Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

What do property fund suspensions mean for investors?

The market turmoil around coronavirus has hit property funds, but what does that mean for investors?

Over the past week a number of property funds have suspended, which means that investors can’t buy or sell the funds. Below we look to answer your pressing questions on the situation.

WHY HAVE FUNDS BEEN SUSPENDED?

Funds that invest in shares listed on a stock exchange have constant updates to the valuation of their holdings – based on the share price rising and falling. But property funds that hold physical properties are harder to value, as there isn’t such a liquid market for the underlying assets.

It means that fund managers rely on independent valuers to determine what the properties are worth. This means that an independent company determines how much a property could sell for in the current market conditions, and gives investors confidence that the price is more accurate than the fund manager valuing it themselves.

However, as the current market is so volatile the independent valuers have said that they can’t accurately determine how much each property is worth. This means that it’s much harder to come up with a unit price for the fund, which determines how much your slice of the fund is worth.

Because of this, fund managers have suspended trading in the funds, as they can’t accurately give a price for what the units you buy and sell should be worth. This move also helps to protect investors in the fund, as it means people redeeming their money aren’t getting a higher value for their assets than those remaining.

HAVEN’T WE SEEN THIS ALL BEFORE?

Yes, property funds suspended just after the Brexit referendum vote in 2016. At this point it was because some investors panicked about the property market being negatively affected by Brexit and that prices would fall, meaning lots tried to sell out of their holdings in property funds.

This means that the property funds ran out of cash and didn’t have enough to pay those investors who wanted to withdraw their money. Because property isn’t a quick asset to sell (as anyone who has sold a home will know) fund managers had to suspend the funds while they sold assets and built up cash levels to meet investor redemptions.

Investors will also remember the suspension of Neil Woodford’s funds last year, which will be very fresh in some memories. But those fund suspensions were for different reasons and so investors shouldn’t be unduly concerned that these suspensions will end up the same way.

WHICH FUNDS ARE ACTUALLY CLOSED?

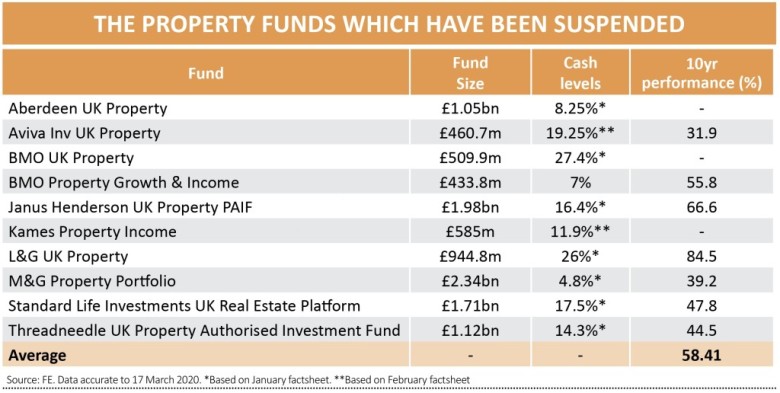

At the moment more than £11bn of investor money is tied up in property funds that have suspended. The affected funds are shown in the table, but the situation is moving quickly and more may have closed.

The M&G Property Portfolio (B89X8P6) had already suspended in December last year, and has remained closed since. This closure was down to investor redemptions, and the knock-on effect that had on cash levels, rather than valuation problems. However, if it was still open it’s likely it would be facing the same issues as much of the rest of the sector.

WHAT CAN INVESTORS DO?

When a fund is suspended there is very little investors can do, other than sit tight and wait for their fund manager to update them. The suspension means you can’t buy or sell any units of the fund, so you couldn’t get your money out even if you wanted to.

The fund managers have to update you ever 28 days on whether the funds will remain closed or re-open, but some fund managers might update you before then.

HOW LONG WILL THE FUNDS BE CLOSED FOR?

Last time the property funds suspended, in 2016, it really varied as to how long they took to re-open. Aberdeen UK Property (BTLX1D0) re-opened after just seven days, but the M&G Property Portfolio was suspended the longest – for four months.

But remember, those closures were because cash was running out in the fund, so those periods were the time it took for the funds to sell assets and generate cash. This time it’s because the markets are moving so quickly it’s too hard to accurately value the assets. In theory, once markets are less volatile and have calmed down, the value of the properties will be clearer and funds should be able to re-open.

That said, the suspensions may have spooked some investors who will want to redeem their money when the funds re-open, so fund managers may also be working on shoring up cash levels while the funds are suspended.

Ryan Hughes, head of active portfolios at AJ Bell, comments: ‘Now is the time to be patient and over time it is expected that equities, bonds and property valuations will settle and allow a normal market to function again.’

WHAT’S THE FCA DOING ABOUT THIS?

The regulator, the Financial Conduct Authority, conducted a review into property funds after they suspended last time. Some of that work is still ongoing, but one part of it concluded – looking at how funds should deal with situations like this.

The FCA determined that if fund managers have uncertainty about the value of 20% or more of the fund assets they should suspend the fund. These rules don’t actually come into place until September this year, but it appears many funds have already adopted them. At the time, it was warned that the rules would mean funds would suspend more quickly and more often than they had in the past – and we’re seeing the first signs of that now.

However, the regulator is still looking at the issues created by holding these big hard-to-sell assets in funds that allow investors to buy and sell daily. Many have urged them to reconsider the structure, and in some cases for funds to only allow investors to trade every week, or every month or even every quarter.

WHAT ABOUT PROPERTY INVESTMENT TRUSTS?

A lot of observers argue that investment trusts are a better vehicle for illiquid assets as the units are listed on the stock market and the fund managers don’t have to factor in investor redemptions to how they invest. In times of stress investors may have to accept a discount to get their money out of the trust, but they still would be able to get the cash back.

This move to big discounts is exactly what we’ve seen happen in recent weeks. For example, BMO Commercial Property Trust (BCPT), a £1.3bn property investment trust, is currently trading at a 65.8% discount, compared to its 12-month average discount of 14.5%. Regional REIT (RGL), another big property trust, is trading at a 46.7% discount compared to its average of 4%.

However, these are discounts to the net asset value calculated by the investment trust managers, and if property funds are struggling to accurately value assets it is very likely that there is some uncertainty about the valuation of property trust underling assets.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine