Five small cap stars to buy today

Even today’s market giants started out small. Microsoft (MSFT:NASDAQ) may now be the world’s largest company with a $3 trillion valuation which rivals the GDP of some major global economies but it began life as a start-up founded by Harvard College drop-out Bill Gates and his childhood friend Paul Allen. Few then would have predicted its global domination today.

While we are not expecting the names discussed in this article to enjoy the same stratospheric trajectory it does illustrate the inherent appeal of small caps, which, thanks to their scope to grow, can generate outsized returns if you invest in the right ones.

On the flipside, because smaller companies are less well established, have less diversified businesses and often more precarious financial positions, you do need to have a reasonable tolerance for risk if you are going to invest in the small cap space.

Another dynamic which is supportive to UK smaller companies, in particular, is valuation. The high interest rate environment and a broader reduction in risk appetite has helped create a negative backdrop and, with UK equities out of favour more generally, smaller companies listed in London have struggled. The FTSE AIM All-Share index is down 18% over the last five years against a 50.1% advance for the FTSE All-World index.

Stuart Widdowson, the manager of Odyssean Investment Trust (OIT), which invests in a concentrated portfolio of well-researched smaller companies, notes this beginning to change. He says: ‘Typically the first asset class to see good capital gains when the interest rate cycle turns are government bonds then it cascades into corporate bonds and then high yield bonds. Then the first element of equities that moves tends to be small cap and UK small caps look pretty interesting [on a global basis].

‘You don’t need that much new money to come in to move share prices very materially. We don’t know what is going to change sentiment but we don’t think it’s too far away.’

To tap into a change in the prevailing mood music around smaller companies, Shares has identified five small cap stars which offer a mix of value and growth. Read on to discover our selections.

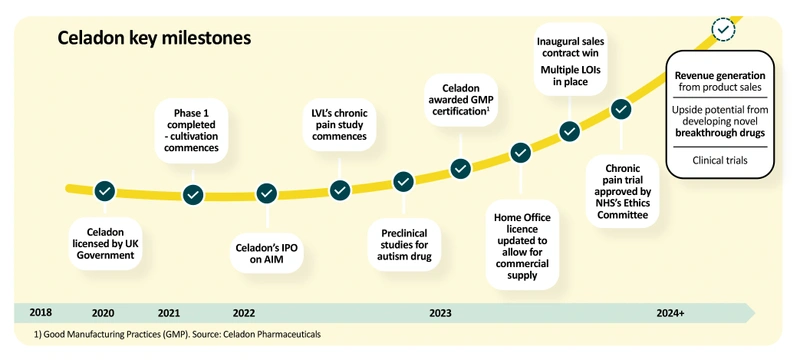

Celadon Pharmaceuticals (CEL:AIM) 84.8p

Market cap: £55.2 million

AIM-quoted Celadon Pharmaceuticals (CEL:AIM) is in a great way to play the fast-growing medical cannabis market as it exploits its first mover advantage in a highly regulated market.

Celadon has built a high-tech indoor hydroponic growing facility in the Midlands covering 100,000 square feet with a replacement cost of £65 million.

The company is one of only two firms in the UK and 10-15 worldwide to have been awarded GMP (Good manufacturing practice) certification.

It has also secured a Home Office license which allows it to commercially supply EU-GMP medical grade cannabis.

Management has made rapid progress in securing commercial manufacturing contracts signing deals worth a combined £30 million in revenues over three years.

Analyst Alex Brooks at Canaccord Genuity estimates the company can generate a healthy 70% gross margin on sales.

In addition, Celadon has received approval from the NHS’s Research Ethics Committee to roll-out a non-cancer chronic pain clinical trial for up to 5,000 patients.

It is the first UK large-scale trial that will provide robust and reliable data on treating chronic pain with cannabis-based medicines. Just as importantly for shareholders the NHS approval allows the company to charge fees.

Brooks estimates the company could generate revenues of up to £18 million with an EBITDA (earnings before interest, tax, depreciation, and amortisation) of around £4 million at full capacity.

The European medical cannabis market is forecast to grow eight-fold over the next five years according to industry consultant Prohibition Partners generating annual sales of €3.2 billion.

Demonstrating keen interest from investors, the company raised £1 million of new equity in October and £2 million in December to fund expansion. Celadon also has a £7 million lending facility.

Although there are above average risks in investing in smaller companies operating in new markets, Celadon has demonstrated great acuity and execution. [MG]

EnSilica (ENSI:AIM) 44p

Market cap: £35 million

The UK listed chip space has been eaten alive by M&A over the past few years but recently a handful of new ambitious smaller companies have breathed new life into the sector. One of them, Oxford-based EnSilica (ENSI:AIM) has, we believe, exciting potential.

With roots in intellectual property creation and consultancy, it has emerged as a fabless ASIC chip designer. ASICs (Application Specific Integrated Circuits) are chips whose end use is very specific and complex, and often requires bespoke functionality.

Set up in 2001 by former Nokia, Hitachi and Siemens engineer Ian Lankshear, EnSilica designs customised chips used in automotive, general industry, satellite communication and healthcare sectors. For example, carmakers use its chips to make vehicles handle the road more smoothly, manufacturers install them in factory robots, health firms deploy them for diabetic patches.

Customers include global corporations and original equipment manufacturers to technology start-ups, although it is cagey about naming names, probably because of non-disclosure clauses. It joined the LSE’s junior AIM market in May 2022 at 50p per share, having to ride out relatively stormy market conditions.

If EnSilica shares are to rally three things need to improve, or show solid signs of improvement; sales growth momentum, operating margin expansion and return on capital. Sales velocity is already showing promise. Comparing the periods 2019 to 2021 (to end May), 2021-23, and forecasts for 2023-25, revenues increased 37%, 138% and 57%.

As for margins and return on capital (how efficiently in converts sales into profits, and how well it uses cash to make profit), both are coming from very low bases of 4% and 3.8%, so assuming sales momentum continues and running costs can be managed well, there should be scope for significant gains here.

For example, Texas Instruments (TXN:NYSE), one of the world’s leading ASIC chips designers, has operating margins of around 25% and returns on capital of 40%.

Small caps can be accident prone with unpredictable sales cycles, and it is likely that EnSilica will need extra growth funding down the line, even after raising £1.56 million in December 2023.

Potential investors will need to accept these risks, but if you do, we believe there could be a real gem of a business here using a business model that has worked for UK chips companies in the past, such as CSR and Wolfson Microelectronics, which were both taken over for large premiums. A buyout in the longer run may well be on the cards for EnSilica, if management can execute successfully enough. [SF]

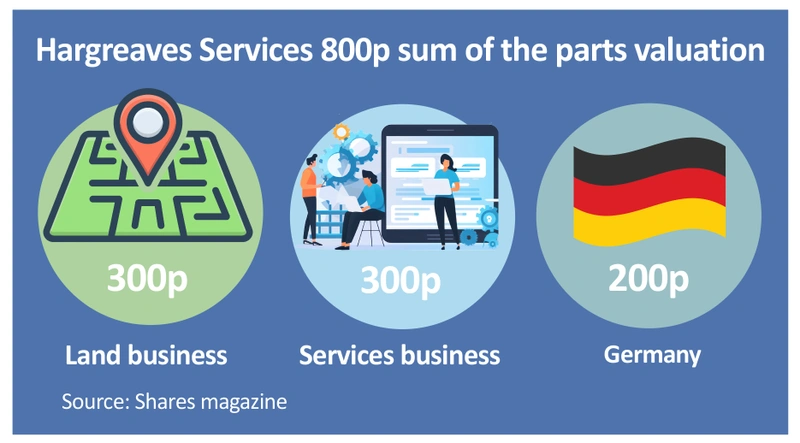

Hargreaves Services (HSP) 475p

Market cap: £155 million

Whereas some of the other companies in this feature are mainly about growth, Hargreaves Services (HSP) is an asset-backed income play.

The firm has a core infrastructure services business, a land business and a large stake in a German industrial materials business.

The bulk of its revenue comes from the infrastructure side where it provides earthworks, mechanical and electrical services to major water and electricity companies, as well as working on HS2.

It is also a preferred partner to Balfour Beatty (BBY) on the Lower Thames Crossing project, and it is the only contractor on site at the Sizewell C nuclear power plant in Suffolk.

The land business owns large former brownfield sites which it upgrades and sells to developers, who go on to build houses, industrial, logistics or retail warehouse assets and renewable energy projects.

After a flat first half of 2023, activity has picked up significantly among the housebuilders and commercial activity is also increasing.

Finally, Hargreaves owns 49.9% of the equity in – but the right to 86% of the earnings from – HRMS, a raw materials business in Germany which trades industrial materials, makes carbon and recycles ferrous metals.

Using a sum-of-the-parts valuation approach, we believe the business is worth around 800p per share, nearly 70% more than its current market value and slightly above the 770p figure achieved by analysts at Singer Capital Markets using a similar process.

We estimate the services business is worth around £100 million or 300p per share, the land business – where the assets are held at book cost – is worth another £100 million, or 300p per share, and the German unit has a book value of £67 million or 200p per share, excluding any profits generated.

Obviously realising this value will take time, but in the meantime, investors have the comfort of a fully covered 36p annual dividend which equates to a 7.5% yield. [IC]

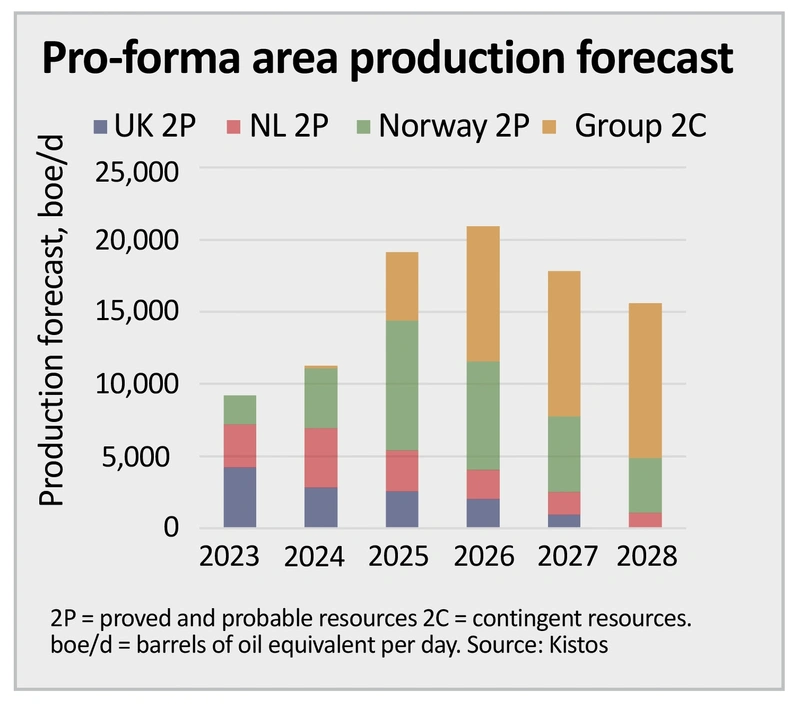

Kistos (KIST:AIM) 143p

Market cap: £118.5 million

If Kistos (KIST:AIM) had its way it may well not have been a small cap by this point. It had hoped a merger with Serica Energy (SQZ:AIM), which it tried and failed to pull off in 2022, would have been a ticket to Main Market status and a place in the FTSE 250.

Having absorbed its failure to get that deal over the line, some other operational disappointments, and a significant drop in the high gas prices which followed Russia’s invasion of Ukraine, the shares have been marked substantially lower by the market.

This has created what looks a pretty compelling opportunity for risk-tolerant investors to buy a company with enviable balance sheet flexibility, scope for significant growth in free cash flow from its existing portfolio and ambitions to target further deals in the northern European energy space.

The company is run by Andrew Austin, who may be familiar to followers of the sector from his previous ventures – including Rockrose Energy (taken over in July 2020 in a £243 million deal).

Kistos’ current producing assets are based in the Netherlands and, in line with the company’s strategy of delivering hydrocarbons with lower accompanying emissions, the platform on its core Q10-A field is powered through wind and solar generation.

The company is also developing assets in Norway and to the west of Shetland. It received a boost in the latter region when Shell (SHEL) received regulatory approval for the development of the Victory gas field. As it plugs into existing infrastructure, including Kistos’ co-owned Shetland gas plant, this could extend the life of the company’s own oil and gas assets in the area, reduce costs and potentially delay decommissioning.

Kistos demonstrated its financial strength by paying down a little under €80 million worth of Dutch bonds early in December, which will reduce interest costs. It closed out 2023 with cash and ‘near-cash’ of €275 million (though net debt of €73 million according to investment bank Berenberg). Based on forecasts from Berenberg the company is expected to generate free cash flow of nearly €150 million in 2025 as new assets come on stream. This should provide the firepower for further M&A and is more than the current market value of the business. [TS]

Victorian Plumbing (VIC:AIM) 87.9p

Market cap: £286.9 million

Investors seeking to tap into a growth stock with a sizeable total addressable market, scope for earnings upgrades and attractive income credentials should buy the UK’s leading bathroom retailer Victorian Plumbing (VIC:AIM). Admittedly, the £286.9 million cap operates in a competitive market with rivals ranging from Kingfisher (KGF)-owned B&Q to Homebase and Wickes (WIX), but this pure-play online retailer benefits from channel shift, a wider product range than rivals limited by store space and its high own-brand mix. Headwinds could turn into tailwinds this year as falling inflation and interest rates lift consumer confidence.

Despite a tough macroeconomic backdrop in the year to September 2023, Victorian Plumbing demonstrated resilience by growing sales, market share and profits and 2024 should be a transformational year for the taps and toilets retailer founded by CEO Mark Radcliffe. The key catalyst for the currently capacity-constrained firm will be the opening of its new automated distribution centre in Lancashire in mid-2024 which should accelerate growth and boost margins.

This state-of-the-art warehouse will provide capacity to double sales to around £600 million, take on more stock within the core bathroom category and allow Victorian Plumbing to scale in the growth categories of lighting, flooring, tiles and trade, which could more than double its UK total addressable market to over £3.5 billion and provide scope for profitable cross-selling opportunities.

A fortress balance sheet business flush with £46.4 million in the coffers at last count, Victorian Plumbing should benefit from the fall in shipping rates, which remain below pandemic peaks, as well as its recently launched app for trade and retail customers which should drive marketing efficiencies.

Canaccord Genuity’s Karl Burns says: ‘We believe Victorian Plumbing could see a re-rating as revenue growth and margins rise.’

‘While cash generation will also build, resulting in a higher dividend payout and yield, further supporting the share price.’ [JC]

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Exchange-Traded Funds

Feature

Great Ideas

News

- Blow-out US jobs report sends stocks higher despite implications for rates

- Tesla shares slide in 2024 as investors mull their next moves

- Elementis shares soar after receiving a preliminary bid from US fund

- Ferrari gets into top gear to buck softer luxury goods trend

- Meta Platform’s dividend call stuns the market

- Can British Gas owner Centrica continue to deliver?

magazine

magazine