Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

What is happening with UK earnings forecasts?

Financial analysts often come in for criticism for ‘herding’ together when compiling their earnings forecasts, but when companies themselves have no idea where earnings are going to be a year from now it may be time to cut them some slack.

What we know from multiple previous business cycles is that corporate margins tend to mean-revert over time. When margins are high – and they have been high for some time, as have equity valuations – typically they are eaten away by new entrants or new technology.

In this case a sudden shock to both supply and demand as countries around the world go into ‘lockdown’ is leading to lower implied margins and hence lower equity valuations.

LACK OF VISIBILITY

Many companies have seen at least a small negative impact to their first quarter earnings: it is almost certain the impact will be much larger in the second quarter.

Analysts in the US have been rushing to downgrade their earnings forecasts, with investment bank UBS admitting that the mobility restrictions being imposed around the world ‘are rapidly moving us towards our worst-case “severe pandemic” scenario – likely exceeding it’.

Yet with many UK companies cancelling their forecasts and offering no up-to-date information on how the virus is impacting their business, it seems as though analysts are as much in the dark as the rest of us.

When Marks & Spencer (MKS) withdrew guidance for the new financial year altogether last week, analyst Clive Black at Shore Capital was left with no choice but to temporarily suspend his forecasts.

‘We could make an estimate but the reliability of such forecasts is subject to considerable doubt because the company is little wiser than we at this point; if it is facing a lack of visibility, what hope us?’

MORE DOWNGRADES TO COME

According to Michael Ellis of M23 Research, using figures from FactSet the aggregate of downgrades to all UK earnings forecasts over the last month is just 2%, weighted for the market size of each stock.

This compares with downgrades of 4% three months ago and 7.6% six months ago, before coronavirus was even an issue, and suggests that analysts are way behind the curve.

In previous crises, the pace of earnings downgrades has been much faster than it is at present. ‘It seems to me that analysts have barely started to downgrade their numbers, presumably waiting for more clarity from the companies themselves’ adds Ellis.

At a company-specific level, according to our screening of Stockopedia, the biggest earnings downgrades are in oil giant BP (BP.), airline services firm Signature (SIG) – formerly known

as BBA Aviation – and publishing group Euromoney (ERM).

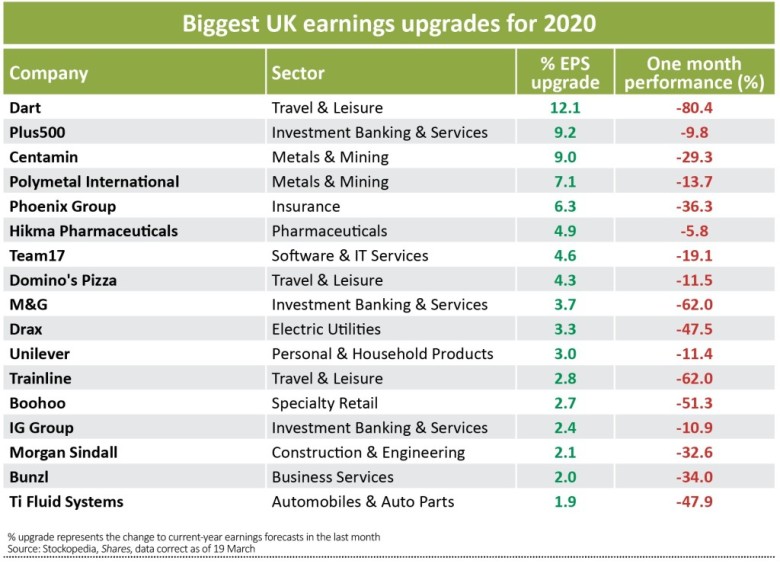

Meanwhile, the biggest single-stock earnings upgrades for this year are in Jet2 holiday operator Dart Group (DTG:AIM), online trading firm Plus500 (PLUS) and gold miner Centamin (CEY).

MEANINGFUL DIVERGENCE

Looking down the two tables, what strikes us is not how different most of the stocks and sectors are but how similar they are.

Business services, construction, investment banking and services, travel and leisure stocks, specialty retailers and even real estate investment trusts feature on both lists.

For stocks such as Plus500 and IG Group (IGG), the melt-down in markets and the subsequent rise in volatility has been hugely helpful, but both firms admit it is unlikely to continue, meaning analysts and investors may both be taking too rosy a view.

On the other hand the 80% hammering which Dart Group has received and the 60%-plus beating handed out to M&G (MNG) and Trainline (TRN) look like situations where the market is clearly ahead of the analysts give they had actually been raising their 2020 earnings estimates for all three firms.

U-SHAPED RECOVERY

Given that company margins mean-revert – along with earnings revisions and valuations – we know that when profits are low, weaker competitors tend to fall by the wayside, easing competition and allowing stronger companies to increase their margins.

At some point the virus-led contraction will ease and profits will recover, but forecasting when that will happen is nigh-on impossible. What is becoming clear though is that notions of a ‘V-shaped recovery’, for Europe and the US at least, are too optimistic. With luck, the recovery may be U-shaped.

The big question on investors’ minds – at least those who are already looking through the sell-off to the point where markets stabilise and they can start buying stocks again – is will the same stocks and sectors which led the market before the coronavirus crisis continue to lead afterwards, or will there be some new kind of leadership?

LOOKING FOR WINNERS

As David Jane, multi asset fund manager at Premier Miton (PMI) puts it, ‘Bear markets often lead to a change of market regime, with different regions and industries fuelling the next phase of economic growth. As we look to position portfolios for the recovery, we need to be alert to the possibility that the next bull market might look very different from the last.’

Trevor Green, head of UK equities at Aviva Investors, is mulling the same question. ‘The debate is, when this virus passes, do we go back to the old momentum with big US technology stocks outperforming or are there new market leaders? Some companies will see an immediate bounce back, for others it will be much slower.’

With reference to the UK, he points out that ‘housing market supply and demand is still favourable for the home-builders, but the question is, can volumes recover in September/October or is that too soon?’

Simon Gergel, head of UK equities at Allianz Global Investors, cautions that ‘even strong businesses will be affected by COVID -19, and those with weak balance sheets may not survive in their current form.

‘We are assessing the direct and indirect impacts of this pandemic on every business in the portfolio, and that has led us to make a number of changes.’

Among the changes, he notes, ‘we have not simply added defensive positions and sold cyclicals. We have also added to more cyclical companies where we are confident in the long term value, and share prices are particularly attractive’.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine