Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Why investors need to do their homework on rivals and suppliers

Whenever a fund manager considers making a new investment, as well as thoroughly analysing the target company’s returns, its finances, the valuation of its shares and so on, they typically take a good look at its rivals to understand the dynamics of the market.

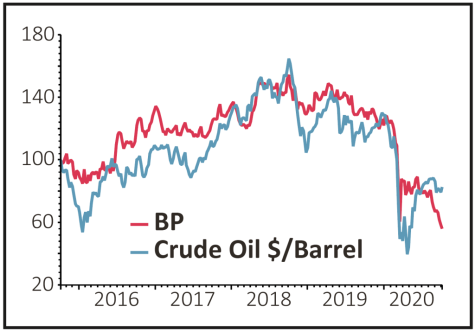

In a global sector like oil, investors who own BP (BP.) or Royal Dutch Shell (RDSB) may follow the news flow from big international rivals like Exxon Mobil and Saudi Aramco.

However, they will likely pay more attention to the price of West Texas Intermediate and Brent Crude oil and any news flow which has an impact on them, such as extreme weather events or output figures from producers’ cartel Opec. It’s typically the price of oil which determines the all-important cash flows the oil majors use to pay their dividends and therefore a great influence on their share price.

LOOK CLOSER

When it comes to more niche markets, the list of major foreign competitors and the factors which can impact revenues and earnings for a given business may not be that obvious.

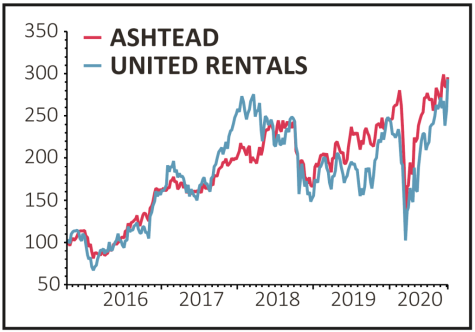

If we take the example of UK equipment hire firm Ashtead (AHT), one of the best-performing FTSE 100 stocks of the last decade, its biggest business – Sunbelt – is based in the US, where its main competitor is Stamford, Connecticut-based United Rentals.

Both firms serve the construction and manufacturing sectors, but United Rentals is the market leader with around 14% share against a 10% share for Sunbelt. Last year United Rentals turned over $9.4 billion of revenues or roughly 50% more than the UK firm.

NOT BLACK AND WHITE

If United Rentals is doing well, is it gaining market share from Ashtead and so should shares in the latter fall on good news from the former? Or does good news from United Rentals mean Ashtead will also report positive trading achievements?

It always pays to look closely at the detail. For example, look at comments about market activity and whether any sales growth or decline is attributed to actions specific to the company or the broad sector trend.

The US equipment rental market is large and although turnover isn’t seen getting back to 2019 levels until the end of 2022, from then on revenues are expected to grow by around 6% to 7% per year meaning there is plenty of growth to go round.

In the meantime, both firms have scope to increase their market share through organic growth and small bolt-on acquisitions at the expense of the dozens of smaller players who are likely to struggle with cash flow issues.

For keen stock-watchers, United Rentals releases its quarterly figures at the end of January, April, July and October, typically six weeks before Ashtead releases its results. Interestingly, the read-across looks to be two-way with good United Rentals numbers and a rise in the share price helping to lift Ashtead shares and vice versa.

VIDEO GAMES SECTOR

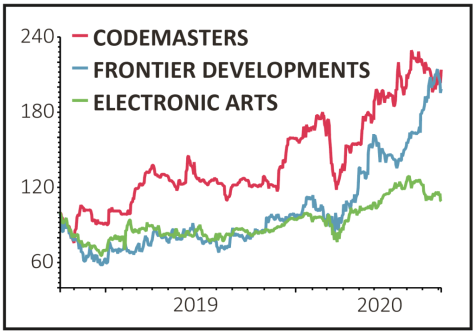

The world of video games is even more niche than equipment rental, and while the UK boasts some world-class games development companies they are valued at a fraction of their global peers.

For example, despite a phenomenal performance this year with revenues and operating profits more than doubling in the six months to September and the shares up 28% against a market which is down more than 10%, UK games company Codemasters (CDM:AIM) is still a minnow with sales last year of £76 million and a market cap of £550 million.

Larger rival Frontier Developments (FDEV:AIM) has a similar level of turnover but is valued at close to £1 billion. By comparison, US games company Electronic Arts has annual turnover of $6 billion and a market value of $36 billion.

For the whole of last year and the first part of this year, shares of Frontier Developments tracked EA shares closely as EA was seen as the industry leader, but from the March low its shares have preferred to track its UK rival, Codemasters. What’s seen as good news for one firm is seen as good news for the rest of the sector.

In some cases, it isn’t the fortunes of domestic or overseas rivals which can determine or influence a firm’s share price performance, it’s those of its key suppliers.

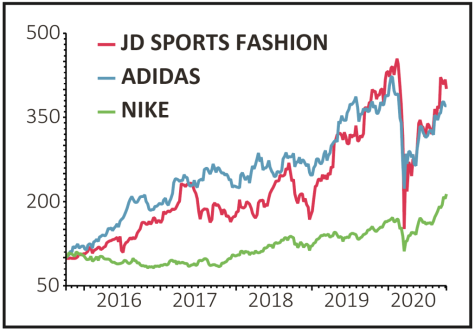

JD Sports Fashion (JD.), the self-styled ‘King of Trainers’, relies heavily on the strength of global sportswear brands such as Adidas and Nike whose products it sells, and on their ability to come up with exciting new products which its customers will crave.

The correlation between the Adidas and JD Sports share prices is so close as to suggest that the fortunes of the latter are almost entirely dependent on those of the former.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Exchange-Traded Funds

Feature

First-time Investor

Great Ideas

Money Matters

News

- Regulators on both sides of the pond size up big tech targets

- AIM index regains strength and US tech stocks rally again

- Leisure sector hit by Boris’ latest lockdown restrictions

- Vodafone could raise stakes in TalkTalk buyout battle

- Hipgnosis rival Round Hill Music to float new trust on UK stock market

- Forget tech, solar and clean energy is the hot sector in 2020

magazine

magazine