Why now is the time for investors to check out Burberry

Burberry (BRBY) £12.94

Market cap: £4.6 billion

Slowing luxury demand and two profit warnings in three months have left Burberry (BRBY) firmly out of fashion with investors. Shares in the British luxury brand have lost around 50% and 30% of their value over one and five years respectively. Given the old stock market adage about profit warnings coming in threes, Shares concedes there is some danger we have gone too early.

However, we believe the risk/reward balance is favourable with the trench coat-to-tote bag purveyor’s sell-off overdone and too much doom and gloom priced into a stock which is cheap relative to its own history.

Potential positive catalysts include an eventual recovery in key luxury market China and the possible reintroduction of VAT-free shopping for wealthy tourists visiting the UK, in the gift of chancellor Jeremy Hunt, which would boost Burberry’s domestic sales.

Tougher luxury market conditions are a headwind, yet Burberry is pulling self-help levers including elevation of the brand to raise margins closer to those of rivals including LVMH (MC:EPA) and Hermes (RMS:EPA) and pushing ahead with revenue-enlivening store refurbishments.

TRUE FASHION ICON

For the uninitiated, Burberry is the FTSE 100 constituent whose competitive strengths include its unmistakable brand – the iconic Burberry check and Equestrian Knight Device pay homage to its heritage - which confers pricing power upon the business, not to mention an extensive luxury distribution footprint and a cash-generative business model.

The £4.6 billion cap is now refocusing on ‘Britishness’ under chief executive Jonathan Akeroyd, who has a strong track record of building luxury brands and driving profitable growth, and new designer Daniel Lee. Despite its FTSE 100 status, the company still has a long growth runway ahead with plans to broadly double sales of leather goods, shoes and women’s ready to wear products and grow outerwear revenues by around 50% in the medium term. In addition, Burberry has yet to reach its full potential in e-commerce.

That said, sales growth is decelerating with the recent boom in luxury spending normalising and even well-heeled shoppers becoming more selective in the face of cost-of-living pressures. This backdrop is proving more challenging for mono-brands such as Burberry and more manageable for the likes of LVMH, a multi-brand conglomerate which sells products at higher price points, although this is reflected in Burberry’s discounted valuation.

BURBERRY STILL HAS A RUNWAY FOR GROWTH

VALUATION TOO CHEAP TO IGNORE

On 12 January 2024, Burberry downgraded its year-to-March 2024 adjusted operating profit guidance from around £550 million to the £410 million to £460 million range after Christmas sales fell flat against the backdrop of slowing luxury demand. Retail revenue fell 7% to £706 million in the 13 weeks to 30 December 2023 and comparable store sales were down 4%, although there were encouraging signs within the sales mix.

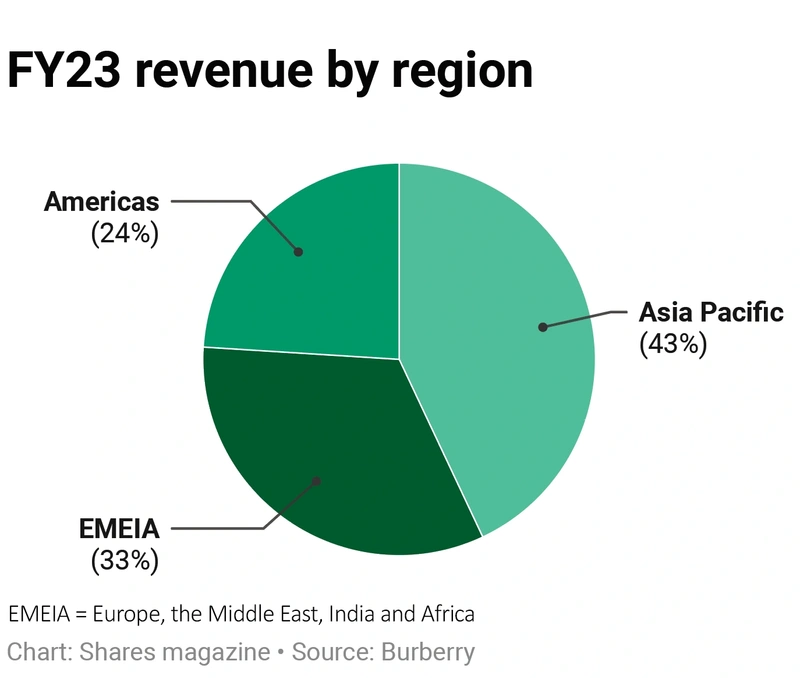

While Burberry suffered sharp sales declines in the Americas and South Korea, sales in mainland China, a vital market for luxury goods, rose 8% and were 9% ahead in Japan, where the consumer has an appetite for British brands. China is struggling, but Burberry will be a prime beneficiary of any near-term recovery in the world’s second-biggest economy once it filters through to consumer sentiment.

Meanwhile, its ambitious new management team has set itself a medium-term goal of increasing sales to £5 billion, up from £3.1 billion in full year 2023, and lifting adjusted operating margins to 20%.

Downgraded consensus estimates point to EPS (earnings per share) of 81.5p and a 51.5p dividend for the current financial year, rising to 84.7p and 53.1p respectively for the year to March 2025.

Based on these forecasts, Burberry trades on a 2024 PE (price to earnings) ratio of 15.9 falling to 15.2 times on next year’s numbers, a massive discount to a recent 2021 PE high approaching 40 times, and investors are being paid to wait for the recovery via an attractive 4% dividend yield. If the market doesn’t ascribe a fuller rating to Burberry before long, a luxury rival or private equity player could pounce with a bid, and a premium-priced one at that, since attractive acquisition targets in the luxury industry are few and far between.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Exchange-Traded Funds

Feature

Great Ideas

News

- Blow-out US jobs report sends stocks higher despite implications for rates

- Tesla shares slide in 2024 as investors mull their next moves

- Elementis shares soar after receiving a preliminary bid from US fund

- Ferrari gets into top gear to buck softer luxury goods trend

- Meta Platform’s dividend call stuns the market

- Can British Gas owner Centrica continue to deliver?

magazine

magazine