Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Where to shift your money as suspended property funds reopen

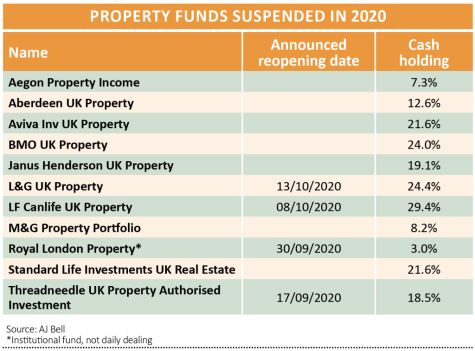

Various open-ended property funds suspended in March are now beginning to reopen but it could be a stop-start process and it looks like investors will face restrictions on their ability to trade in and out of the funds as new regulations are introduced by the Financial Conduct Authority (FCA).

There is no easy fix to the fact that these funds look to offer investors the ability to buy and sell daily while having their cash tied up in an asset class where it takes much longer to facilitate a transaction.

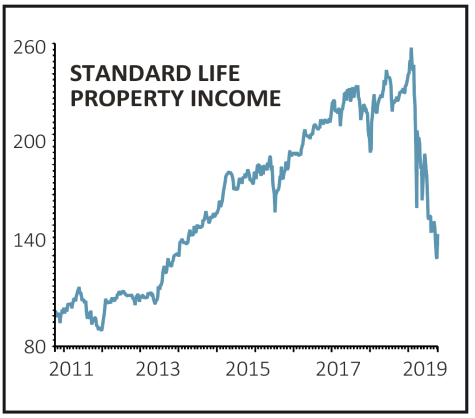

There is a strong argument for investors in open-ended property funds to pivot to real estate investment trusts (REITs) and other listed property plays which offer similar exposure without some of the more severe structural problems. We suggest Standard Life Property Income (SLI) later in the article.

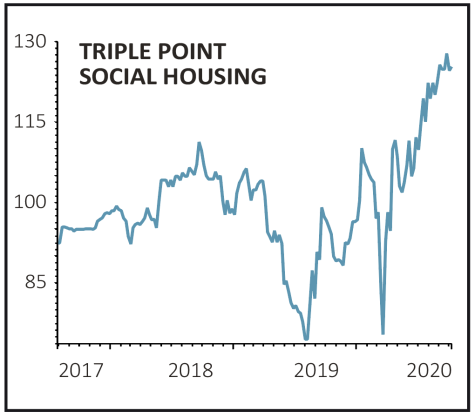

Investors may also want to consider more specialist investment trusts linked to the property market which have held up relatively well through the coronavirus. Triple Point Social Housing (SOHO) looks interesting, as we explain later on.

A QUICK RECAP

Dealing in many big open-ended property funds was suspended in March 2020 when the volatility in asset prices around the pandemic led to uncertainty over the value of the properties in their portfolios. This meant funds couldn’t accurately give a price on the individual units bought and sold by investors.

The episode had echoes of the situation in the wake of the Brexit vote though the problem that time was that they couldn’t sell assets quickly enough to return cash to shareholders who wanted to take their money out.

Investec comments: ‘We believe that the open-ended product is fundamentally flawed (for property funds), and seems destined to deliver inferior long-term returns and relatively low dividend yields, while yet again liquidity has proved to be an illusion at a time when investors need it the most.

‘Meanwhile, FCA proposals to include a 180-day redemption notice period is stretching the concept of “open-ended” to the limit.’

Investment trusts and REITs – classified as closed-ended funds – are better vehicles for assets like property because they are listed on the stock market and the fund managers don’t have to factor in redemptions to how they invest – REITs also have to pay out 90% of qualifying income in dividends.

However, they will typically trade at a discount to net asset value (NAV) when the market is experiencing stress and many diversified trusts have cut their dividends.

SLOW TO REOPEN

In September Threadneedle resumed trading in its affected property fund and the largest UK property fund LGIM UK Property Fund (BK35DT1) reopened on 13 October.

When the others will reopen is so far unclear. Apparently keen to avoid a situation where they reopen again but are almost immediately forced to close as they run out of the funds required to meet redemptions, LGIM and other open-ended funds have been building up their cash reserves.

