Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

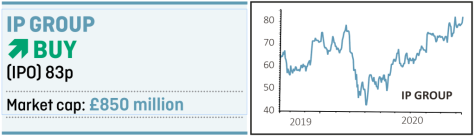

Snap up IP Group before it starts selling more assets

The risk-to-reward on offer at IP Group (IPO) is very attractive with many investors unappreciative of the near-term positive catalysts at various mature companies in its portfolio.

IP Group was set up to evolve ideas from partner universities into world changing companies. It pioneered the partnership model with UK universities and has spent many years honing a unique approach to building businesses and providing support along the journey from ‘cradle to maturity’.

Over half of its portfolio consists of businesses which are over eight years old, potentially providing numerous cash realisations over the next five years. What we find interesting from an investor standpoint is that the company is close to an inflexion point where the business model becomes self-sustaining.

Investment bank Berenberg thinks the company is approaching the ‘steep uphill part of its J-curve’ which looks anomalous with the shares trading at around a 30% discount to net asset value. IP Group recently crystallised its investment in alternative energy supplier Ceres Power (CWR:AIM), generating a return seven times its cost.

In private equity the J-curve is used to illustrate the tendency for investments to deliver losses in the early years followed by investment gains when the companies mature and cash is returned to investors.

Portfolio company Oxford Nanopore Technologies has just secured £84.4 million from existing and new shareholders. The firm has been working with various public health laboratories in China to support the only real-time sequencing of Covid-19 to better understand the outbreak.

On 9 October Oxford Nanopore’s Covid-19 test gained CE-Mark approval for sale across the EU while the business is on track to receive approval in the US. Separately, the Federal Drug Agency has approved a different sequencing virus test which uses the company’s technology. IP Group owns a 15% stake in Oxford Nanopore.

Another portfolio holding which has seen a lot of progress over the last few months is quoted hormone deficiency specialist Diurnal (DNL:AIM) whose share price has more than doubled since July.

The company has developed and commercialised Alkindi, a drug aimed at children suffering from cortisol deficiency. Cortisol is a steroid hormone that helps the body to respond to stress by increasing the body’s metabolism of glucose and controlling blood pressure.

For patient investors, IP Group’s current discount to net asset value provides a very attractive entry point to buy the shares in anticipation of a number of potential cash realisations from the mature part of its portfolio.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Exchange-Traded Funds

Feature

First-time Investor

Great Ideas

Money Matters

News

- Regulators on both sides of the pond size up big tech targets

- AIM index regains strength and US tech stocks rally again

- Leisure sector hit by Boris’ latest lockdown restrictions

- Vodafone could raise stakes in TalkTalk buyout battle

- Hipgnosis rival Round Hill Music to float new trust on UK stock market

- Forget tech, solar and clean energy is the hot sector in 2020

magazine

magazine