Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Politics

Russia remains the subject of certain EU (and American) economic sanctions and Ukraine remains a bone of contention in more ways than one. Eastern Europe’s influence could go global in 2020 because Ukraine’s President - Volodymyr Zelensky, a former actor and comedian who created a show about a fictional leader of his country - is embroiled in the ‘Ukrainegate’ scandal in the USA, which the Democrats are using as a pretext to impeach President Donald J. Trump.

One election result in Latin America shook markets to their core in 2019, when Alberto Fernández and his running partner, former President Cristina Fernández de Kirchner, unseated the Cambiemos Party’s Mauricio Macri. A return to power for the leftist Front for Victory party was be a huge rebuttal of the reforms that Macri had attempted to implement and investors ran for cover and represented a nasty shock for those who had become accustomed to the pro-business administrations of Jair Bolsanaro’s in Brazil, Ivan Duque in Colombia, Sebastian Pinera in Chile and Martin Vizcarra in Peru. Vizcarra looks set to put his credentials on the line with a snap election about constitutional reform a year early in April 2020.

The ongoing conflicts in Libya, Yemen and Syria and unrest in Algeria mean it is tempting to paint an uncompromisingly downbeat view of African politics. But reform programmes are underway in many countries, including Tanzania (even if the initial popularity of President John ‘The Bulldozer’ Magufuli appears to be waning), Ethiopia and also Sudan, which is transitioning to civilian rule under Prime Minister Abdalla Hamdok after 30 years of autocracy under President Omar al-Bashir.

Ethiopia’s scheduled 2020 General Election will be a good test of the progress made by Prime Minister Abiy Ahmed and his technocratic cabinet and parliamentary polls are also due in Tanzania, Burundi, Somalia, Ghana and in theory in Egypt, for the Senate at least. Meanwhile voters will get to elect presidents in Guinea, the Côte d’Ivoire, the Central African Republic and Togo.

Economics

With Iran suffering its worst recession since the 1980s (thanks in part to American and international sanctions), South Africa having to bail out its heavily-indebted, state-owned electricity utility Eskom and allegations of corruption in Democratic Republic of Congo that are threatening to ensnare FTSE 100 constituent Glencore, it easy to paint a bleak picture across the Africa and Middle East region, just as it is in the political sphere. The Middle East and North Africa in particular are still growing at slower rate than the global average.

Middle East and North Africa are lagging the global rate of GDP growth

| GDP growth, year-on-year (%) | ||||||

|---|---|---|---|---|---|---|

| 2015 | 2016 | 2017 | 2018 | 2019E | 2020E | |

| Middle East and North Africa | 2.5% | 3.9% | 2.2% | 1.8% | 1.5% | 3.2% |

| Sub-Saharan Africa | 3.4% | 1.4% | 2.9% | 3.0% | 3.5% | 3.7% |

| World | 3.1% | 3.0% | 3.8% | 3.6% | 3.3% | 3.8% |

Source: International Monetary Fund

But any continent where the population could double to more than two billion by 2050 has a helpful tailwind behind it and growth will not rely solely on foreign direct investment, Chinese largesse or overseas loans. The African Continental Free Trade Agreement (AfCFTA) became operational in 2019 54 signatories and 27 formally ratified members. The goal is to create a $3 trillion single market, although challenges remain, including agreements over tariffs and freedom of movement among the continent’s population.

Meanwhile, Turkish President Recep Tayyep Erdoğan continues to try and fix the mess left behind by 2018’s currency collapse as an overheating economy, swollen current account deficit and hefty overseas debts took their toll. Erdoğan fired Murat Çetinkaya as governor of the central bank when he did not deliver interest rate cuts his successor. Murat Uysal, proved more accommodating and perhaps as a result Moody’s downgraded Turkey from Baa1 to Baa3, just one step above ‘junk’ status.

The same ratings agency upgraded Russia to Baa1, meaning that Moody’s, S&P and Fitch all now rate the country as investment grade. That gave the Central Bank of the Russian Federation chance to cut interest rates five times to a five-year low of 6.25% as 2019 drew to a close.

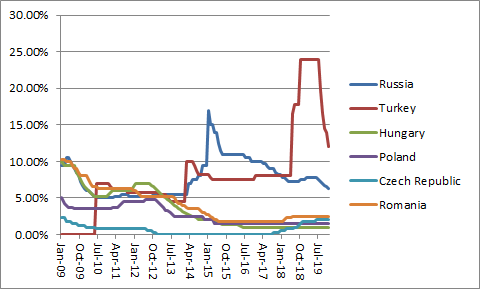

The interest-rate cycle looks to be turning in Eastern Europe

Source: Refinitiv data

Argentina was teetering on the brink of its ninth sovereign debt default since 1800, even before Macri’s ejection from office, and although Brazil and Mexico have their challenges but they are nothing like Argentina’s. Both nations have more room for manoeuvre. Mexico cut interest rates for the first time in five years in late summer and Brazil’s Selic rate reached a new low of 4.5% at the same time, figures that are light years away from the 60% Leliq rate of Argentina.

Argentina’s century bond and currency have both collapsed

Source: Refinitiv data

Markets

Buoyed by Russia’s world-leading stock index performance in 2019, in sterling, total-return terms, Eastern Europe ranked best out of eight geographic options. Moscow’s RTS index drew encouragement from interest rate cuts, the easing of some international sanctions and, as the year drew to a close, renewed strength in oil, thanks for fresh OPEC production cuts.

However, the good news ended there as Latin America and the Africa/Middle East region came seventh and eighth.

Emerging markets generally lagged developed ones in 2019

| Total return in £, 2019 (%) | |

|---|---|

| Eastern Europe | 30.4% |

| USA | 26.4% |

| West. Europe | 20.5% |

| UK | 19.2% |

| Japan | 17.2% |

| Asia ex-Japan | 14.9% |

| Latin America | 13.3% |

| Latin America | 12.2% |

Source: Refinitiv data. Total returns in sterling

This poor showing, at least on a relative basis, is merely the continuation of a trend that has been evident for most of the decade. Emerging markets have simply failed to compensate investors for the political and economic risk they have taken. Portfolio builders would instead have been better served by playing it safe and keeping their money in developed arenas such as Western Europe, Japan and, above all, the USA.

Emerging markets lagged developed ones across the past decade

Source: Refinitiv data. Total returns in sterling, 1 January 2010 to 31 December 2019

Two trends which dominated the decade were prevalent in 2019, both to the disadvantage of emerging markets. A reversal of momentum on both fronts could therefore help in the 2020s.

A strong dollar is generally bad for emerging markets and this relates to the issue of debt. Many emerging markets borrow dollars so when the buck rises that makes paying the interest more expensive in local currency terms. Argentina has effectively defaulted again, while Turkey frightened many overseas lenders in 2018. A weak dollar would buy a lot of EMs a lot of breathing space, although that probably needs to US economy to weaken and lose its lustre, perhaps weighed down by its own monstrous budget deficit.

The dollar looks to have an inverse relationship with EM equities

Source: Refinitiv data.

The role of commodity prices is often dismissed by EM specialists as lazy shorthand and frankly it may well be, especially as some EMs are net exporters and others net importers. But overall, the historic relationship between the Bloomberg Commodity index and the MSCI EM index seems pretty clear.

Commodity prices look to have a strong influence EM equities

Source: Refinitiv data.

This final chart may be the most telling. This decade can be characterised by low growth, low interest rates and soggy commodity prices. The USA has been the best place to be, as it is packed with technology companies with strong secular growth and home to the deepest, most liquid markets and the world’s reserve currency. Maybe EMs need a return to cyclical growth and inflation to really shine again.

Russ Mould, AJ Bell Investment Director

Read more from our World Investment Outlook 2020 series:

World Investment Outlook - Chapter one: UK

World Investment Outlook - Chapter two: USA

World Investment Outlook - Chapter three: Japan

World Investment Outlook - Chapter four: Asia

World Investment Outlook - Chapter five: Western Europe

World Investment Outlook - Chapter six: Emerging Markets

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 17/04/2024 - 09:52

- Tue, 30/01/2024 - 15:38

- Thu, 11/01/2024 - 14:26

- Thu, 04/01/2024 - 15:13