What do European companies really care about right now?

If a management team is any good at running a public company then the numbers contained in a results statement should often be something of a non-event.

It means those at the top have done a good job of setting expectations for revenue and earnings ahead of time – both in the background through briefings with the financial community and in publicly-available trading updates – and there is little for the market to pick over. This is why the focus is so often on the surrounding commentary and outlook, which has the additional bonus of offering forward-looking insights.

Analysts at investment bank Morgan Stanley have carried out an interesting analysis of company-level commentary across Europe to examine which themes are cropping up most right now, how that compares with the past and the wider story that tells us.

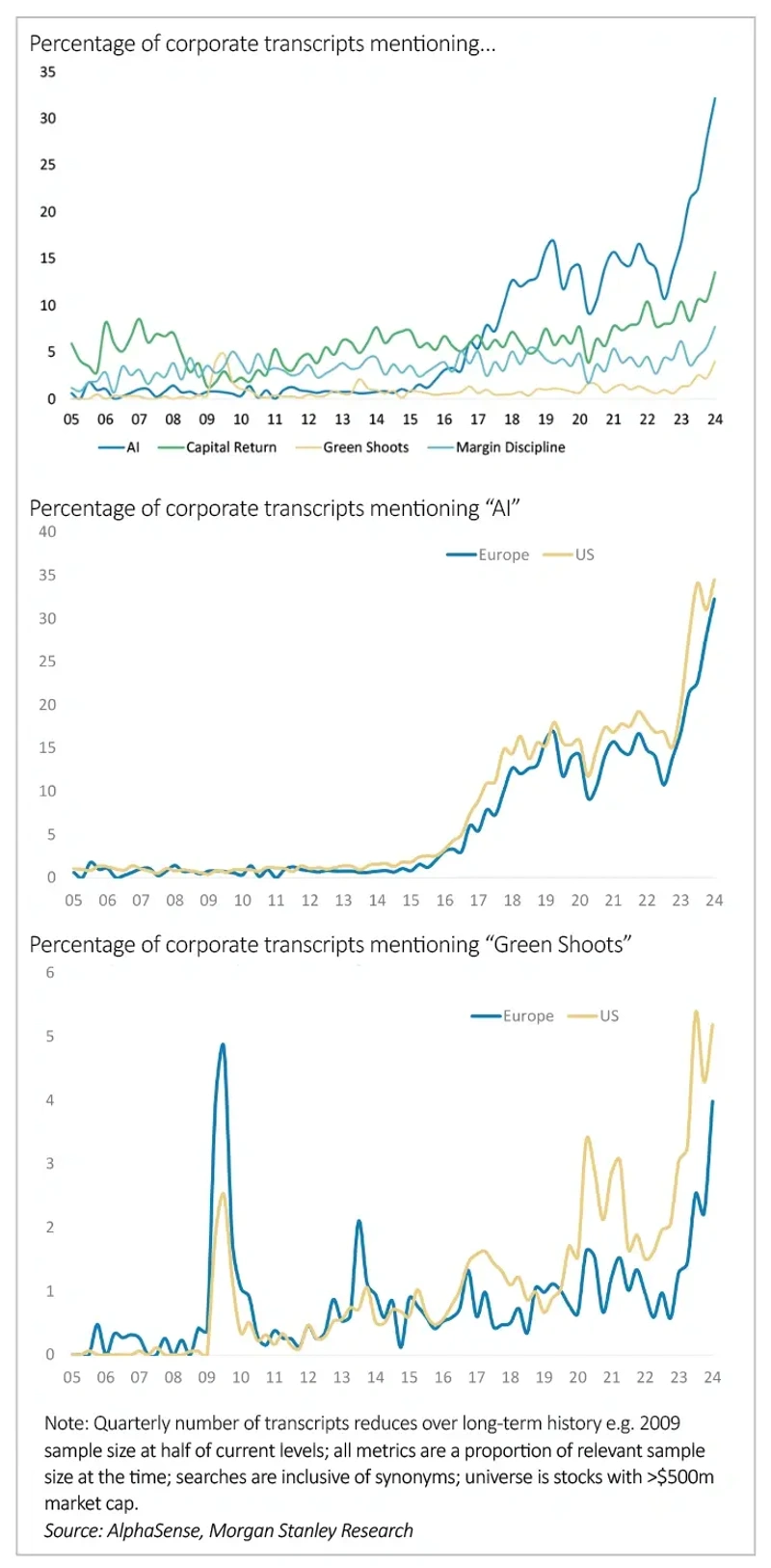

Appropriately enough the top theme, which, surprise, surprise, is AI (artificial intelligence), was used to power Morgan Stanley’s AlphaSense LLM (large language model) technology which parsed more than 300,000 transcripts from the last 20 years.

The results from the current earnings season show 32% of European companies discussed AI, while the number of companies mentioning ‘energy costs’ has dropped from 40% at the at the 2022 peak to 21% and there was a steady rise from lows in the mentions of ‘layoffs’. Encouragingly, the term ‘green shoots’ is also rising in prominence.

The team comment: ‘In most cases, Europe is following the US trend but in several important areas Europe is leading in terms of the proportion of companies mentioning a theme. In addition to ESG and ‘Energy Transition’, we see a higher proportion of European companies mentioning “efficiency”, deleveraging, “capex cuts”, “cost cutting” and M&A. Notable areas where Europe lags are “consumer strength”, “capital returns/buybacks” and AI.’

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Ask Rachel

Daniel Coatsworth

Editor's View

Feature

- Why the Taiwanese market is more than just TSMC

- Emerging markets: semiconductor surge, electric vehicles and Egypt

- Small world: a look at some of the month’s interesting small-cap stories

- Sweet like chocolate: the total return stocks profiting from the sale of tasty treats

- Invest in fantasy: The power of imagined worlds and the ways to play them

Great Ideas

News

- Activist investor buys into Scottish Mortgage as buyback is announced

- Next shares reach new all-time high as earnings top estimates

- Dowlais shares skid to record low on bumper provision

- Markets move higher on more ‘dovish’ central bank comments

- Why Apple US antitrust probe has spooked investors

- Gold and stocks scale new heights after dovish Fed meeting

magazine

magazine