Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

ETF providers quick to launch more ethical funds

Exchange-traded funds (ETFs) with an ethical tilt are all the rage with most of the big investment firms looking to bring out new products with an ESG (environmental, social and governance) flavour.

It’s easy to understand the appeal. ETFs provide a low cost way to invest ethically, and because they simply track an index, you can often see all of the holdings in the ETF and can ensure your cash is going into the right sorts of investment.

Plus, there’s growing evidence to suggest companies with strong ESG practices will deliver better stock market returns over the long term than those that don’t take it seriously.

While they have their merits, active funds are more expensive and don’t have the same level of transparency, with only the top 10 holdings visible.

TAPPING INTO THE DEMAND

All the big investment firms know this and are trying to tap into the demand, hence the plethora of ESG ETF launches in recent months.

There’s also a big market for them to exploit. Research by Invesco has found that more than half of institutional investors (55%) believe the majority of their ESG investments will be held in passive products such as exchange-traded funds within the next five years.

According to Morningstar data as at 31 March, ESG ETF assets in Europe totalled just $31 billion, compared to the $781 billion European ETF market as a whole, showing the headroom for growth.

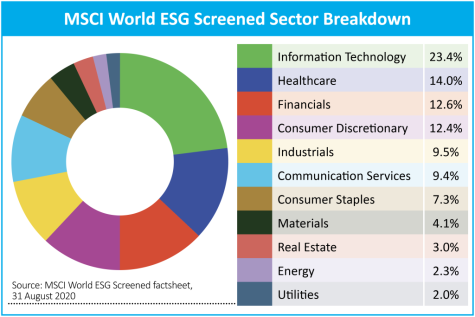

But ESG investing can be subjective and so there’s no one size fits all approach. That’s why all these new ESG ETFs can vary quite a lot, and if there are certain areas you want to avoid, it’s important to take a closer look at what the ETF and its underlying index track.

HOW IS ESG DEFINED?

As an example, a recent report by Bloomberg showed that oil and gas giant ExxonMobil had plans to increase its annual carbon dioxide emissions by as much as the output of the entire nation of Greece, at a time when virtually all major companies around the world are looking at ways to significantly reduce their emissions.

The company had a $120 billion programme to expand fossil-fuel production and according to Bloomberg its internal projections showed its carbon emissions rising by 17% to 2025. These estimates were taken before the coronavirus pandemic and so might’ve changed given the collapse in oil demand, but nonetheless show the company’s intentions.

SO WHAT DOES THAT HAVE TO DO WITH ETFS?

Exxon is included in the S&P 500 ESG Index, making up 0.7%, and so is included in popular ESG ETFs tracking the American stock market like Invesco S&P 500 ESG (SPEP) and UBS S&P 500 ESG (S5SD).

Invesco points out in a statement to Shares that there has been a long running debate about disinvestment or exclusion compared to company engagement and shareholder influence, and believes it’s not clear the best outcomes are necessarily going to be achieved through disinvesting in a company, ‘as at that point the investor has lost the ability to influence company management through their voting rights’.

STEWARDSHIP TAKEN SERIOUSLY

A number of big ETF providers say they take stewardship seriously. There’s an argument that ETF providers shouldn’t just be silent shareholders, and should be obliged to ensure companies they invest in adopt long-term value to shareholders instead of focusing on short-term share price gains. This argument would support the likes of Invesco and UBS staying invested in such companies to help bring about change.

Invesco adds: ‘The fact that Exxon is in the index means that it is in the top 75% of ESG scores in the energy industry group globally and in the S&P 500. Put more simply, within the S&P 500 index there are energy companies that do less well than Exxon from an ESG perspective and these are excluded from the index.’

While ExxonMobil may score well when it comes to having strong governance and a good social impact for example, the wider issue of having companies like that in general ESG indices are why some companies have specifically launched ‘low carbon’ ETFs.

AVOIDING GUNS, GAMBLING, FAGS AND BOOZE

Most ESG indices exclude alcohol, tobacco, gambling, nuclear power and controversial weapons companies, but often the world’s big energy companies make the cut. They emphasise their social programmes and strong governance practices rather than the fact that the vast majority of their revenue is derived from fossil fuels.

In June HSBC launched three sustainable equity ETFs for Europe, US and Japan which target a 50% carbon emissions reduction and a 50% fossil fuels cut relative to the parent index.

It’s also why BlackRock changed the benchmark of its iShares MSCI World SRI ETF (SUSW) from the MSCI World SRI Select Index to MSCI World SRI Select Reduced Fossil Fuel Index, with further screens on thermal coal, power generation and oil and gas companies.

Other recent ESG ETF launches include Amundi launching eight ETFs that follow the MSCI World ESG Leaders and MSCI World ESG Universal indices, which aims to go one further than the S&P 500 ESG index for example in picking the top 50% of companies of the parent index in terms of ESG scores, rather than the top 75% for the S&P index.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Exchange-Traded Funds

Feature

First-time Investor

Great Ideas

Money Matters

News

- Regulators on both sides of the pond size up big tech targets

- AIM index regains strength and US tech stocks rally again

- Leisure sector hit by Boris’ latest lockdown restrictions

- Vodafone could raise stakes in TalkTalk buyout battle

- Hipgnosis rival Round Hill Music to float new trust on UK stock market

- Forget tech, solar and clean energy is the hot sector in 2020

magazine

magazine