Help: I’ve just started thinking about pension planning and I’m not sure where to start

I have only recently started thinking seriously about my retirement. However, I am paying the maximum I can into my employer’s pension to get matching contributions, and I also pay into my SIPP each month.

I am 48 years old and am trying to figure out how much more I need to pay into my SIPP to retire. I have also built up investment ISAs and I have 10 years more to pay off the mortgage on my house.

David

Rachel Vahey, AJ Bell Head of Public Policy, says:

Retirement can often seem like a long way off, and planning can naturally feel challenging. But when trying to take on a big task, often the easiest way to solve the problem, is to break the question down into smaller parts.

People may want to start by considering when and how they want to stop working. For example, if they want to completely stop at a certain age, or if they would like to ‘run down’ into retirement, possibly by moving to a less stressful job, or working part-time on a consultancy basis.

WORKING OUT HOW MUCH YOU NEED

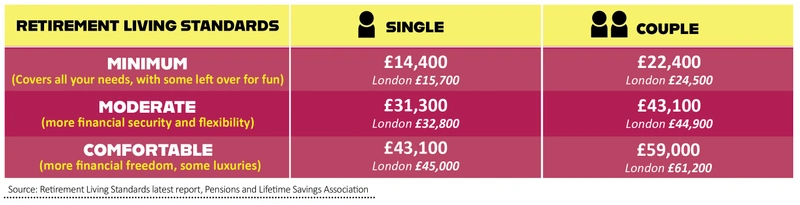

Once someone knows when, another question is often ‘how much money will I need?’. This can be difficult to work out. Fortunately, help is at hand. The PLSA (Pensions and Lifetime Savings Association) have put together a set of Retirement Living Standards to show people what life in retirement looks like. There are three different levels showing how much money is needed (after tax) to afford a given living standard.

The aim of these standards is to build awareness, to help people picture their future and what it costs. The figures are based around a basket of goods and services, for example including the costs of maintaining a house, not just the energy bills, but new furniture, decorating, or employing a cleaner or gardener. The budget also considers how often someone would eat out, if they were running a car, and other things, such as holidays or new clothes.

For example, the costs for someone on a moderate retirement living standard include a Tesco food shop with 50% branded products, an £8 bottle of wine each week, a three-star European summer holiday plus a UK weekend break.

Whereas those on a comfortable retirement would be upgraded to a Sainsbury’s food shop, a £10 bottle of wine each week, a four-star European summer holiday with additional spending money and three weekend breaks.

WHAT CAN YOU REALISTICALLY EXPECT?

The next question is where someone could expect to land on that scale. To work that out people need to know any defined benefit pension income they expect to receive plus the total pension pot from defined contribution plans. State pension should always be added in as that is often the bedrock of people’s financial income (£11,500 for this tax year).

However, some may want to stop working – or work less – before age 67 or 68 when the state pension kicks in. So some other income may be needed to fill that gap. That could be from other investments, or tax-free cash taken from pensions.

The PLSA assume a couple would each need a pension pot of between £280,000 to £450,000 to provide the comfortable standard, between £150,000 to £250,000 each for the moderate standard. But nothing extra for a couple on the minimum standard. (That’s because the figures assume each receive a full state pension, which may not be the case.) Obviously, cashing in other investments will reduce the size of the pension pots required.

If someone doesn’t like the look of what they could expect in retirement, they may want to do something about it. Paying in additional contributions could be a solution, and there are various pension calculators available that help figure out what that could achieve.

Finally, this is a tricky area, so a regulated financial adviser will be able to help build a personalised cash flow model and plan.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Daniel Coatsworth

Funds

Great Ideas

News

- Big banks expected to report largely benign fourth quarter earnings

- Shares in specialty chemical maker Victrex hit fresh multi-year lows

- Global data services specialist Experian continues to deliver positive news

- Consolidation in commercial property market shows no signs of slowing

- S&P 500 surpasses 5,000 milestone and chip design firm ARM almost doubles in a week

magazine

magazine