging up red meat for retailers including Tesco (TSCO), Ahold in Europe and Woolworths in Australia, from state-of-the-art plants using automation and robotics.

Growing volumes with supermarkets around the world, Hilton Food is a company to own for the long term as it exports a proven, cash generative business model to additional territories with existing and new retail customers. Supplier consolidation in the industry favours scale operators such as Hilton, able to produce private label packed meats cost effectively while meeting high traceability standards.

Furthermore, the need for supermarkets to keep their shelves stacked during recent bouts of pandemic-induced panic buying may well have given volumes a boost. Hilton Food is certainly moving with the times, tapping into consumers’ appetite for healthier eating options by diversifying into high-growth proteins.

The £81m, 2017 acquisition of fish processor Seachill provided an entry into the growing fish protein category – Seachill enjoyed a full year of Tesco shellfish business in 2019 as well as increased level of breaded products to Waitrose last year – and is also benefiting from the booming trade in vegetarian and vegan products made by its vegetarian and vegan business Dalco.

Holland’s leading vegetarian product maker, Dalco has secured listings with a number of Hilton’s retail customers, although one risk to weigh is whether the vegan movement ultimately results in a drop in meat-related business and whether there is enough plant-based activity to pick up the slack.

Hilton’s results for the year ended 29 December are due on 26 March and will confirm a continuation of the strong year-on-year sales and volume growth driven primarily by Hilton’s operations in Australia, not to mention growth in a number of existing and new markets. However the market’s focus will be on the impact of the coronavirus crisis on this well-capitalised business.

Before the escalation of the pandemic, Shore Capital’s 2019 forecasts called for pre-tax profit of £47.4m and earnings per share of 43.3p in a year of consolidation for Hilton. The broker was expecting a return to double-digit growth in 2020, calling for pre-tax profit of £54m and EPS of 49.1p, although those forecasts look optimistic in light of current events.

Smith & Nephew (SN.) £12.60

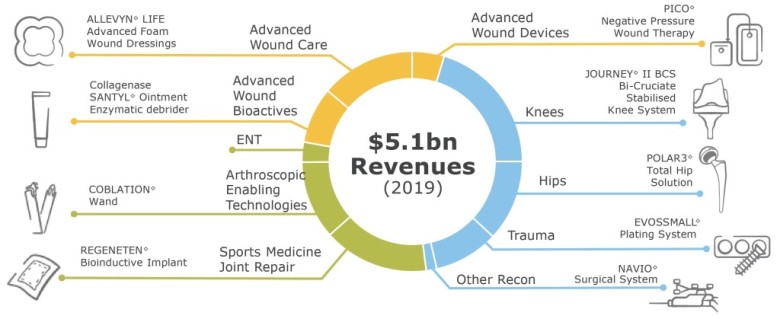

Shares in hip and knee medical devices maker Smith & Nephew (SN.) have slumped 45% since reporting market beating full-year 2019 revenues and profits on 20 February.

Chief executive Roland Diggelmann highlighted an improving trend in underlying revenue growth (4.4%), the best for several years as group sales topped $5bn for the first time.

In addition, analysts have since continued to nudge-up their earnings expectations for 2020. This means that the stock’s price to earnings (PE) ratio has dropped to the lowest level in a decade.

To illustrate, the price-to-earnings ratio today is just 12 times compared with 22 times on 20 February.

We believe that the fall in the share price is the result of panic selling of all UK shares as investors react to growing economic risks as a result of the coronavirus pandemic.

This has created a great opportunity for long-term investors to pick-up a quality share on the cheap.

The company operates three global franchises in growing markets with defendable positions. The business achieves consistently high operating margins and returns on equity, which provides it with the financial muscle to invest in organic growth as well as acquisitions in faster growth segments.

Five acquisitions were made in 2019, the largest of which was the $660m purchase of Osiris Therapeutics while so far this year Tusker Medical has been added to the stable of niche, high growth businesses.

One of the more interesting growth areas is in the so called active healing or bioactive market, thought to be growing at 10% a year and worth $1bn in revenues.

Wound bioactive materials have intrinsic healing properties that release antibodies, plant extracts or insulin, which aid the healing process.

Smith & Nephew’s business has a fair degree of operating leverage, which means that even single digit revenue growth translates into double-digit profit increases as more revenue drops turns into profits.

There are few businesses unaffected by the economic damage being unleashed from by the coronavirus pandemic. Smith & Nephew has a globally diversified business and strong market positions, which give it resilience in time of economic stress.

The long-term demand drivers for Smith & Nephew’s products remain firmly in place, though delays to elective surgeries as hospitals focus on tackling coronavirus is a potential short-term headwind.

Obesity is on the rise across the globe, which is a major risk factor for contracting diseases such as diabetes and joint related problems.

Smithson Investment Trust (SSON) £10.44

It says a lot about the indiscriminate nature of the recent sell-off that shares in Smithson (SSON) were down around a third in less than

a month.

Smithson – the name stands for Small & Mid Cap Investments That Have Superior Operating Numbers – is the brainchild of Terry Smith, founder of the Fundsmith Equity Fund (B41YBW7), and as such it shares the same ‘quality’ bias.

