Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

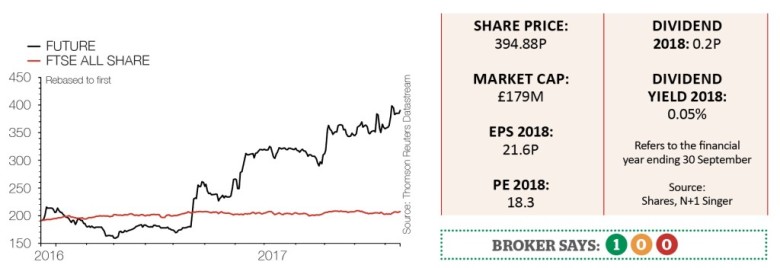

Share pick for 2018: Future

Niche publisher Future is positioned for growth and the likely resumption of dividends in 2018 illustrates how the business has regained strength

Investors should back Future’s (FUTR) continuing transition from old fashioned operator in the structurally challenged publishing industry to an innovative global platform for specialist media.

Interest in the story is picking up, helped by the company saying in November that it may restart dividends in the current financial year.

The shares have already responded well in 2017 as the company has got better at making its content pay and we think there is further upside to come.

Future is split into two divisions – Media and Magazine. The Media division, currently around 40% of the business but growing fast, has three revenue streams: e-commerce, display advertising and events.

The Magazine division derives revenue from news trade, subscriptions and advertising. Among the better-known titles in its portfolio are Techradar and Total Film.

Newspaper and magazine publishers continue to struggle with falling sales and have struggled to get readers to pay for their relatively generic content, but consumers have shown a greater willingness to pay for specialist and niche content which they are unable to get elsewhere.

In a recent report on trends in the media sector, consultant PwC noted ‘fans’ spend more and show greater loyalty. Future’s titles, covering topics from films to computer games and photography, are often a conduit between fans and their enthusiasm or hobby.

Taking advantage of this situation, the company aims to monetise a single article through several avenues including e-commerce, licensing and digital advertising.

As well as growing organically the company is looking to buy other publishing assets and applying this same model to them.

Home Interest, a portfolio of home improvement events and magazines, was acquired from Centaur Media (CAU) for £32m in July 2017, part-funded by a share placing at 250p per share. Its integration should help demonstrate to the market Future’s ability to maximise returns from content assets.

Free cash flow increased from just £100,000 in the 12 months to 30 September 2016 to £8.2m in the year just gone and the strong cash generation has helped keep a lid on net debt, which is less than one times earnings. This leaves plenty of scope to pursue further deals and pay a dividend. (TS)

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Big News

- Regulators take aim at trading platforms

- Purplebricks pasted on cost concern

- Heavyweights join OneMedia board

- Another video games developer joins stock market

- Tough festive trading to put retailers to the test

- UK water companies facing earnings, dividends pressure

- What does Disney-Fox deal mean for Sky shareholders?

Editor's View

Feature

Great Ideas Update

Investment Trusts

Main Feature

- Share pick for 2018: Future

- 10 superb stocks for 2018

- Share pick for 2018: DotDigital

- Share pick for 2018: Alliance Pharma

- Share pick for 2018: Johnson Matthey

- Share pick for 2018: Biffa

- Share pick for 2018: Dixons Carphone

- Share pick for 2018: Charter Court Financial Services

- Share pick for 2018: Sage

- Share pick for 2018: Dignity

- Share pick for 2018: AB Dynamics

magazine

magazine