Construct an ISA portfolio: Put the building blocks in place for investment success

We are weeks away from the end of the tax year and inevitably there is plenty of focus on ISAs – whether that relates opening an account or using up existing allowances.

In all the hoo-hah it’s easy to lose sight of just what a compelling vehicle this is for investors. Whatever you are investing for, whether it’s the cost of the kids’ education, to supplement your income in retirement or to fund home improvements and extensions, an ISA not only allows you to accrue capital gains and income from your investments free of tax, but it also means you avoid the stress and time involved with filling out a tax return every year.

To take things back to the fundamentals and help you, whether you’re looking to invest for the first time or bring some order to a collection of holdings which are perhaps lacking a bit of structure or logic, this article is going to look at the different considerations and options when it comes to constructing an ISA portfolio.

A mistake made by some investors when they are starting out is to act like a collector, buying things they like or are excited by without any regard to how they fit with each other. Instead, having the building blocks in place, the solid foundation to your portfolio, is a more surefire route to success.

WHY INVEST AT ALL?

The rise in interest rates over the last two years mean you can currently get a decent return by holding money in the bank, but assuming you plan to invest for a decent period – at least a decade or more – then investing your money makes more sense.

According to the 2023 edition of Barclays Equity Gilt Study, which looks at the returns of different asset classes over the last 125 years, on a 10-year view the probability of shares outperforming gilts (government bonds) and cash is 91%.

You should not expect a smooth journey and being aware of this in advance should help manage your emotions when markets go through a sticky spell. Stock markets move up and down all the time, so rather than getting 6% every year you’re more likely to see a more volatile pattern; 12% up one year, 5% down another year, 3% up, 7% down, 16% up, 9% down and so on.

WHAT ARE YOU INVESTING IN?

Stocks and shares are units of ownership in a company. Companies sell them to shareholders to provide funding to grow their business. Some companies have millions of shareholders, who all own a tiny piece of the company; others have just a handful. People buy and sell shares on stock markets like the London Stock Exchange.

There are two ways for shareholders to ‘earn’ money:

- Selling their shares for a higher price than they paid for them (also known as a capital gain);

- Holding onto their shares in return for a payment from the company, known as a dividend.

That can create a return that’s higher than the rate of inflation, which is how the right investment can help you beat rising prices.

If there are concerns about the company’s growth or performance and demand for shares is low, the value of your shares will go down and you may get back less than you invested. There’s no guarantee on dividends either.

In a poor year, the directors may decide there isn’t enough surplus cash available from the business to pay shareholders what they were expecting, or any dividend at all. But it is important to remember, over the long term, dividends and share prices are likely to produce something close to their long-term averages.

HOW TO GO ABOUT INVESTING

If that answers the why and what questions, then we need to turn to how you might go about investing.

There are three ways to invest in the financial markets. You can:

- Choose the individual investments yourself;

- Employ an expert to choose investments for you, which can be prohibitively expensive if you are only investing relatively modest sums;

- Invest through a fund, where a professional manager chooses the underlying assets on behalf of all the investors in the fund, or in a tracker fund or ETF which aims to match the returns of an index.

THE COSTS OF INVESTING

If you open a Stocks & Shares ISA, Lifetime ISA or Junior ISA with an investment platform there are various costs and charges which need to be factored into your planning.

For example, AJ Bell imposes an annual custody charge which is a fee for holding your investments. For shares, investment trusts, ETFs and bonds, this is 0.25% a year, capped at £3.50 per month. For funds, you pay 0.25% for the first £250,000 of assets, 0.1% for the next £250,000 worth of investments and nothing above £500,000.

For buying and selling investments there are costs associated with each trade. AJ Bell charges £1.50 for funds or £9.95 for all other types of investments including shares. The latter can fall to £4.95 per trade if you have done 10 or more share deals in the previous month. You can set up a regular investment service whereby you buy the share, investment trust, fund or ETF each month for £1.50 per trade.

You have to pay 0.5% stamp duty on UK-listed shares (excluding those on the AIM market) and there are also foreign exchange fees if you buy overseas-listed shares.

Funds have an in-built charge which is typically 0.1% to 0.2% for products that track an index or 0.75% to 1% for those where a fund manager makes all the portfolio decisions.

For most people looking to create a portfolio from scratch or help bring order to a muddled collection of investments, funds, investment trusts or ETFs are a good starting point in terms of both cost and diversification. In this article we will look at three different options which involve varying degrees of input on your part to create a portfolio, from ready-made solutions to purported one-stop shop vehicles to a mix of low-cost exchange-traded funds.

