Invest in the future of medicine

At the centre of the current boom in generative AI (artificial intelligence) is chip maker Nvidia (NVDA:NASDAQ).

It designs some of the fastest computer chips in the world which are needed to run data hungry LLMs (large language models) capable of understanding natural language.

Readers may be familiar with Nvidia’s historical link to the gaming industry, but less familiar with the US giant’s connection to the biotechnology sector, supplying superfast GPUs (graphics processing units) used in gene sequencing.

On 20 March Nvidia announced a collaboration with Danish diabetes specialist Novo Nordisk (NOVO-B:CPH) to build one of the world’s most powerful supercomputers.

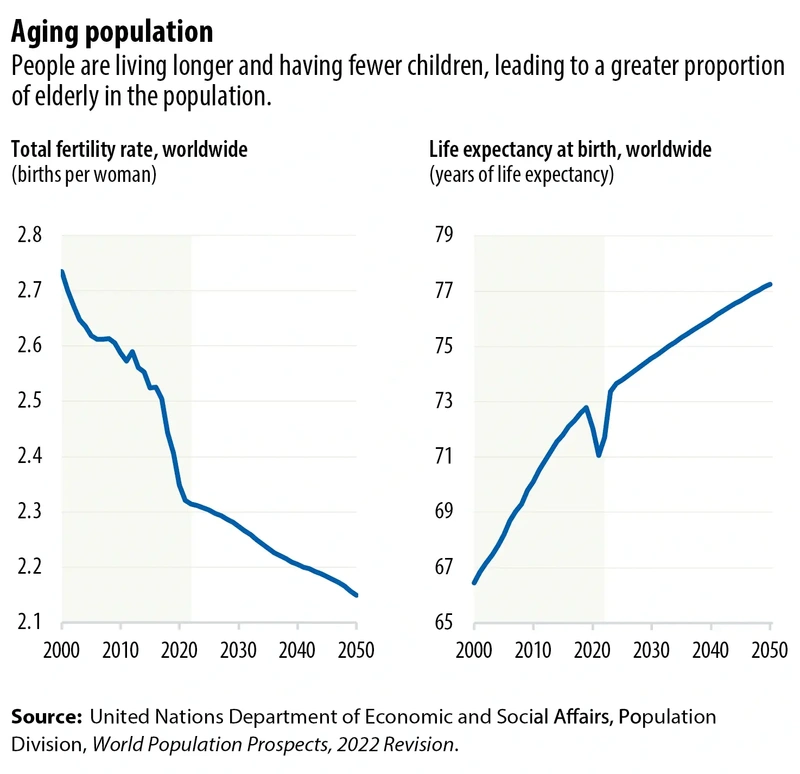

This is just one example of the way technology is transforming the world of medicine. Crucial as the West, in particular, contends with the challenges of an increasingly elderly population.

A WEIGHT-LOSS BOOM

Novo Nordisk is at the forefront of another boom attracting frenzied interest from investors, weight loss treatments.

Novo Nordisk owns the weight-loss drug Wegovy which is a leader in a market expected to top $100 billion in sales by 2030.

The project will be funded by the Novo Nordisk Foundation and powered by Nvidia’s AI technology with the aim of discovering new medicines.

The Foundation has awarded the building contract to France’s Eviden which has named the supercomputer Gerfion.

In a statement Eviden’s head of quantum computing Cedric Bourrasset said Gerfion should provide, ‘unprecedented potential to accelerate ground-breaking scientific discoveries in areas such as drug discovery, disease diagnosis and treatment.’

The potential for ‘next generation’ AI to accelerate scientific discoveries was highlighted in January 2024 when Microsoft (MSFT:NASDAQ) said a new battery material had been discovered in weeks rather than years.

In April 2023 US biotechnology firm Moderna (MRNA:NASDAQ) known for developing the first Covid-19 vaccine using mRNA technology signed an agreement with IBM (IBM) to explore quantum computing for developing future medicines.

Quantum computing is a rapidly emerging and transformative technology that utilises the principles of quantum mechanics to solve problems too complex for classical computers.

WHAT IS THE PROMISE OF GENERATIVE AI?

One of the biggest applications for generative AI in healthcare is in gene sequencing and gene editing.

By leveraging generative AI’s capabilities, scientists can rapidly and accurately analyse vast amounts of data. It can help identify patterns, make predictions, and classify genetic variations based on training from large datasets.

For example, a widely acclaimed large language model for genomic data has demonstrated its ability to generate gene sequences that closely resemble real-world variants of SARS-CoV-2, the virus behind Covid-19.

It is hoped advances in technology can facilitate the detection of mutations, leading to personalised medicine and targeted treatments.

The first sequencing of the human genome (discovering the base pairs of DNA) was a project involving international collaboration and took 13 years to complete at a cost of roughly $3 billion.

By 2003 the project had discovered over 90% of the human genome but it took another decade and the development of next generation sequencing machines to map the entire genome.

US gene sequencing giant llumina (ILMN:NADSAQ) dominates the market and in 2023 revealed a machine which can sequence a genome for as little as $200.

The speed record for sequencing a genome is around five hours although more commonly it takes weeks. Costs continue to fall and Ultima Genomics is offering high-throughput whole genome sequencing at just $100 per sample.

UK challenger Oxford Nanopore Technologies (ONT) offers the only single technology that can sequence any-length DNA or RNA fragments in real time. These features allow the rapid discovery of more genetic variation.

For example, Seattle Children’s Hospital has used its high throughput nanopore sequencing instrument PromethION to understand a genetic disorder in the first few hours of a newborn’s life.

An estimated 40 exabytes (a billion gigabytes) will be needed to store all human genome data by 2025 according to George Vacek at Nvidia. For reference, that is equivalent to more than eight times the storage required to store every word spoken in history.

WHERE AI IS ALREADY MAKING A DIFFERENCE

Traditional AI has been used in health care for decades, from the computers which drive robots to assist in surgeries to diagnostics such as detecting lung cancer from a CT (computed tomography) scan.

As mentioned, a growing theme in the use of AI in medicine is the adoption of personalised medicine. The goal is precision medicine for all, although it may be a while before it is achieved.

There are two broad AI approaches being adopted; AI algorithms and deep learning.

AI algorithms are a set of instructions enabling machines to analyse data, perform tasks and make decisions. It is a subset of machine learning which allows computers to operate independently.

Deep learning is a method in AI which teaches computers to process data in a way inspired by the human brain. It is called a neural net method.

Deep learning models can recognise complex patterns in pictures, text, sounds, and other data to produce accurate insights and predictions.

WHERE ELSE IS TECHNOLOGY BEING APPLIED?

Let’s look at some of the applications being adopted across different areas of healthcare and medicine.

UK global medical products company Smith & Nephew (SN.) has developed a next generation handheld robotics platform for knee and hip replacements called the CORI system.

The platform is the only one on the market which allows for personal planning using simulation and AI. Based on individual clinical profiles, the software provides procedural planning and implant placement guidance.

Smith and Nephew’s robot-assisted solutions are already having positive effects with patients being discharged in under 24 hours without complications or readmissions.

AIM-quoted LungLife AI (LLAI:AIM) is a diagnostic company focused on the early detection of lung cancer.

The company is developing a test that pairs a simple blood draw with artificial intelligence to provide clinicians and patients the information they need to make informed decisions about the management of lung nodules and lung cancer.

In January 2024 the results of a clinical study demonstrated a strong PPV (positive predictive value) of 81% in discriminating cancerous lung nodules in patients with smaller nodules less than 15 millimetres.

These types of nodules present the greatest challenge for physicians in detecting cancers. Current standard of care generates a PPV of 60% which leads to material delays in diagnosis of deadly cancers.

Cardiovascular disease causes over 18 million deaths a year across the globe. Discovering ahead of time who is more susceptible to developing the disease could save millions of lives.

Genincode’s (GENI:AIM) lead product CARDIO InCode is a genetic risk assessment cardiovascular test with US FDA (Food and drug administration) approval on the horizon.

The company’s LIPIDW InCode test measures susceptibility to high cholesterol. Both tests combine clinical algorithms and AI to provide advanced patient risk assessment to predict cardiovascular disease.

Analyst Emma Ulker at WH Ireland estimates the two tests have a total addressable market opportunity in the US of around $6.3 billion if approved.

Patients suffering from second and third-degree burns can wait up to two weeks in hospital, all the while suffering pain while they find out if they require surgery. This is because of the uncertainty surrounding tissue regeneration.

Burn experts are only 70% accurate in assessing the viability of burnt tissue and non-specialists are the equivalent of a 50-50 coin-flip.

Up to 50,000 patients are admitted to hospital every year of which 10,000 die of burn-related infections. This means finding a quicker and more accurate assessment is paramount to saving suffering and lives.

OFFERING A DEEP VIEW

One exciting and much needed solution could be Spectral AI’s (MDAI:NASDAQ) DeepView technology.

Based on extracting millions of multispectral datapoints from each wound the company’s machine learning model integrates the information with a proprietary clinical database.

The result is a day-one assessment which is 92% accurate which means patients are directed to the most suitable care with less suffering and hospital time.

The average cost for treatment of a severe burn is around $780,000 according to Spectral AI. If burns are more serious the costs can skyrocket to cost $1.6 million on average.

Another company developing precision medicine is Oxford Biodynamics (OBD:AIM) which is commercialising its proprietary EpiSwitch3D genomics platform. The company has built one of the largest patient clinical databases in the world.

In September 2023 the company received early validation of its prostate cancer screening test which is 94% accurate compared with 55% using standard of care testing methods in the NHS.

The test opens the prospect of fewer men being recommended for unnecessary invasive and expensive biopsies and more patients will get the treatment they require.

Further exciting news came on 18 October when Oxford Biodynamics announced a strategic partnership with Bupa, the UK’s leading health insurer, to give patients access to EpiSwitch Cirt (Checkpoint inhibitor Response Test).

It is a first-of-its-kind blood test that accurately predicts an individual cancer patient’s therapeutic response to treatment and thereby identifies those most likely to benefit from this class of therapy.

WAYS TO INVEST

Picking individual shares is a risky endeavour at the best of times. In specialist sectors like healthcare and biotechnology the risks are higher still.

Even companies with proven and regulated products can struggle to fully commercialise novel treatments and technologies.

For most retail investors going down the fund route is a good option. Here Shares provides a share pick for more adventurous souls and an investment trust for more conservative investors.

It is worth reminding readers the biotechnology sector is deeply out of favour, with the Nasdaq Biotechnology Index (NBI) languishing around 18% below its 2021 peaks.

Schrodinger (SDGR:NASDAQ) $25.65

Market cap: $1.9 billion

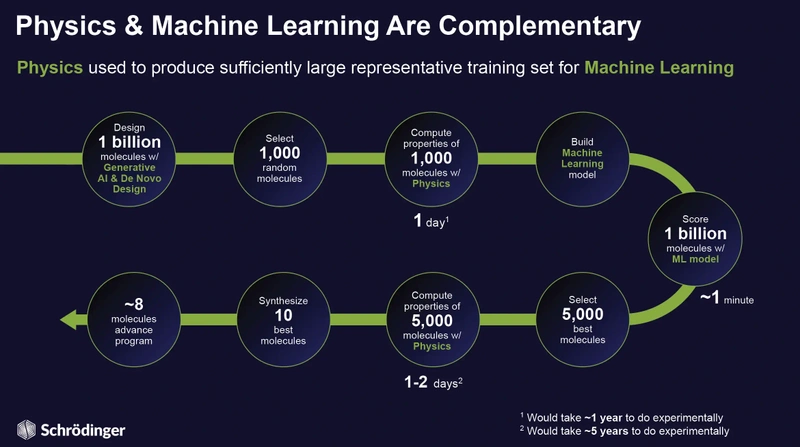

Schrodinger (SDGR:NASDAQ) has developed the leading physics-based computational platform which enables the discovery of molecules for targeted drug development.

The software whittles down potential molecules from over a billion to a few compounds in a matter of days. The underlying technology is based on machine learning which amplifies physics-based simulations.

The company has partnered with 17 drug and material design companies including Eli Lilly (LLY:NASDAQ) and German-based pharmaceutical company Bayer (BAYN:ETR).

The Eli Lilly collaboration involves Schrodinger discovering and optimising small-molecule compounds against a target which are then put into pre-clinical trials.

The deal comprises a small upfront fee and potential discovery, development, and commercial milestones of up to $425 million.

Schrodinger generates revenue from selling software licenses which grew 17.4% in 2023 to $159 million. Total 2023 revenue was $217 million. Revenues have grown at a compound annual growth rate of 24% a year since 2020.

It is worth pointing out the company is still loss making to the tune of $212 million based on analysts’ forecasts for 2024, although the firm made a $41 million net profit in 2023.

The good news is Schrodinger has $463 million in cash on the balance sheet to fund its growth ambitions.

Those ambitions are underpinned by 15 programmes eligible for royalties on sales with a cumulative total milestone opportunity of around $5 billion, according to management.

International Biotechnology Trust (IBT) 655.2p

Market cap: £246.5 million

Investing in the International Biotechnology Trust (IBT) not only provides diversified access to some of the most innovative and highest quality quoted companies in the sector but also exposure to unquoted companies.

In addition, the trust trades at a 10% discount to net asset value, one of the steepest since the pandemic and unusually in the sector the trust pays a 4% dividend of closing net asset value, paid twice a year.

Managers Ailsa Craig and Marek Poszepczynski apply a rigorous and differentiated risk management process which involves taking prudent steps to reduce individual company risk ahead of binary events such as readouts from clinical trials.

Craig has been involved with the trust since 2006 and Poszepczynski since 2014. They became co-managers in March 2021.

During the first half of 2022 and 2023 the managers increased exposure to smaller, earlier stage businesses as valuations became more attractive.

Explaining the rationale, Craig commented: ‘Many of these companies are trading at or below cash values, yet this sort of risk-off environment can still yield ground-breaking innovation and tremendous growth.’

The trust has outperformed the Morningstar Biotechnology sector category over three, five and 10-years with an annualised return of 10.9% a year over the last decade, almost double the sector category. The trust has an ongoing charge of 1.2% a year.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine