Invest in fantasy: The power of imagined worlds and the ways to play them

The world of fantasy is clearly having a moment. The rise of ‘romantasy’ authors like Sarah J Maas, who has been a big part of UK publishing outfit Bloomsbury’s (BMY) recent success, have taken the genre out of its previous male-dominated realm to a whole new audience.

Bloomsbury’s surging sales and the ongoing phenomenon that is Games Workshop (GAW) are two examples on the UK market which show the devotion fantasy worlds can inspire.

Warren Buffett disciple and manager of CFP SDL UK Buffettology General (BKJ9C67) Keith Ashworth-Lord once described Games Workshop, which represents 9% of the portfolio, as the ‘nearest thing to legal drug dealing on the stock market’, with the tabletop games firm ticking one of the key boxes he looks for in a business: capturing a piece of its customers’ minds.

But this concept is a global one which is applicable beyond the fantasy genre. Imagined worlds are powerful – connecting with people on an emotional and intellectual level and driving a connection which creates significant barriers to entry and pricing power for the owners of the relevant intellectual property.

THE DEVELOPMENT OF THE METAVERSE

The whole idea of taking real estate in people’s brains could become even more powerful as technology develops and artificial intelligence, virtual reality and the metaverse move into the mainstream. The opportunities for businesses with the right intellectual property could be significant given the ability for people to engage with fictional characters and universes on a deeper level.

This sort of symbiotic relationship is not new, cartoons in the 1980s were used as a means of selling toy ranges and more recently the huge success of Mattel’s Barbie film has shown the power of this form of cross-pollination.

It is also an effect which has played out in Walt Disney’s (DIS:NYSE) theme parks for decades. As media commentator Matthew Ball described it in an essay a few years ago: ‘There is nothing that can compare to the impact of a child being hugged by her heroes. The ability to enjoy your favourite intellectual property as “you” is unique and lasts a lifetime.’

The development of the metaverse could, for example, allow you to be a member of the Avengers or enter Hogwarts as a new wizarding pupil from the comfort of your own home, reinforcing your connection with these characters and universes.

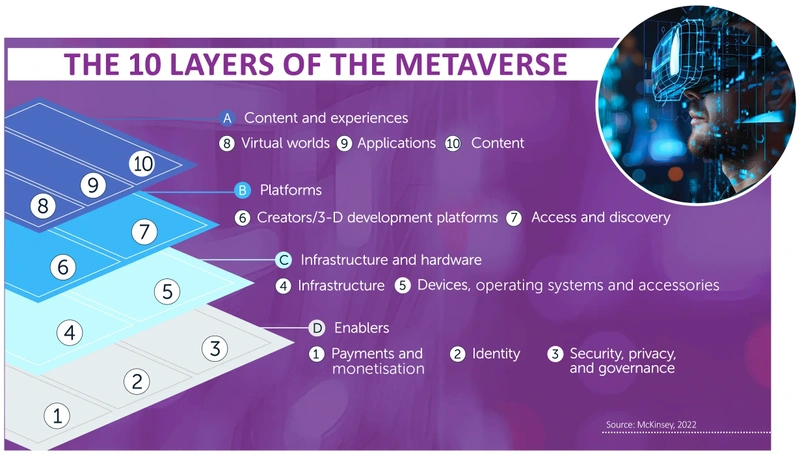

As the graphic shows, there are several layers of the metaverse from content and experiences through to the platforms, infrastructure and enablers including chip makers like Nvidia (NVDA:NASDAQ). Technology giant Microsoft (MSFT:NASDAQ) is an example of a business which might operate across several of these layers. Its presence in this nascent market was bolstered by its torturous acquisition of games company Activision Blizzard which eventually completed in October 2023 for $75.4 billion.

The deal provides Microsoft with ownership of established brands like World of Warcraft and Call of Duty. At the time the transaction was first unveiled in January 2022 Microsoft chair and chief executive Satya Nadella said: ‘Gaming is the most dynamic and exciting category in entertainment across all platforms today and will play a key role in the development of metaverse platforms.

‘We’re investing deeply in world-class content, community and the cloud to usher in a new era of gaming that puts players and creators first and makes gaming safe, inclusive and accessible to all.’

When it comes to the hardware required to make the metaverse a reality, Apple’s (AAPL:NASDAQ) launch of a virtual reality headset feels like a watershed moment. While the company’s recently launched Vision Pro product hasn’t been without teething problems, its track record suggests it will eventually get things right and that the hefty price tag will begin to come down over time making it accessible to a broader market.

THE ROLE OF GAMING

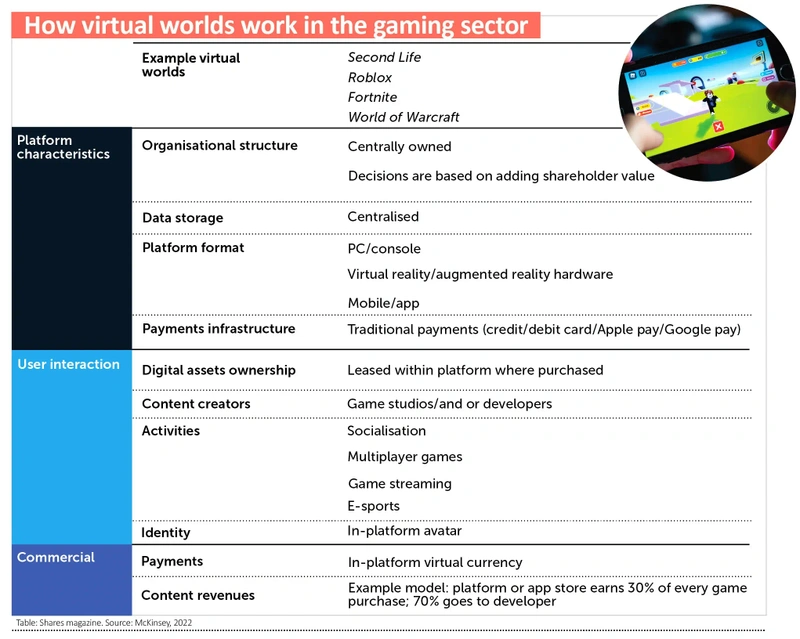

Writing in 2022, consultancy McKinsey argued: ‘The “proto-metaverse” exists, fueled by a powerful force: the gaming experience. Gaming eclipses other subsectors of the entertainment industry with its popularity. With more than three billion users globally and a total value of more than $200 billion, the gaming sector is larger than movies and music.’

Sandbox games and massive multiplayer online role-playing games like the Grand Theft Auto series, World of Warcraft and, at the more kid-friendly end of the spectrum, Minecraft and Roblox (RBLX:NYSE), give you considerable freedom to tinker with the environment of the game and to interact with other players online.

Meanwhile, Nintendo’s (7974:TYO) Pokémon Go, launched in 2016, brought the concept of augmented reality into the mainstream – with people able to capture the creatures in the real world.

Entertainment giant Disney’s recent tie-up with video game outfit Epic Games – the company behind the hugely popular Fortnite game – looks interesting in this context.

As part of the joint venture Disney is taking a $1.5 billion equity stake in Epic. The plan is to create a ‘persistent universe’ using Epic’s Unreal Engine software framework allowing consumers to play, watch, shop and engage with content and characters and stories from Disney, Pixar, Marvel, Star Wars and Avatar. Disney IP (intellectual property) already features in the existing Fortnite universe and this looks to be a much more ambitious concept.

Disney as a business faces lots of challenges right now, from succession planning to its streaming strategy and onerous investment in its parks, but it is possible to see significant potential in a more concerted move into the gaming sphere with the company only at the foothills of fully exploiting its IP.

WAYS TO INVEST IN FANTASY, IMAGINED WORLDS AND THE METAVERSE

Games Workshop (GAW) £100.20

Tabletop games business Games Workshop (GAW) has a devoted fanbase and has only begun to scratch the surface of tapping into this devotion. A deal with Amazon (AMZN:NASDAQ) to develop its Warhammer 40,000 universe into films and a TV series, long in the gestation, was confirmed in December 2023. This provides a potential stream of income for the business – Jefferies has estimated it could earn $1 million for each episode of any future series aired – plus a very high-profile shop window for its IP.

While it will likely be some time before anything hits the screens, and there are risks of alienating devotees if execution is poor, Games Workshop is already generating significant licensing revenue. This is highly attractive as it comes with extremely limited costs attached. The company is also cognisant of the dangers of getting it wrong. It says: ‘We will continue to grant licences to carefully chosen partners that respect the need for us to have complete ownership of our unique IP, to ensure no harm is done to the core business.’ The shares trade on a price-to-earnings ratio for the 12 months to 31 May 2025 of 21.5 which seems undemanding for what is a pretty unique business.

Microsoft (MSFT:NASDAQ) $422.60

At the forefront of AI (artificial intelligence), cloud computing and data which will provide the infrastructure behind the metaverse, Microsoft (MSFT) also has a footprint at the front end thanks to its capture of Activision Blizzard and the World of Warcraft and Call of Duty franchises. The shares are not cheap at 31.8 times 2024 consensus forecast earnings but that reflects the strengths of a business which also enjoys a leading position in corporate software and communication tools like Teams and Microsoft 365. Microsoft is firmly plugged into the future of work and entertainment.

ETF options

There are several exchange-traded funds which aim to track the development of the metaverse but these are modestly-sized and new to the market. The largest, with assets of £25 million, is iShares Metaverse (MTAV) which has an ongoing charge of 0.5%. The portfolio includes names like Meta Platforms (META:NASDAQ), Nvidia and Electronic Arts (EA:NASDAQ). A larger and more established product exists which tracks the video game and e-sports market in the form of VanEck Video Gaming and eSports (ESGB). This has an ongoing charge of 0.55% and provides exposure to Nintendo and Take-Two Interactive Software (TTWO:NASDAQ) among others.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Ask Rachel

Daniel Coatsworth

Editor's View

Feature

- Why the Taiwanese market is more than just TSMC

- Emerging markets: semiconductor surge, electric vehicles and Egypt

- Small world: a look at some of the month’s interesting small-cap stories

- Sweet like chocolate: the total return stocks profiting from the sale of tasty treats

- Invest in fantasy: The power of imagined worlds and the ways to play them

Great Ideas

News

- Activist investor buys into Scottish Mortgage as buyback is announced

- Next shares reach new all-time high as earnings top estimates

- Dowlais shares skid to record low on bumper provision

- Markets move higher on more ‘dovish’ central bank comments

- Why Apple US antitrust probe has spooked investors

- Gold and stocks scale new heights after dovish Fed meeting

magazine

magazine