Why the sinking yen is a big market story

The world’s biggest stock market by market capitalisation, America, is making headlines as it sets new all-time highs and the second largest arena, China, is making them for the wrong ones, as the Shanghai Composite index is no higher now than it was in 2007, thanks to a soggy economy and a spectacular property bust. But perhaps the biggest surprise to many investors will be the renaissance of the world’s third most valuable market, Japan, where the Nikkei 225 is on the verge of regaining the all-time high set all the way back in late 1989.

Japan’s (almost unnoticed) return to favour offers several useful lessons to investors:

1. The bigger the bubble, the bigger the hangover is likely to be. Japan’s debt-fuelled equity and property party in the 1980s was a whopper and it has taken the Nikkei just over 34 years to recover. By contrast it took the Nasdaq ‘only’ 15 years to get back its to 2000 peak once the technology, media and telecoms bubble burst (something fans of the Magnificent Seven may need to ponder, at some stage).

2. Even the most unloved market can return to favour (perhaps something to ponder in the context of the UK and emerging markets, which remain out in the cold).

3. Valuation really does matter. Strategists regularly flagged Japan as being extremely cheap, especially on the basis of book value (where a big chunk of the net assets were net cash positions) and eventually that value has attracted buyers as catalysts have emerged to crystallise it, in the shape of the Abenomics reforms, activist investors and improved corporate governance (something the UK should weigh as it considers watering down some of its listing requirements).

But there are other factors at work, which may have implications for global markets and not just those in Tokyo, namely the Bank of Japan’s ongoing use of ultra-loose monetary policy and the continued decline in the yen.

CURRENCY TAILWIND

With its heavy weightings toward information technology (26%) and industrials (17%), the Nikkei 225 also taps into the key themes of AI and deglobalisation, as Japanese firms may be primed to benefit from sanctions against China, as a valuable alternative source. A low weighting toward financials (3%) is also noteworthy, as banking stocks in the US and UK continue to flounder.

But Japan also has things in its favour, which may be lacking elsewhere, notably:

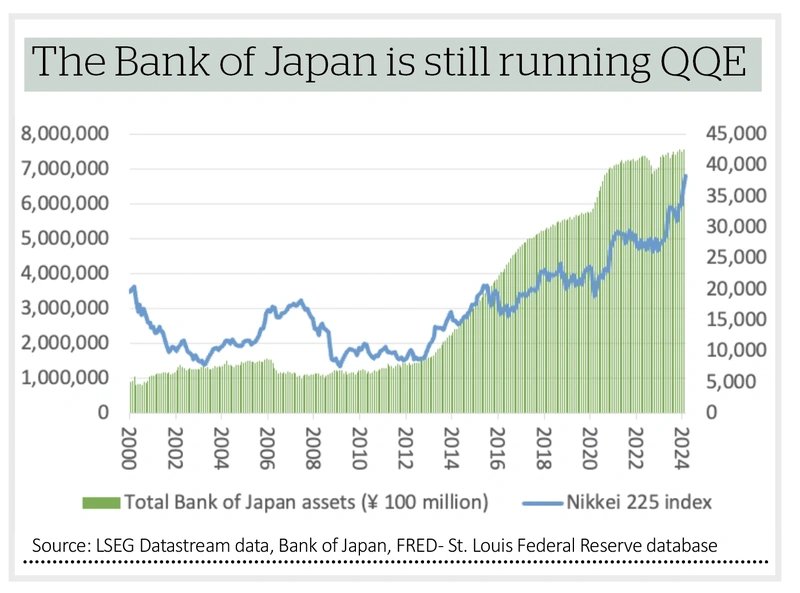

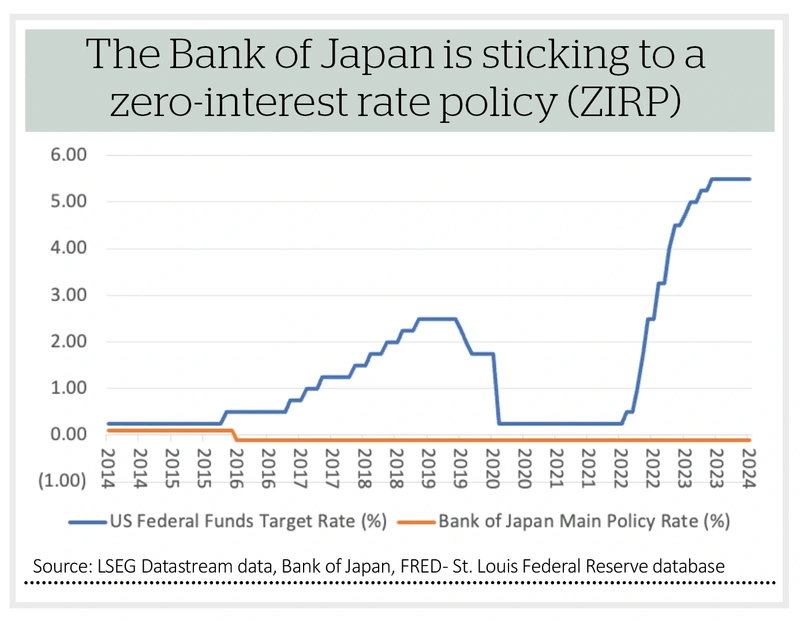

1. A central bank which remains committed to ultra-loose monetary policy, in contrast to those in the West. While the US Federal Reserve, European Central Bank and Bank of England have jacked up interest rates and started to shrink their balance sheets, the Bank of Japan has stuck with a negative interest rate since 2016 and continued to run a qualitative and quantitative Easing (QQE) bond buying scheme, designed to suppress bond yields and borrowing costs and pump liquidity into Japan’s economy and financial system.

2. A currency that continues to slide. The yen is back down to ¥150 to the dollar, pretty much an all-time low. This helps to attract overseas buying (as the cheap currency is an added bonus, on top of what may be cheap stocks) and boosts exporters at the same time (like those technology and industrial companies in which Japan specialises).

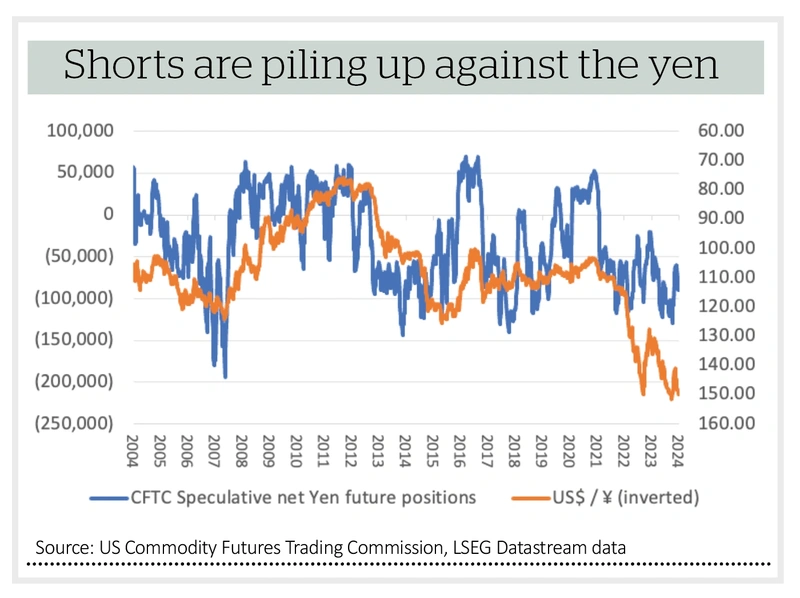

One reason for the yen’s weakness is the interest rate differential between the greenback and the Japanese counter. But another is how international investors (and particularly hedge funds) use the yen as a funding currency for other positions. It costs nothing to short the yen, given the negative interest rate that prevails in Japan, and that cheap cash can be used to generate returns elsewhere (or so the theory goes). Data from America’s Commodity Futures Trading Commission shows that short positions are again piling up against the yen.

SHORT SQUEEZE

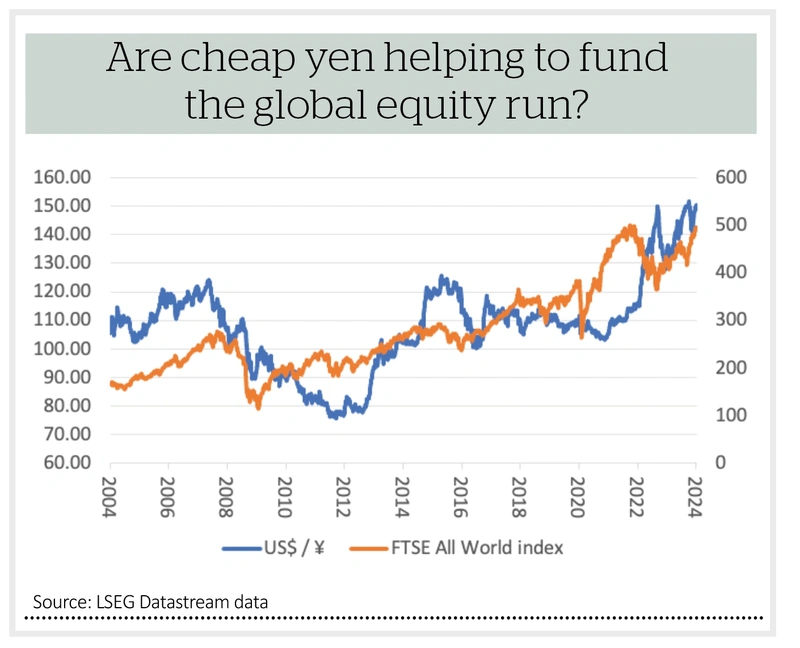

It may therefore not be entirely a coincidence that global equities are surging along, buoyed by the US, which represents some 60% of the FTSE All-World index. Other factors are helping here, too, notably Bidenomics and free-spending fiscal policy, but a plentiful supply of cheap funding might be helping, too.

This matters because the Bank of Japan is, in theory, inching its way towards a first interest rate hike, just as the western central banks are laying the groundwork for their first cuts. A reduced interest rate differential could spark buying of the yen, prompt a closure of short positions against it and turn off the tap on one important source of global liquidity. Watch this space.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

Great Ideas

Money Matters

News

- Why interest in Currys could spark further mergers and acquisitions in the sector

- What have the top US fund managers been doing recently?

- XP Power plummets to 10-year low after two successive profit warnings

- YouGov looks in great shape amid talk of move to US listing

- Uber unveils $7 billion buyback as ride hailing firm shocks investors

magazine

magazine