Is MicroStrategy more than just a proxy for Bitcoin?

Is $11 billion US firm MicroStrategy (MSTR:NASDAQ) really the largest independent business intelligence company listed anywhere, as it claims, or merely a proxy for cryptocurrency Bitcoin, as many investors perceive it to be?

On its website, MicroStrategy says it provides modern analytics on an open, enterprise platform used by many of the world’s most admired brands in the Fortune Global 500. It offers stories from well-known names like Sainsbury’s (SBRY), Pfizer (PFE:NYSE), Ebay (EBAY:NASDAQ), and Standard Chartered (STAN).

MICROSTRATEGY STORY

MicroStrategy was founded 35 years ago as a data mining and analytics company. It went public in 1998, and its stock soared from its split-adjusted IPO (initial public offering) price of $60 to a record high of $3,130 near the apex of the dotcom bubble in early 2000.

That bubble burst shortly after MicroStrategy’s stock peaked, and the stock’s decline was exacerbated by the unexpected restatement of its financial results for the previous two years. Those sudden revisions prompted the US SEC (Securities and Exchange Commission) to launch a probe into the company that eventually ended in a settlement.

Over the two decades that followed, MicroStrategy divested itself of some of its businesses and expanded its software into the mobile and cloud markets. However, the aging software company faced fierce competition from higher-growth analytics companies like Salesforce (CRM:NYSE) as well as expanding cloud infrastructure giants like Amazon Web Services and Microsoft Azure.

FROM A SOFTWARE MAKER TO A BITCOIN HOARDER

From 2010 to 2020, MicroStrategy’s revenue only grew at a compound annual rate of 0.6%. It plunged into the red in 2020, chalking up a net loss of $7.5 million. That is why it might seem odd that its stock surged 172% in 2020.

That rally was completely driven by the company’s abrupt decision to hoard Bitcoin as the cryptocurrency’s price skyrocketed. It initially bought $250 million worth of Bitcoin in August 2020 and continued to purchase more over the following three years.

MicroStrategy’s revenue rose by 6% to $511 million in 2021 as its software business stabilised in a post-pandemic market. However, its net loss widened from $7.5 million in 2020 to $535.5 million in 2021 as its Bitcoin impairment losses surged.

Bitcoin’s price peaked at more than $65,000 in November 2021. But by the end of 2022, its price had dropped to about $16,000 as inflation, rising interest rates, and a market wide shift away from risk assets crushed the cryptocurrency market. However, MicroStrategy was still holding 132,500 Bitcoin that it had acquired for an aggregate cost of $4 billion and at an average price of $30,100 per Bitcoin.

In the meantime, MicroStrategy’s core software business stayed sluggish as declining product license and support revenues offset its rising subscription revenue. As a result, its revenue fell by 2% to $499 million in 2022 and its net loss widened to $1.47 billion. Most of that loss was attributed to its $1.29 billion in Bitcoin impairment charges.

WHAT DOES BITCOIN’S REBOUND MEAN FOR MICROSTRATEGY?

MicroStrategy seemed to be on the ropes last year, but Bitcoin’s recovery to above $50,000 is bringing back the bulls. As of January 2024, the company was holding 189,150 Bitcoin at an average price of $46,506 with a market value of $8.8 billion, according to data from Statista. That is more than 80% of company’s current $10.9 billion market cap. On that basis, if Bitcoin continues to rally it would certainly drive MicroStrategy’s stock higher. It is up 9% so far in 2024.

Its software business remains stuck in a rut. Revenue in 2023 came in at $496 million, modestly off 2022’s $499 million, although subscription revenues in the fourth quarter rose 23% to of $21.5 million year-on-year, helping to offset 11.4% declines in its product license and support revenues of $39.9 million.

The company generated a fourth quarter net profit of $89.1 million, lifting net profits for the year of $429 million, but it continues to run up large impairment charges on its Bitcoin holdings, running at around $2.27 billion last year. As it stands, MicroStrategy’s Bitcoin holdings are valued at $42.531.41 per token, versus an average cost per bitcoin of approximately $31,168.

For full year 2024, analysts expect MicroStrategy’s revenue to barely budge, forecasting $505 million, with net profits predicted to plunge again to just $1.41 million.

VALUATION ISSUES

If we use price to earnings multiples as a valuation metric, the stock looks inflated. Based on current forecasts for 2024, the PE stands at 342, 21.5-times projected sales. Net gearing, the level of debt versus equity, stands at 98.7%, according to Stockopedia data, putting the company firmly at the high-risk end of the spectrum, which could limit share price progress going forward, especially if rates stay higher for longer.

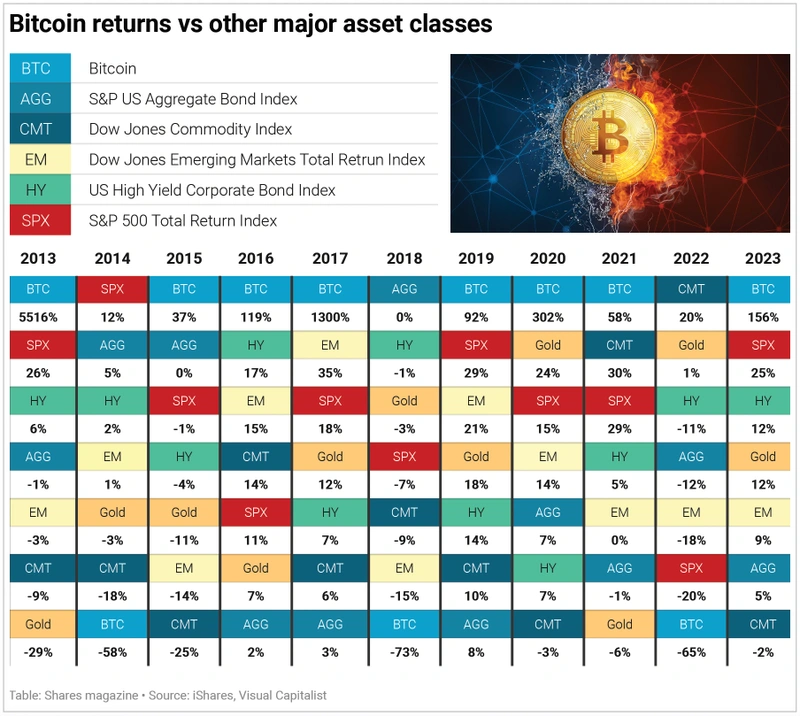

Whether these traditional valuations tools are helpful is a crucial part of any Bitcoin debate. The cryptocurrency use case is far from proven and given its highly volatile journey to date, the store of value argument is also in question. For investors, owning MicroStrategy shares might be a convenient way to play Bitcoin, if you believe its value will rise, and you do not fancy investing directly through a crypto exchange.

This is understandable in the wake of the FTX debacle, and questions over other crypto exchanges like Binance and Coinbase (COIN:NASDAQ). But many will feel more comfortable avoiding the whole cryptocurrency universe completely, and in that case MicroStrategy shares are certainly not for you.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Daniel Coatsworth

Funds

Great Ideas

News

- Big banks expected to report largely benign fourth quarter earnings

- Shares in specialty chemical maker Victrex hit fresh multi-year lows

- Global data services specialist Experian continues to deliver positive news

- Consolidation in commercial property market shows no signs of slowing

- S&P 500 surpasses 5,000 milestone and chip design firm ARM almost doubles in a week

magazine

magazine