Energy stocks only this cheap three times in last 40 years

Oil prices recently hit a four-month high with Brent crude topping $86 per barrel after US inventories came in lower than expected and amid reports of attacks on Russian facilities.

Yet the FTSE 350 Oil & Gas Producers sector is pretty much flat, like the wider UK market. In the US, energy stocks are underperforming the S&P 500 with a 7.4% gain against 9.4% for the wider market.

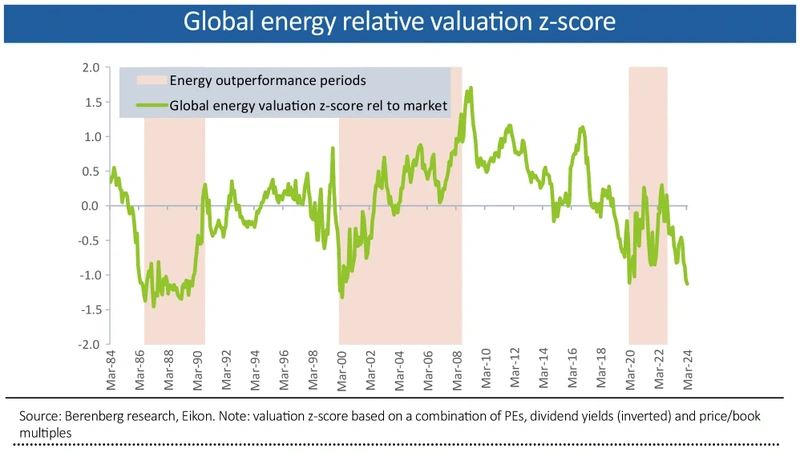

Writing in mid-March, Berenberg observed that: ‘The US and European energy sectors now trade at, or near, all-time lows relative to the market across various valuation metrics. On a global basis, energy trades at relative valuation levels only seen three times in the past 40 years: the late 1980s, 2000 and 2020.

‘Investors would have been rewarded for taking on exposure to energy equities at each of these points, outperforming the market by an average 108% (14% annualised) from these levels.’

The German investment bank also notes that energy stocks are generating high levels of cash, have strong balance sheets and are busily returning capital to shareholders in the form of dividends and share buybacks.

The other reason energy might look interesting to investors is the current heightened levels of geopolitical risk – notably those linked to conflicts in the Middle East and Ukraine which have a direct impact on the flow of oil and gas. Escalation in either of these regions could place upward pressure on prices.

There are reasons energy stocks trade at a discount. Funds which screen on ethical or sustainability criteria are likely to steer clear, the world is supposed to be phasing out fossil fuels and their fortunes are tied to commoditised products over whose price they have limited to no control.

But Berenberg’s analysis is worth at least bearing in mind as we await first-quarter results from FTSE 100 heavyweights Shell (SHEL) and BP (BP.) on 2 May and 7 May respectively.

Much has been written about the difficulties facing the UK market as it battles an exodus of high-profile companies with few substantial new listings to replace them, but they got a partial vote of confidence from the chief executive of British American Tobacco (BATS) Tadeu Marroco who told the Financial Times there was nothing to suggest it was a ‘no brainer’ to move a listing to the US – describing talk of such a move as a distraction. In an upcoming issue of Shares we plan to examine whether companies which have moved their primary listings from the UK really have benefited from improved valuations.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Exchange-Traded Funds

Feature

- Understand whether Super Micro Computer is an investment flop or technology great

- Do markets actually care who wins the US election in November?

- Construct an ISA portfolio: Put the building blocks in place for investment success

- Fear of missing out has supplanted fears of a market sell-off

- Find out how London Tunnels plans to create one of the biggest tourist attractions in the capital

Great Ideas

Money Matters

News

- Springfield Properties hits new highs as confidence recovers

- Focusrite shares nosedive after company warns on sales and earnings

- Scottish Mortgage tackles NAV discount with £1 billion buyback while Witan invites new managers

- Nvidia unveils new ‘superchip’ at its first conference for four years

- Could litigation headaches lead to a breakup of Reckitt Benckiser?

magazine

magazine