REGULAR INVESTMENT AND REINVESTMENT

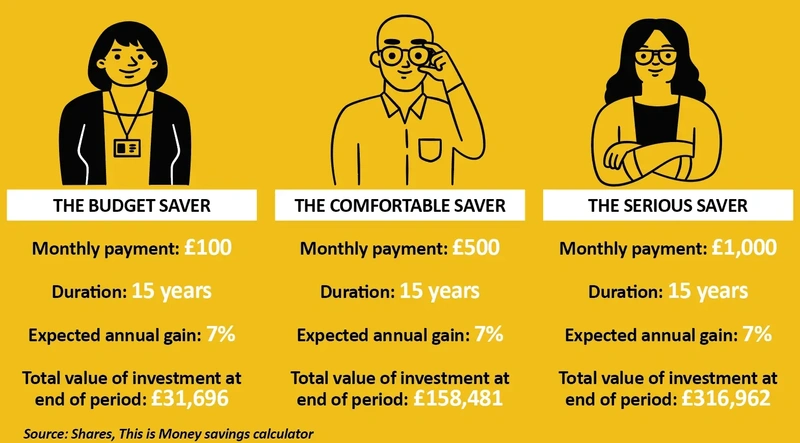

Putting away a small amount of money each month can build into a large pot over time and means you don’t need a large sum to get started. Below are three examples that illustrate the potential returns, excluding costs and dividend income.

Many individuals don’t feel they can invest because they may only have a small amount of cash left over from their wages each month. Yet it is easy and fairly cheap to make nominal contributions into the stock market, from as little as £25 per month. By using cash from dividend payments to buy more shares – known as reinvesting – you can enhance wealth creation on offer thanks to the effect of compounding.

A flat fee of £1.50 is quite common but might not be worth paying until you start getting sizeable dividends. For example, if you get a cheque for £25 from dividends, the reinvestment fee would reduce that amount by 6%.

You can usually reinvest dividends from a decent range of UK shares as well as trusts and ETFs which are quoted in pounds, but you can’t reinvest dividends from funds. An accumulation unit of a fund automatically reinvests income.

By drip-feeding cash into the markets, you also benefit from a phenomenon known as ‘pound cost averaging’. By investing a regular sum every month, you buy more shares when the price goes down and fewer shares when the price goes up. This lets you average out the purchase price of an investment. The table illustrates how this works.

WHERE DO I START?

STARTER PORTFOLIOS

If you do not have the time or inclination to do your own portfolio planning, ready-made portfolios can be a decent option. AJ Bell has four ‘starter portfolios’ to suit cautious, balanced, adventurous and income-focused investors. Judging where you sit here will largely depend on how long you are planning to invest for but also on your temperament. This applies accross the board with investing.

You’ll need to make a minimum initial investment of £1,000 and you’ll kick off with a group of five to nine products from AJ Bell’s ‘Favourite funds’ list which fit your chosen category. These starter portfolios are updated by AJ Bell and you have the power to update your own portfolio too. This makes them a useful starting point which you can build on as you become more confident in your investing.

You’ll pay £1.50 each time you buy or sell a fund, and a 0.25% custody charge (tiered down to zero) per year for holding the funds.

ONE-STOP SHOP FUNDS

Novice investors with neither the time nor inclination to research individual stocks might prefer to leave the decisions to the experts, and this is where ‘one-stop-shop’ funds have a role to play.

These products are designed to give investors everything they need under one roof and tend to be multi-asset, which means they own shares and bonds, and can sometimes give you access to commodities or property, while avoiding anything too exotic that could suddenly blow a hole in performance.

The Association of Investment Companies’ (AIC) Global sector plays host to F&C Investment Trust (FCIT), a long-term capital growth and income fund that is ultra-diversified, since it invests in over 400 individual companies in 35 countries. Currently trading on an 11% discount to NAV (net asset value), F&C has increased its dividend for 53 successive years.

Other examples include Witan (WTAN), offering first-time portfolio builders exposure to the fruits of global economic growth via a multi-manager approach. Witan scours the globe for the best managers to create a portfolio diversified by region, sector and at the individual company level and its multi-manager approach reduces the potential risks arising from reliance on a single manager. Though the trust has just announced a strategic review in response to the departure of longstanding manager Andrew Bell.

Aiming to be a core equity holding for investors that delivers a real long-term return through capital growth and a rising dividend is the diversified Alliance Trust (ATST). Investment manager WTW has appointed a number of stock pickers pursuing different styles; each one ignores the benchmark and only buys a small number of stocks in which they have strong conviction.

Capital preservation trusts such as Ruffer (RICA) and Personal Assets (PNL) also have one-stop shop appeal, as they provide exposure to equities, bonds and commodities including gold through a single share. For those seeking opportunities in the funds universe, Trojan Ethical (BKTW4R1) is a flexible multi-asset strategy focused on preserving capital and targeting steady returns regardless of the market backdrop. Flexibility is a key strength for the Charlotte Yonge-managed vehicle, since she can vary allocation to the four asset classes (equities, fixed income, gold, cash) depending on the outlook. [JC]

BUILDING A PORTFOLIO WITH TRACKERS

A no hassle, diversified, cost-efficient way of building a portfolio is to use exchange-traded funds or ETFs and index fund trackers.

An ETF is a pooled investment vehicle which, like a mutual fund, offers investors a proportionate share in a pool of stocks, bonds, and other assets.

Unlike a fund whose shares are priced daily based on the value of its assets, an ETF can be bought or sold throughout the day on a stock exchange at a market-determined price.

This is the main difference between ETFs and index trackers which price once per day.

The main challenge to building a portfolio using passive products is to decide on the weighting of each asset type. From low-risk assets like bonds to riskier assets like shares.

Every investor should try to build a portfolio which suits their individual risk appetite. Novice investors should probably aim to build a core balanced portfolio initially.

Once more confidence and experience are gained, weightings can be adjusted as appropriate.

Age is another factor to take into consideration. Someone in their 20s, 30s or 40s may prefer to have a lower weighting to bonds, as they have time on their side to ride the ups and downs of the stock market and stocks have historically produced better returns than bonds.

A good starting point is to simply divide the investment universe into stocks and bonds.

Stocks can be further split into developed markets and faster growing but riskier emerging markets. Bonds can be split into safer government bonds and riskier corporate bonds.

For greater diversification and inflation protection investors could also consider adding exposure to property, infrastructure, and gold.

A balanced portfolio would broadly aim for roughly 60% in riskier assets like stocks and 40% in lower risk assets like bonds.

STOCKS

The advantage of using a global ETF or tracker over a regional one is broader diversification and exposure to faster growing parts of the world.

The MSCI World index captures large and mid-cap stocks across 23 developed counties and is comprised of 1,479 constituents.

An exceptionally low-cost way to track this index is tracker fund Fidelity Index World (BJS8SJ3), which has a total expense ratio of 0.12% a year.

Getting exposure to emerging economies is generally a good idea. The MSCI Emerging Markets Index provides exposure to large and mid-cap companies across 24 markets and 1,440 companies.

An efficient way to track the index is the iShares Core MSCI EM IMI (EMIM) which has an ongoing annual charge of 0.18% a year. It’s also one of the most popular ETFs tracking this space globally with responsibility for more than $15 billion of investors’ money.

BONDS

Government bonds, especially those issued by developed market governments like the UK, are seen as a haven in times of uncertainty.

The increase in interest rates over the last two years means bonds now provide a decent level of income. For example, 10-year UK government bonds have a yield of 4.1%.

In similar vein to the stock part of the portfolio, it makes sense to get a broad exposure to global bonds. The Bloomberg Global Aggregate Bond index is a flagship measure of global investment grade (highest quality) debt across 28 markets.

An efficient way to track the index is the £1.7 billion Vanguard Global Aggregate Bond ETF GBP (VAGS) which has a total expense ratio of 0.1% a year and invests in more than 9,000 bonds.

PROPERTY, GOLD, AND INFRASTRUCTURE

Property provides some inflation protection as well as decent yields and further diversification benefits.

The HSBC EPRA/NAREIT Developed ETF USD (HPRO) is the largest and cheapest ETF which tracks the largest property companies in the world’s developed equity markets.

The ETF has a total expense ratio of 0.24% a year and is invested across 368 holdings.

Gold has traditionally been seen as a good hedge against inflation. The cheapest way to track spot gold is the Invesco Physical Gold A (SGLP) ETC (Exchange traded commodity).

The $11.3 billion product replicates the performance of gold and is backed by physical holdings of gold. The total expense ratio is 0.12% a year.

Infrastructure spending is a growing segment of the global economy and provides investors with further diversification, some inflation protection and income.

The iShares Global Infrastructure ETF (INFR) tracks the world’s largest infrastructure companies by seeking to physically replicate the FTSE Global Core Infrastructure Index.

The £1.2 billion ETF has a total expense ratio of 0.65% a year and invests in 252 companies. Dividends are distributed quarterly, and the current dividend yield is 2.5%. [MG]

DISCLAIMER: Financial services company AJ Bell referenced in this article owns Shares. The authors (Tom Sieber, James Crux and Martin Gamble) and editors of this article (Tom Sieber and Ian Conway) own shares in AJ Bell.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Exchange-Traded Funds

Feature

- Understand whether Super Micro Computer is an investment flop or technology great

- Do markets actually care who wins the US election in November?

- Construct an ISA portfolio: Put the building blocks in place for investment success

- Fear of missing out has supplanted fears of a market sell-off

- Find out how London Tunnels plans to create one of the biggest tourist attractions in the capital

Great Ideas

Money Matters

News

- Springfield Properties hits new highs as confidence recovers

- Focusrite shares nosedive after company warns on sales and earnings

- Scottish Mortgage tackles NAV discount with £1 billion buyback while Witan invites new managers

- Nvidia unveils new ‘superchip’ at its first conference for four years

- Could litigation headaches lead to a breakup of Reckitt Benckiser?

magazine

magazine