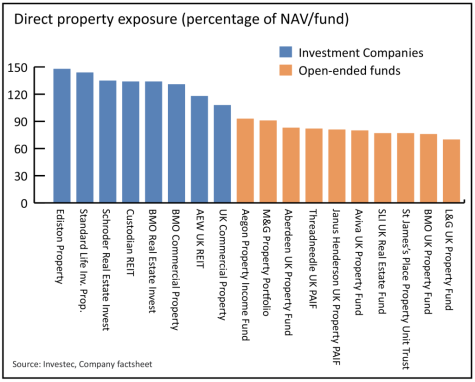

Holding more cash acts as a drag on returns and, to build up these buffers, managers are essentially forced sellers at exactly the wrong point in the cycle.

The chart shows how with open-ended funds you are receiving much less direct exposure to property than their closed-ended counterparts due almost entirely to their larger cash positions.

The argument for having any diversified exposure to property is that while some areas are performing much stronger for now, that might not be the case in the future and so it can pay to spread your risks across the sector.

Offices are currently out of favour, while industrial assets, with links to the rise in online shopping, are in the ascendancy.

Industrial assets are currently more expensive to buy and lower yielding, while offices are currently cheaper meaning they also have more scope for an uplift in value in a recovery scenario.

WHAT ABOUT RETAIL PROPERTY?

Retail property has structural issues which have been exacerbated by Covid-19 and which were evident in recent news that West End property investor Shaftesbury (SHB), which has heavy exposure to Central London shops, had received less than half the rental income it was due. However, areas of retail – like convenience stores and out-of-town outlets – are holding up better.

Major commercial property investor British Land (BLND) has revealed a recovery in retail with footfall across its sites in September at 84% of the same period last year.

SEEKING INCOME

Another approach if you want to invest in property, if you are in the large group that invest in the asset for yield, is to seek out niche areas which offer particularly sustainable income streams.

This includes investors in healthcare facilities and social housing where a large chunk of their income is, in effect, backed by the state.

Diversified trust to buy

Standard Life Property Income (SLI) 50.8p

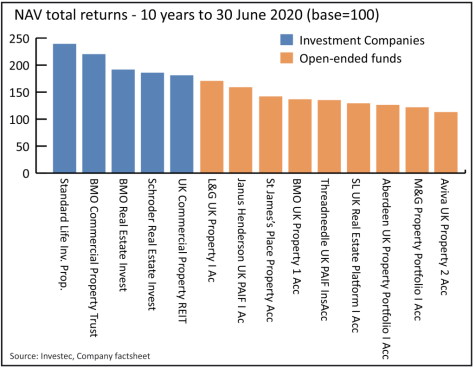

This trust has an excellent long-term track record – according to Investec it has generated a net asset value total return of 139.5% over 10 years at an annualised rate of 9.1% and yet it trades at a 35.6% discount to NAV.

Manager Jason Baggaley has been in-situ since 2006 and recently expressed his confidence that a ‘policy of investing in buildings that create an environment where people want to work remains relevant’. Nearly 40% of the fund is in industrial assets. In the third quarter it received 75% of its rental income.

Specialist trust to buy

Triple Point Social Housing (SOHO) 106.5p

The investment trust recently reported 100% rent collection for the eight-month period to 30 August 2020 –demonstrating the resilience of a portfolio which is focused on housing for people with long-term care and support needs linked to mental health issues, learning disabilities or physical impairments.

It is raising £70 million to invest in a £150 million pipeline of assets which should enable it to grow an income stream which is paid by local authorities and backed by central government. In this context a yield of nearly 5% looks attractive.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Exchange-Traded Funds

Feature

First-time Investor

Great Ideas

Money Matters

News

- Regulators on both sides of the pond size up big tech targets

- AIM index regains strength and US tech stocks rally again

- Leisure sector hit by Boris’ latest lockdown restrictions

- Vodafone could raise stakes in TalkTalk buyout battle

- Hipgnosis rival Round Hill Music to float new trust on UK stock market

- Forget tech, solar and clean energy is the hot sector in 2020

magazine

magazine