Its aim is to provide a superior risk-adjusted return over the long term by investing in companies with market capitalisations between £500m and £15bn, by following the same strategy as Fundsmith: buy good companies, don’t overpay, and do nothing.

While we constantly advocate that investors make use of ’time in the market’ rather than trying to ‘time the market’, we realise that many investors – including professionals – do not have the luxury of being able to take a long-term view of five or ten years.

Most professional investors for example are measured on a monthly or quarterly basis, and as the fund management industry moves increasingly towards gathering assets rather than managing assets their short-term performance is increasingly scrutinised.

Smithson, as its fact sheet says, only invests in companies ‘which we can own for the long term, which we believe will continue to compound in value over many years and will therefore become worth significantly more.’

Investors should note that the trust doesn’t pay a dividend as its ‘primary objective is to provide shareholder returns through long-term capital appreciation rather than income’.

The managers look for companies which generate substantial cash flows and can sustain a high return on operating capital employed (ROCE) rather than growth in earnings per share (EPS).

If a company can reinvest some of its cash flow back into the business and continue to generate a high return on capital, its cash flows will compound over time, increasing the intrinsic value of the business.

Sources of sustainable high returns include ‘intangible assets’ such as dominant market shares, strong brands, patents, customer relationships, distribution networks and large installed bases of equipment or software which provide a captive market for services, spares and upgrades.

Performance in 2019 was strong, with the shares gaining 29.8% and net asset value (NAV)gaining 33.2%, but in February the shares gave back almost 12% and this month’s sell-off has brought them down to even more attractive levels and a discount to NAV.

SSE (SSE) £11.34

Utility companies have always been in favour with investors in times of stress as their boring, stable nature makes them particularly appealing when the rest of the market is in turmoil.

Known as ‘bond proxies’ because they have a reliable earnings stream, predictable cash flow and like bonds have reliable income through decent dividends, utilities are generally considered safe investments.

Indeed during this economic crisis due to the coronavirus pandemic, the government has moved to protect the revenues of utility firms even if customer bills are temporarily scrapped.

The pick of the bunch in the sector in our view is SSE (SSE), which has the best growth prospects and is also a ‘greener’ investment than its competitors with its focus on renewable energy.

It is already the UK’s leading renewable generator with nearly 7,000 gigawatt-hours of production, with renewable power accounting for 34% of the company’s electricity output in the nine months to 31 December.

SSE has committed to trebling its renewables output by the end of this decade, including more than doubling its UK wind capacity by 2025.

Writing back in February, analysts at Jefferies conservatively estimated a 200p per share value creation from this pipeline.

Looking long-term they also foresee a re-rating of SSE shares coming from the sale of its gas production assets, reportedly worth around $1bn, and offshore wind farm-downs, which will also give it better visibility on cash flows.

A farm-down model is where a company sells a stake in a project to outside investors before construction, in order to free up its own money for further projects.

Compared to its rivals, SSE ranks better on most quality metrics with the best return on capital in its sector of 13.4% and return on equity of 34.4%, according to Stockopedia. It also has one of the best operating margins at 30.5%.

Dividends are one of the main benefits of investing in utilities, particularly at a time when many companies are cutting theirs, and SSE has been one of the most solid payers over the last 30 years.

It is worth pointing out SSE’s dividend cover is less than ideal at 1.07x (anything above 2x is considered safe), but this is not unusual in the utilities sector given the relatively stable and predictable revenue streams.

Even if SSE did cut its dividend, investors might accept this if the company can make a good enough case regarding its investment in renewables for future growth.

Unilever (ULVR) £38.91

While organic growth has been harder to come by in recent periods for Marmite, Magnum and PG Tips maker Unilever (ULVR), we consider a coronavirus-driven share price dip to be an attractive buying opportunity at this consumer goods giant.

Now guided by CEO Alan Jope, successor to Paul Polman, Unilever’s fourth quarter sales growth slowed to 1.5%, albeit a smidgeon

ahead of expectations after a pre-Christmas profit warning.

The Dove soap-to-Ben & Jerry’s ice cream maker, which has announced a strategic review of its global tea business encompassing brands like Lipton and PG Tips, left its 2020 outlook unchanged at the full year results in January, guiding to underlying sales growth towards the lower end of the targeted 3% to 5% range. This relies on a recovery that won’t be forthcoming as the world is plunged into recession by the coronavirus.

Near-term, there will be challenges ahead for Unilever, although the threat posed by challenger brands might be blunted somewhat as the businesses behind them may not prove as durable and their distribution is unlikely to be as robust as Unilever’s.

The Anglo-Dutch consumer goods giant does have debt but at a manageable level.

Unilever has an enviable portfolio of foods and refreshment, personal care and home care brands, many of which people will need in this crisis. Unilever has pricing power and crucially, the strong free cash flow to see it through the crisis and hopefully sustain the dividend.

Unilever’s return on invested capital for fiscal 2019 was 19.2%, up from 18.1% in the prior year and demonstrating the quality of a business able to drive operating profit growth.

Unilever’s footprint in developing and emerging markets is another bull point for investors with a long-term horizon and there

are self-help levers Unilever can pull.

As Jope explained in January, Unilever is ‘stepping up execution against our fundamental drivers of growth’, seeking to increase penetration by improving brand awareness and availability, improve its performance in faster growing channels and fuel growth through cost savings.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine