Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Don’t get carried away with DG Innovate and its Tesla trio

On 11 December 2023, a teeny company on the UK stock market saw a sudden surge in interest.

Shares in Yorkshire-based EV (electric vehicle) technology firm DG Innovate (DGI:AIM) almost tripled as three former senior Tesla (TSLA:NASDAQ) executives joined the board.

Taking over as chief executive is the magnificently-named Peter Bardenfleth-Hansen, joined by Christian Eidem and Jochen Rudat as executive directors.

The trio are taking a combined 40% stake, with Eidem - a classmate of Elon Musk at Wharton business school and an early investor in the EV leader - taking a 29% shareholding.

Current chair Nicholas Tulloch remains in place and chief executive Peter Tierney is set to become an executive director.

The share price surged more than 170% on the news – though to put this in context the firm it is still only valued by the market at just over £13 million.

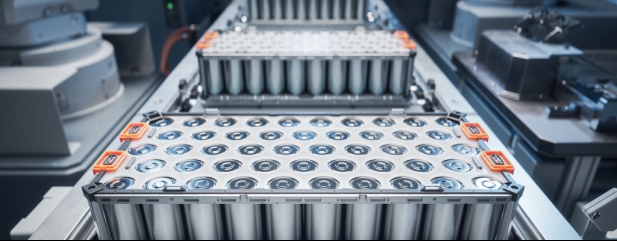

The company is working on sodium-ion batteries for EVs, flagged as a potential alternative to the lithium-ion technology widely used at present. It is also working on an electrical drive system.

Many investors will have been pulled in through the fear of missing out – particularly after online comments from an equity research firm suggested the shares could ‘5 to 10 bag into New Year’ or in other words increase by five to 10 times in value.

It is easy to get carried away by the promise of a breakthrough technology but it can be a real slog for a small-cap company to take an innovation, however interesting, and make it mainstream.

This is particularly true for industries like the automotive sector which are traditionally fairly conservative and risk-averse given the emphasis placed on safety and the heavy regulation they face.

This author’s experience, based on more than a decade of following the resources space, is minnows really struggle to achieve scale and traction and the financial backing to turn a promising idea into reality. Agreements with large industry players, while helpful, can also involve surrendering control over the timetable.

Take Velocys (VLS:AIM), which makes SAF (sustainable aviation fuel) from waste products – a technology which in theory could be extremely useful as well as valuable as the world looks to limit the environmental impact of fossil fuels.

Excitement over its potential drove the firm’s market valuation to more than £250 million in the mid-2010s. However, after running out of cash it was recently acquired in a heavily discounted £4.1 million deal which rescued it from insolvency.

Another alternative fuels developer, Quadrise Fuels (QED:AIM), which once had a promising agreement with shipping giant Maersk (MAERSK-B:CPH) to test its marine fuel, saw that relationship fizzle out and reported a widened loss in the year to 30 June 2023 as it flagged delays to two of its key projects.

DG Innovate has raised £2.4 million through a convertible bond issue to advance its existing technologies and there are plans for it to become an acquisition vehicle in the EV and energy storage space. This could help build scale and diversification, but shareholders should ready themselves for further fundraises in 2024.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

News

- Why economists are adamant China does not face Japan-style stagnation

- Alphabet’s Gemini AI launch has Wall Street in raptures

- Has British American Tobacco’s future gone up in smoke?

- Artisanal Spirits’ down 50% in six months following profit warning dram-a

- Climate change and geopolitics could force transport costs higher again

magazine

magazine