Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

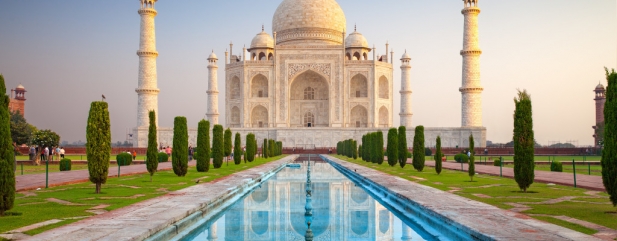

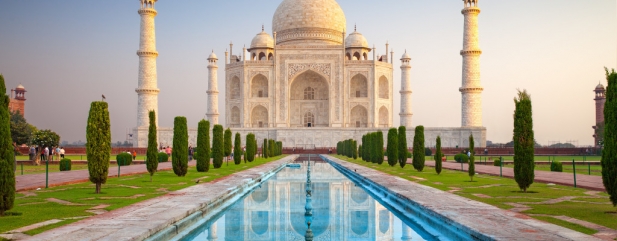

The demographics driving India

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The introduction of new more generous tax laws has helped to revive interest in the Indian investment story. Although growth expectations have taken something of a knock in recent months the long-term picture in the country is underpinned by several drivers not least the country’s favourable demographics.

A recent report from the United Nations projected that India would overtake China as the world’s most populous country around 2027, with around 273m new Indians being added to the population between 2019 and 2050.

Having a growing and youthful population, around half of which is under 25, means plenty of new recruits for the jobs market and should also underpin long-term demand for housing, health care and consumer goods, particularly as incomes go up.

The growth of the middle class in India has been promised since the 1990s but has taken longer than forecast thanks to slower urbanisation than in other emerging economies like China and a more geographically and culturally diverse population.

However, the country now appears to be catching up with a middle class more than 100m strong. There has also been a shift away from agriculture to the manufacturing and services sectors and internet penetration is increasing rapidly. Meanwhile India is a democracy and has a relatively strong education system.

The backdrop is not unblemished however. The International Monetary Fund recently downgraded growth expectations for 2019 from 7% to 6.1%, citing weaker domestic demand and issues in the financial sector, but the organisation expects growth to return to the 7% mark in 2020.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine