Six great funds for your ISA: These consistent names have delivered time after time

The end of the tax year is fast approaching and with it the opportunity to maximise your £20,000 ISA allowance for the year.

In this article we have identified six names from a list of some of the most consistent funds and fund managers in the UK which could be a good fit for your tax wrapper. While we have aimed for a balance across different investment styles and asset classes this is not intended as a portfolio as such but just a source of ideas to suit a range of investors and investment goals.

Our starting point was to look at funds which were top quartile performers over one, three, five and 10 years. Past performance is no guarantee of future returns but to have achieved this level of consistency provides a measure of confidence that a fund has a solid investment process underpinning it. The table shows a selection of the names thrown up by this screening exercise. We also ran the rule over the recently released list of ‘Alpha Managers’ from fund services and data provider FE Fundinfo.

In order to qualify, managers have to be in the top 10% of UK retail-facing managers based on their entire career performance. We paid particular attention to the 10 managers which have received an ‘Alpha’ rating for 15 years. Two of these, David Dudding and Mark Slater, manage funds which we have highlighted later in this article.

WHY BEING TOP QUARTILE IS IMPORTANT

While the fortunes of, and sentiment towards, themes, geographic markets and industry sectors will wax and wane, super-consistent funds are likely to outperform sector peers on the way up and/or preserve investors’ capital better on the way down.

This is the reason quartile rankings are so important. They provide a measure of how well a fund has performed against all other funds in its category, with rankings ranging from ‘Top Quartile’, often referred to as ‘First Quartile’, to ‘Bottom Quartile’, over various time periods.

Put simply, if a given fund category has 100 funds, each quartile will be made up of 25 funds. And the 25 funds with the highest returns will belong to the top or first quartile, while the next best 25 funds will inhabit the second quartile and so on.

CT Global Focus Fund (BF0Q8L9) 221p

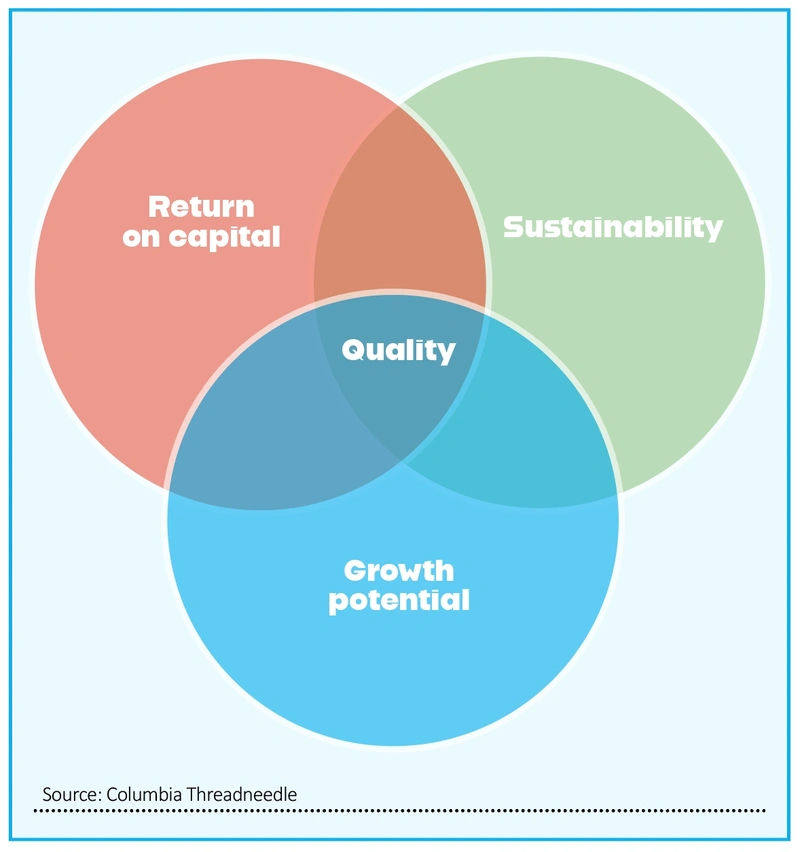

This fund is a ‘best ideas’ portfolio of stocks which the manager, David Dudding, believes are the world’s highest-quality companies with a sustainable competitive ‘edge’ which means they can continually grow their earnings at a faster rate than the market.

Dudding is one of a very select group of FE ‘Alpha Managers’ who are in the top 10% of UK retail-facing fund managers based on their entire career record and has received this accolade in each of the last 15 years.

As its name suggests, the fund invests globally but is highly selective with between 30 and 50 holdings, and while it is benchmarked against the MSCI World Index, due to the bottom-up stock selection process there is no set allocation to countries or sectors.

Dudding and his team seek out businesses with what are known as wide ‘economic moats’ a concept we have touched on before.

These could be strong brands, a low cost of production, network effects, scale effects or their product or service being so deeply embedded in their customers’ business that switching is seldom an option.

The businesses it owns have sustainably high returns on capital and plenty of growth potential, which given the market tends to assume high returns eventually fade means these companies can be undervalued.

Inevitably, being a global fund, most of its investments are outside the UK, mainly in the US, Europe and Japan, which makes it a useful diversification tool, and it has a relatively low 0.58% annual charge.

Meanwhile, due to its high concentration and its distinctive style, the fund sits towards the riskier end of the spectrum which means it would suit an investor who is looking for capital appreciation over an extended time horizon and who is prepared to accept potentially large price moves. [IC]

FTF Martin Currie UK Rising Dividends (B5MJ560) 268p

Adorned with a five-star rating from Morningstar, FTF Martin Currie UK Rising Dividends (B5MJ560) is a savvy portfolio pick for investors seeking a super-consistent fund able to combat the deleterious impact of inflation and cope with the earnings pressure created by domestic recession.

Offering a 3.9% yield, this reliable performer has consistently delivered top quartile performance and aims to grow in value by more than the FTSE All-Share by generating a growing income, together with capital growth, over a three to five-year period after fees and costs. FTF Martin Currie UK Rising Dividends has delivered excellent long-term risk-adjusted performance, while Morningstar data shows 10-year annualised total returns of 7.4%, ahead of the 5.1% from its UK Large Cap Equity category.

Managed by FE Alpha Manager Ben Russon alongside Joanne Rands and Will Bradwell, the £218 million fund typically invests in between 30 and 50 companies that have grown their payouts in at least eight of the past 10 years. The core of the portfolio is invested in robustly financed large and mid-caps from the FTSE 350 index and the sleep-at-night strategy has consistently favoured high-quality stocks with low financial leverage and solid returns on equity.

Top 10 names as at 31 January 2024 included oil major Shell (SHEL), cash-generative consumer products powerhouse Unilever (ULVR), drugs giant GSK (GSK) and high-yielding cigarettes-to-vape products maker British American Tobacco (BATS), not to mention Nurofen, Durex and Dettol supplier Reckitt Benckiser (RKT), data services specialist Experian (EXPN) and US and UK-focused utility National Grid (NG.). One potential issue for a sustainability-focused investor is that FTF Martin Currie UK Rising Dividends doesn’t have an ESG-focused mandate. The ongoing charge is 0.52%. [JC]

Henderson High Income Trust (HHI) 154.5p

Managed by David Smith this trust aims ‘to provide investors with a high dividend income stream while also maintaining the prospect of capital growth’, and that is what it has done for the last decade or more. As befitting the remit, the dividend yield is a generous 6.28%.

Smith largely invests in ‘unloved’ UK companies but what makes the trust stand out from the peer group is the bond exposure, managed by the parent asset manager’s bond specialists. This provides more resilience and diversification to its income stream. The equity component of the portfolio includes a mix of well-known and smaller companies.

The trust’s top holdings include high dividend yielding companies like energy giants BP (BP.) and Shell (SHELL), and global tobacco firms British American Tobacco (BATS) and Imperial Brands (IMB) and banking firm HSBC (HSBA).

‘Having been forced to stop dividend payments during the pandemic it is good that banks’ dividends have been restored and grown back to pre-pandemic levels. We expect further dividend growth this year given the rise in profits from higher interest rates have yet to fully flow through to earnings,’ Smith observes.

In October 2023 the trust announced a merger with Henderson Diversified Income the purpose of which was to narrow the discount the trusts trade at. The merger of the trusts was approved by shareholders in January 2024.

Henderson High Income is currently trading at a discount of 7.5%, offering an attractive entry point for investors. The ongoing charge is 0.84%. [SG]

Natixis Loomis Sayles U.S. Equity Leaders (B8Y83Y0) 605.4p

Undoubtedly this fund has benefited from an exceptionally strong period for US stocks, led by some of the big technology names which populate its portfolio. However, that only makes its ability to consistently come out on top in its category and beat its benchmark even more impressive.

There is enough to the strategy to make a decent case for paying the extra costs of active management versus a low-cost tracker on the US market. We have faith in the fund’s ability to adapt to different market conditions and invest through different points of the cycle.

Manager Aziz Hamzaogullari adopts a long-term approach to avoid what he perceives as the market’s ‘short-sighted’ herd mentality which can ignore a company’s underlying strengths.

In his view just a tiny number of firms have genuine and sustainable growth potential over the long run and he undertakes rigorous research to identify names which are trading below intrinsic value. A seven-stage, private equity style investment process is focused on quality, growth and valuation.

The first four ‘quality’ criteria encompass elements like barriers to entry, whether the owners of the company have their interests oriented with other shareholders and the consistency of cash flow – logical given cash is the life blood of any business. Then other factors like growth drivers over the next decade and value are considered – with positions often adjusted on valuation grounds.

This is a concentrated fund with just 37 holdings at the latest count and the top 10 accounts for more than 50% of the whole portfolio. The ongoing charge stands at a competitive 0.6%. [TS]

Schroder Strategic Bond (B717KH5) 53p

Some sort of bond exposure in a portfolio makes sense, particularly amid suggestions the negative correlation between the asset class and stocks may reassert itself as interest rates and inflation come down. An increase in yields in the fixed income market also means bond funds offer attractive levels of income.

Choosing a fund which has the flexibility to invest in different types of credit only enhances the diversification benefits associated with bonds and this fund has one of the strongest and most consistent track records in its universe.

Steered by Julien Houdain and Daniel Pearson, the aim is to achieve income and capital growth of between 2.5% and 4.5% a year (after fees have been deducted) over a three-to-five-year period by investing in bonds issued by governments, government agencies, supranational organisations (an association consisting of two or more countries) and companies across the globe.

Commenting in January, Schroder’s global unconstrained fixed income team observed: ‘Against [the current] backdrop, yield curve steepening trades (for example, trades which look to capitalise on shorter bonds outperforming longer dated bonds) remain a favoured express of our views in rates.

‘In terms of asset allocation, we prefer high quality credit, remaining very positive on securitised credit, covered bonds and agency mortgage-backed securities. Elsewhere, US investment grade (IG) credit offers unattractive valuations, and we continue to prefer European IG instead.’ This preference is reflected in the portfolio, with Europe enjoying a dominant weighting. Ongoing charges on the fund are 0.65% and the yield is a generous 5.9% with income paid out twice a year. [TS]

Slater Growth (B7T0G90) 660.26p

Investors seeking a pure growth fund with a tried-and-tested process and an impressive long-term risk-adjusted performance should buy Slater Growth (B7T0G90). Managed by Mark Slater, the fund has handsomely outperformed the IA UK All Companies sector since its 2005 inception and should prove a strong beneficiary once sentiment towards UK stocks turns positive again.

Mark Slater has pedigree in backing dynamic growth companies without overpaying to own the shares and scours the market for firms he believes are currently undervalued and boast potential for a significant re-rating. He successfully employs the PEG (price to earnings growth) valuation metric, which compares the price to earnings ratio with a company’s earnings growth, as a screening tool to find shares which have a demonstrable track record of earnings growth, and which are inexpensive to boot.

With a slant towards small and mid-cap stocks, Slater Growth’s stated objective is to achieve long-term capital growth by investing in ‘attractively priced companies that exhibit superior, sustainable growth potential’. Slater employs a proven methodology to find growth companies using value filters that should continue to work in the years ahead. He uses the PEG screen to help to reduce the investable universe, with other measures then overlaid such as cash flow screens. He also hunts for companies with a competitive advantage such as a high market share, as well as bullish signs in recent trading updates and directors buying stock.

As of 31 December 2023, the top 10 of 49 holdings included insurance powerhouse Prudential (PRU) and Britain’s biggest retailer Tesco (TSCO), as well as outsourcing specialist Serco (SRP), asset manager Foresight (FSG), acquisitive veterinary services group CVS (CVSG:AIM) and Ten Entertainment, the ten-pin bowling and entertainment group since taken over by private equity via a premium-priced bid. Among the fund’s recent strong performers from the small cap ranks is fast-growing consulting firm Elixirr International (ELIX:AIM). Ongoing charges are 0.78% [JC]

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

Great Ideas

Money Matters

News

- Why interest in Currys could spark further mergers and acquisitions in the sector

- What have the top US fund managers been doing recently?

- XP Power plummets to 10-year low after two successive profit warnings

- YouGov looks in great shape amid talk of move to US listing

- Uber unveils $7 billion buyback as ride hailing firm shocks investors

magazine

magazine