Wealth preserver Ruffer had a really bad 2023 – is this just a blip?

Capital preservation funds are positioned to help investors avoid large losses while growing their wealth too, albeit more slowly than more risk-tolerant funds. In the investment trusts patch, the three main wealth preservers are Ruffer Investment Company (RICA), Capital Gearing Trust (CGT) and Personal Assets Trust (PNL), while RIT Capital Partners (RCP) also has a capital preservation bent.

During bull markets, like the one we are currently driven by AI hype and interest rate cut hopes, capital preservation trusts struggle to keep pace since they have a lower exposure to shares than a standard income or growth fund and are defensively positioned to reduce risk and volatility.

Given that its principal objective is to achieve a positive total annual return, Ruffer disappointed investors by delivering negative NAV (net asset value) total returns of 6.2% in 2023, compared to a 7.9% rise for the FTSE All Share, in the trust’s worst year of absolute performance since its 2004 launch. Ruffer lagged in last year’s mega cap rally with its unconventional portfolio protections being the largest drag on performance.

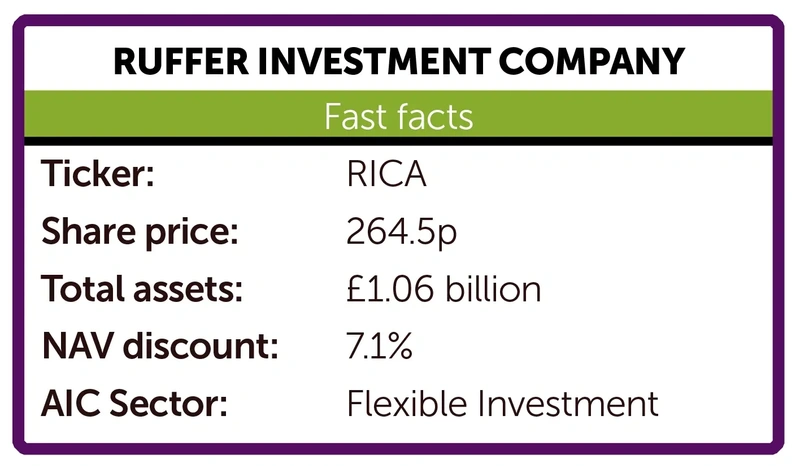

But Ruffer’s rough 2023 followed a stellar 2022 in which it made positive returns as equity and bond markets fell, and the Duncan MacInnes and Jasmine Yeo-managed fund boasts an impressive long-run record of delivering consistent growth with low volatility. That said, in both NAV and share price terms, returns are negative over one year and year-to-date and as the market has become less worried about inflation, the trust has moved from a premium to a rare 7.1% discount that has led to the board initiating share buybacks.

According to AIC data, on a one-year share price total return basis, Ruffer is down 11.7% whereas close peers Personal Assets and Capital Gearing are modestly up. Ruffer is ahead of both, and rival RIT Capital Partners, over five years. On this timeframe it is the flexible investment sector’s second-best performer.

YOUR RUFFER REMINDER

Given this discount, and an AI-fuelled rally that has sent the S&P 500 and Nasdaq indices to all-time highs, investors jittery about toppy valuations and the potential for market drawdowns might be taking a closer look at Ruffer. Especially when you consider the derivative protections the fund holds and the diversification it brings to the table.

Ruffer has an impressive record of insulating against market falls, notably during 2022, the Covid-19 pandemic and the global financial crisis. Able to go anywhere and invest in anything, the trust has pedigree in delving into asset classes that retail investors couldn’t or wouldn’t invest in themselves in order to make money, whether that’s owning Swiss bonds or Japanese yen before the financial crisis – a trade that worked well for shareholders - investing in Bitcoin in 2020, or its canny use of complex volatility call options and credit protections.

COMPELLING LONG-TERM STORY

Straight-talking money manager MacInnes concedes last year was ‘a stinker’.

‘Ruffer Investment Company was down about 6%, equal with our worst year ever. We also had a minus 6% in 2018, but apart from that in the 20 years RICA has been going, the other 18 years are all positive,’ he stresses. Over the very long term, the fund aims to deliver equity-like returns but with bond or hedge fund-like volatility explains MacInnes.

He reminds this author that Ruffer has a ‘very compelling long-term story, but we have this massive aberration of 2023.

‘You tell people you are not going to lose money and then you lose 6%, then you’ve done a bad job. We got some things wrong for sure, but we were also quite unlucky.’

Ruffer may be bruised by the headwinds faced in 2023, but MacInnes and Yeo are energised by the future. They challenge the certainty of a world of low and stable inflation, growth and geopolitical stability with low-risk premiums and high asset prices.

They continue to believe that over the longer term, structural challenges to the global economy are likely to create a more inflation-prone, volatile environment in which the portfolios long-dated inflation linked bonds and gold equities would benefit.

‘We’ve decided to call it “the ugly duckling portfolio”,’ adds MacInnes. ‘Because we’ve got this collection of assets that we really like, but which have been totally shunned by most investors.’

Examples include the yen, at a 50-year low relative valuation, inflation-linked bonds, which are down 70% from 2021 highs, as well as Ruffer’s credit spreads and volatility call options.

‘The sort of things we put in our “unconventional protective toolkit”, that are at the same level of cheapness as they were pre-Covid when nobody was worried about downside risk,’ says MacInnes.

MacInnes points out Chinese equities, albeit only 4% or 5% of Ruffer’s portfolio but a decent chunk of its stock-based holdings, are: ‘The one part of the global equity market that nobody wants anything to do with. And the rest of the equity book is quite value cyclical, not The Magnificent Seven. Every single asset has been really beaten up and that’s why we’ve felt quite a lot of pain.’

CAN RUFFER BOUNCE BACK?

However, MacInnes likens Ruffer’s contrarian portfolio to ‘a tennis ball held underwater’ and believes that ‘some of these things are going to do really, really well’, with gold and gold mining stocks starting to work.

The trust owns Newmont (NEM:NYSE), Barrick Gold (GOLD:NYSE) and a host of smaller miners. Around 8% of the portfolio is in gold mining companies and in silver. Even though gold is at all-time highs, investor interest remains low and the gold miners ‘are much, much cheaper’ than the actual commodity according to MacInnes, the same with silver.

Yet while gold is at all-time highs, ‘nobody cares’, says MacInnes. ‘Which is so weird because Bitcoin has taken all the headlines away from it. Gold is actually rising despite the fact that it is seeing massive outflows from ETFs. That tells you that the buyers of gold right now are not retail investors and wealth managers, its far more global central banks and high net worth investors. It’s a healthy sign and suggests that the market has quite a bit further to go.’

As outlined in Ruffer’s latest monthly investment report, MacInnes and Yeo expect persistent inflation to remain an issue since policy makers have shown a willingness to ‘deliver a swift and deep-pocketed response to any economic pain and the most realistic long-term solution to bulging government deficits is inflation’.

‘We continue to position the fund to benefit from this structural theme, through exposure to gold, inflation-linked bonds and commodities,’ he concludes.

As MacInnes tells Shares: ‘We think the decade post Covid is going to have higher average inflation, maybe more like 3% to 5% but with much more volatility. Pre-covid, 2% inflation was sort of the ceiling whereas now I think it’s the floor.’

He continues: ‘We are running war time deficits when the stock market is at all-time highs, the economy is not in recession and unemployment it at 50-year lows, so what’s the deficit going to look like if we ever have economic weakness? That’s why we have such confidence in the long-term inflation thesis. Where we’ve sort of gone wrong is in the shorter term, letting cyclical recession concerns get in the way a little bit.’

STOCK MARKET HOLDINGS

MacInnes and Yeo believe sentiment and positioning in Chinese equities has reached extreme lows, which is reflected in ‘attractive valuations’. Furthermore, the support being provided to asset markets by the Chinese authorities gives Ruffer’s managers ‘comfort they are pushing in our direction. This stands in stark contrast to the setup for US equity markets where, needless to say, we remain cautious of both valuations and momentum’.

Ruffer’s overall equity weighting is low is because MacInnes and Yeo think it will be ‘very difficult, given the dominance of the US in global markets now, for the rest of the world to decouple’.

The fund doesn’t have a lot of US equity exposure due to aforementioned valuation worries, but valuations appear ‘less stretched’ in the UK, Europe, Japan and China, where the fund has more exposure. ‘China is absolutely hated and that’s understandable,’ MacInnes informs Shares. ‘However, there’s a right price for everything.’ Holdings include China ETFs, ecommerce colossus Alibaba (BABA:NYSE), the former market darling now valued like an ex-growth company with 30% of its market cap in cash, not to mention Cathay Pacific-owner Swire Pacific (HKG:0019).

Kepler Trust Intelligence says: ‘Ruffer is a valuable hedge against central banks not being able to engineer a “soft landing”. We think Duncan and Jasmine are right in their view that markets are now pricing in an incredible escape from the inflationary environment of the past few years. As a result, a typical equity and bond portfolio could be dangerously exposed if this outcome doesn’t emerge, and Ruffer could provide valuable protection once more.’

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine