Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

10 big questions for 2024: the markets outlook for the year ahead

As we move into another year there is plenty for investors to consider. Are we on the other side of inflationary pressures? Will rates be cut in 2024? What will happen with the US presidential election? In this article we address these and some other big questions for the year to come.

IS THE BATTLE AGAINST INFLATION OVER, WILL RATES BE CUT IN 2024 AND WHAT WILL HAPPEN TO THE DOLLAR?

A big question facing investors in 2024 is whether the inflation battle has been won and if so, how quickly interest rates fall.

Before looking at the range of economic predictions, it is worth pointing out that bond markets have already priced in around 1.7% of rate cuts for the US in 2024. Whether this proves overly optimistic or too cautious is likely to play a big part in how stocks and other asset classes perform in 2024.

A key factor driving the actual outcome is how well economies perform in coming months and broadly, there are two opposing camps.

Goldman Sachs is in the bullish camp predicting the global economy will outperform consensus expectations in a similar fashion to 2023.

According to chief economist Jan Hatzius that won’t prevent inflation continuing to fall back towards central bank targets. ‘We don’t think the last mile of disinflation will be particularly hard,’ writes Hatzius.

‘If anything, we think that the risks to the achievement of target-consistent inflation are on the earlier side.’

Goldman economists expect core inflation to fall from 3% to average 2% to 2.5% across the G10 excluding Japan.

Strategists at JP Morgan Asset Management take a more cautious view due to the ‘long and variable lags in monetary policy that so often plague economic forecasters’.

They believe it is too early for central banks to take a victory lap on inflation and anticipate interest rate cuts will come later than many expect but then fall further than predicted.

‘Averaging the last 12 recessions, US GDP growth in the quarter prior to a recession was 3% in real terms and 7% in nominal terms,’ points out JP Morgan.

The latter part of 2023 was marked by a big decline in the US currency – what may become apparent in 2024 is whether this is set to be a short-term phenomenon or the beginning of a more meaningful structural shift.

There is a definite trend among central banks outside the US to move their foreign exchange reserves into other currencies. A substantial budget deficit is another issue for the greenback with some suggestions there may be a return to quantitative easing as a result – effectively increasing the supply of dollars and thereby depressing their value. An extended period of currency weakness for the dollar could have positive implications for emerging markets and commodities. [MG/TS]

WHAT IS THE OUTLOOK FOR PROPERTY, INFRASTRUCTURE AND INVESTMENT TRUSTS?

Heading into 2024, investors in property, infrastructure and investment trusts will above all be hoping for interest rates to normalise and for discounts to NAV (net asset value) to narrow from the historically wide levels of 2023.

While property rents are expected to continue growing, liquidity in the sector is still a long way from normal so accurate valuations will remain hard to pin down.

The infrastructure market at least has a visible pipeline of work for 2024 from committed funding and long-term programmes. Both property and investment trusts are likely to see more consolidation as managers of sub-scale trusts look to merge and shareholders push for change at underperforming companies. [IC]

CAN THE UK (FINALLY) PLAY CATCH UP NEXT YEAR?

According to the Association of Investment Companies’ (AIC) latest annual fund manager poll, the UK is predicted to be the best performing region in 2024 with nearly half of respondents highlighting it.

Bulls point to UK equity valuations near a 20-year low and the fact the FTSE offers the highest dividend yield of any developed market, providing investors with a strong margin of safety, although bears will stress the UK has been cheaper than many other markets since the Brexit vote and there are no obvious rerating catalysts.

However, with the UK economy remaining fragile and inflation continuing to fall, it is plausible that the Bank of England could be the first major central bank to cut interest rates, which would provide a strong tailwind for UK stocks.

In its 2024 investment outlook, JP Morgan Asset Management said UK stocks ‘offer a relatively low beta to global stocks, and a high weight to the energy sector could prove a useful diversifier if higher oil prices challenge the disinflation narrative’.

Elsewhere Martin Currie’s chief investment officer Michael Browne sees strong signs that UK macroeconomic conditions are turning positive heading into 2024 and points out that as conditions improve, ‘the opportunity for attractive future returns is arguably at its greatest’. In contrast to some markets, Iain Pyle, manager of investment trust Shires Income (SHRS), remains ‘very optimistic on the UK given the low valuations for equities and the likelihood that any downturn will be short and shallow and is already priced in’. [JC]

WILL MORE LONDON-LISTED COMPANIES BE SNAPPED UP?

Following a summer lull, M&A activity from private equity and corporate buyers of quoted UK companies picked up in the latter half of 2023. Shares believes 2024 could prove another busy year for takeover activity unless unloved UK equities enjoy a long-awaited rerating, which would further shrink the pool of publicly listed companies. Should investor sentiment towards the UK remain poor, expect overseas trade buyers and private equity bidders to pounce on high quality British assets, especially global companies with a UK listing and with a focus on the heavily discounted small cap end of the market. [JC]

CAN AI AND TECH CONTINUE TO DRIVE US MARKETS HIGHER IN 2024?

The US stock market is bang on track to be the 2023 performance leader for the major asset classes, by a wide margin. The key reason – big tech shares have been running hot. Strip out the ‘Magnificent Seven’ and US equities’ year-to-date performance fades to grey, with mediocre returns in line with money-market funds and savings accounts.

‘After a stock rally this year that has nearly erased the decline in 2022, some small investors are taking profits and selling riskier investments, as they ponder whether or not the handful of technology companies that have propelled major indexes can continue to prop up markets,’ reported Bloomberg.

Does this mean the slow deflation of the big tech balloon hamstringing US equity performance in 2024? Not according to Goldman Sachs. ‘Our baseline forecast suggests that in 2024 the mega-cap tech stocks will continue to outperform the remainder of the S&P 500,’ says David Kostin, chief US equity strategist at Goldman Sachs.

‘Analyst estimates show the mega-cap tech companies growing sales at a CAGR (compound annual growth rate) of 11% through 2025 compared with just 3% for the rest of the S&P 500. The net margins of the Magnificent Seven are twice the margins of the rest of the index, and consensus expects this gap will persist through 2025.’

They are not alone. Booming spending on AI (artificial intelligence) and cloud computing infrastructure has ignited a new tech bull market, claim analysts at US broker Wedbush. While overall IT budgets are expected to be up modestly in 2024, cloud and AI-driven spending will be up 20% to 25% over the next year, ‘with usage now exploding’ in the enterprise and consumer landscape.

AI is seen by many as the most transformative technology trend since the start of the Internet in 1995, and against a softening interest rate backcloth, big tech could again power US equities to the top of major market performance leagues next year. [SF]

WHAT DID WE GET RIGHT AND WRONG IN OUR 2023 OUTLOOK?

We were right inflation would dominate the agenda but also that it would begin to abate through the course of the year and that a pivot, or at least the promise of a pivot, away from high rates would help drive a rally in stocks. We were also correct to point to an encouraging outlook for gold which hit new records in 2023.

We were right inflation would dominate the agenda but also that it would begin to abate through the course of the year and that a pivot, or at least the promise of a pivot, away from high rates would help drive a rally in stocks. We were also correct to point to an encouraging outlook for gold which hit new records in 2023.

On emerging markets, we were probably right to be tepid on Chinese recovery hopes which have failed to live up to expectations and to point to India which has been one of the best performing markets anywhere in the world over the last 12 months.

Despite flagging the UK market as a value opportunity, it has failed to keep pace with global counterparts. Bond markets, while not facing the meltdown they endured in 2022, did not justify our description of their outlook as ‘promising’. [TS]

WILL VALUE STOCKS OR GROWTH STOCKS SHINE?

Growth stocks outperformed value stocks in 2023 supported by expectations of central bank interest rates cuts to come and the hype over artificial intelligence, which fuelled the so-called ‘Magnificent Seven’ rally. Entering 2024, the outlook appears to favour growth over value again given the strong earnings growth emanating from the technology sector, and with investors anticipating rate cuts. In terms of the UK outlook, Martin Currie’s Michael Browne sees ‘clear market signals’ that we are ‘heading to a soft landing and will likely see a rotation from value to growth stocks’.

However, across the pond, Ariel Investments’ chair John Rogers observed to CNBC’s Scott Wapner that ‘the top of growth stocks is coming’. Noted value investor Rogers argues the mega-cap tech stocks that outperformed in 2023 are ‘priced for perfection’ and will face challenges heading into 2024; another reason for Rogers’ bullishness on value names is the widening performance gap between growth and value. [JC]

WHAT WILL HAPPEN IN THE BURGEONING OBESITY DRUG SPACE?

Booming demand for weight loss treatments looks set to continue but a key feature of 2024 is increasing competitive threats to the market leaders Novo Nordisk (NVO:NYSE) and Eli Lilly (LLY:NYSE).

So far, Novo’s obesity drug Wegovy and type-two diabetes drug Ozempic have enjoyed huge success in a market which is predicted to grow to more than $100 billion a year in years to come.

Eli Lilly’s obesity drug Zepbound went on sale in the US in early December and Berenberg points out that despite offering superior weight loss than Wegovy its list price is 20% below.

UK pharmaceutical company AstraZeneca (AZN) recently beefed up its obesity portfolio and Swiss diagnostics firm Roche (ROG:SWX) entered the obesity race after paying $2.7 billion for Carmot Therapeutics. [MG]

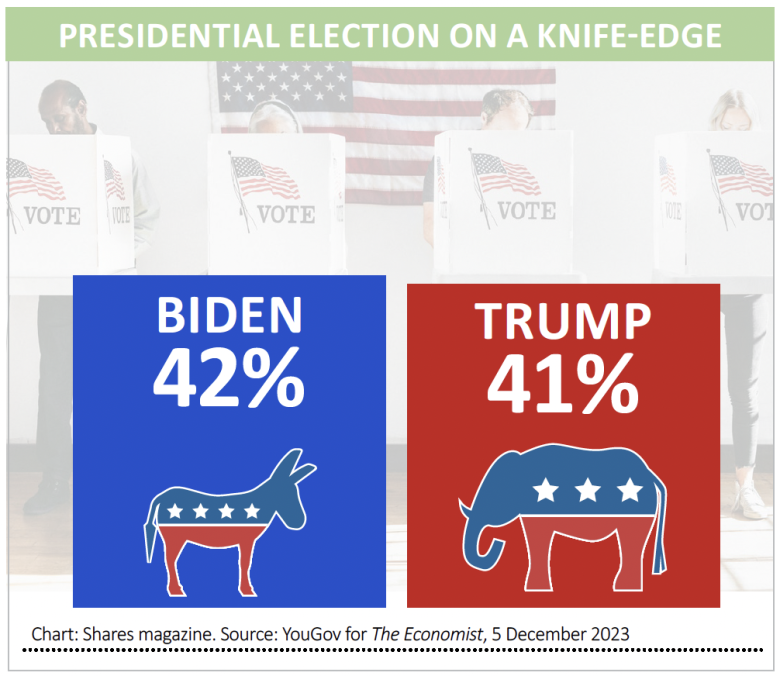

WILL THE US PRESIDENTIAL ELECTION EXACERBATE GEOPOLITICAL CONCERNS?

One thing which seems certain for 2024 is the geopolitical outlook will be more not less predictable than 2023.

While we aren’t necessarily forecasting an increase in regional conflict, politics will play a huge part in where markets go next year. The rise in recent years of ‘outsiders’ such as Giorgia Meloni, Geert Wilders and Javier Milei suggests voters around the world want a change from the norm, even if they don’t fully support the views of the challengers.

With elections in the US in November and the UK potentially before the end of 2024, there could be wholesale change on the cards. In the US, president Biden has ‘over-delivered’ on his promise to be unexciting, says Michael Schaeffer of Politico, which could prove to be his undoing.

In a similar vein, Vanity Fair observes that the Biden’s administration’s ‘superpower, its ability to slide under the radar while getting a lot done for the American people, may also be its Achilles heel, holding it back from getting the credit it deserves’.

The issue is, at least some Americans no longer care about policies or ‘getting things done’, because politics has descended into reality television and needs to be exciting, full of flamboyant characters who can make them feel emotion, especially anger.

In other words, it is the perfect environment for made-for-TV candidate Donald Trump, who despite his trail of destruction still leads the race to be the Republican nominee.

Some of Trump’s actions in his first term and his rhetoric since leaving office suggest the US political system’s checks and balances could be tested if democratic norms are going to be preserved in Washington. While Trump’s reported ties with Russian premier Vladimir Putin could have wider ramifications outside the US.

As we move closer to election day on 5 November the latest polling data and the nature of the political debate may start to have a greater bearing on global markets. [IC]

WHAT’S THE OUTLOOK FOR GOLD AND OIL?

Gold and oil prices have diverged in recent weeks with the precious metal outperforming crude to reach new record highs. WisdomTree head of commodities Nitesh Shah observes that while gold demand to date has been concentrated among central banks and the retail sector, ‘institutional investors are likely to be increasingly concerned about global risks – geopolitical and financial – and seek more hedging tools’. BofA energy strategist Francisco Blanch thinks OPEC+ cuts can support oil despite an uncertain economic outlook. A key thing to watch is how disciplined members of OPEC are at sticking to quotas as that will dictate the cartel’s credibility with the market. [TS]

What should investors do?

Faced with all this information and possible outcomes how should investors respond? For genuine long-term investors the answer is probably not too much – sticking to your plan and your investment goals is probably the best way of seeing your portfolio through what could be a volatile 12 months. The traditional strategy of investing in a mix of stocks and bonds may be a more successful way of achieving diversification in the coming 12 months as asset manager Pictet observes: ‘For investors, 2024 will be less of a banner year, which is why we are sticking to a defensive bias. However, we expect some of the tight correlation between asset classes that characterised the markets during the past few years – where equities and bonds moved in lock-step – to ease, which should allow balanced portfolios to show better diversification.’

Morningstar comments: ‘In terms of portfolio positioning, our base case macro-outlook of lower growth, inflation and rates, but without a recession, is supportive of classic multi-asset portfolios invested in bonds and equities. Bonds in particular have become more attractive as yields have increased.’ [TS]

CAN CHINA GET ITS ACT

TOGETHER AND WILL OTHER

EMERGING MARKETS SHINE?

The expected rebound in the Chinese economy following its decision to abandon a zero-Covid policy has struggled to gain traction.

Adding to the country’s woes credit rating agency Moody’s Corp (MCO:NYSE) downgraded China’s sovereign credit rating from ‘stable’ to ‘negative’

on 5 December.

Moody’s is concerned that Beijing’s possible bailout and support of distressed local governments and state-owned enterprises will push up debt to unsustainable levels.

While Moody’s retained China’s long-term rating it expects GDP growth to slow to 4% in 2024 and 2025 and average 3.8% from 2026 to 2030.

Investment manager Camignac sees China’s first half growth stabilising at around 4% in 2024 but is doubtful of an improvement in the second half.

‘A reacceleration in H2 2024 requires the leadership to abandon its gradualist approach for a strategy combining a restructuring of all housing-related debts, nationalisation of losses, bank recapitalisation and consumption stimulus.’

An additional challenge for the world’s second biggest economy is that large multinationals

have been busily reshoring supply chains following the pandemic.

This means more manufacturing based in China serves the local market rather than overseas.

The multiple challenges China is facing is arguably already reflected in poorly performing stock prices and low valuations. The CSI 300 index of leading Chinese stocks has dropped more than 40% over the last two years.

Invesco is in the camp which views Chinese shares as cheap on a cyclically adjusted PE (price to earnings) basis with earnings momentum likely to improve as economic stimulus kicks-in.

‘Given our belief that economic momentum will be better in China than in the West (due to policy support), we remain optimistic that Chinese equities will rebound (given how cheap they are), though we are less optimistic about Chinese bonds.’

A possible negative for China in 2024 is a continuation of the trend which has seen countries like South Korea and Vietnam eat its lunch. Tensions with the West driving more big global companies to shift to these alternative manufacturing hubs.

In terms of broad positives for emerging markets heading into the next 12 months Nick Price, portfolio manager of Fidelity Emerging Markets (FEML) says: ‘The strong fiscal position of many emerging economies also stands the asset class in good stead. Unlike many developed countries, emerging markets were largely slow to extend fiscal subsidies during Covid lockdowns.

‘We see lower levels of debt-to-GDP in many emerging market countries, particularly relative to the US, where the near-breaching of the debt ceiling brought the country’s unsustainably high levels of debt into sharp relief.’ [MG/SG]

Saxo Bank’s outrageous predictions for 2024

Each year, Saxo Bank chief investment officer Steen Jakobsen and his colleagues put together a number of scenarios involving ‘unlikely but underappreciated events which, if they were to occur, would send shockwaves across the financial markets’.

While they are always entertaining, they also have a reasonable ‘hit’ rate, particularly when it comes to the gold price, bitcoin, market volatility and political upheaval.

This year’s list begins with a scenario where the US Federal Reserve tightens interest rates again due to a second wave of inflation at the same time as the government increases defence spending due to geopolitical uncertainty.

This sends the budget deficit above 10%, a level only surpassed during WWII and the pandemic, so under ‘intense pressure’ from the White House, Congress makes capital gains and interest income on US Treasuries tax-free.

The yield curve flattens as investors lock in the highest yields in decades, but the stock market collapses as cash is sucked into the bond market apart from companies with large cash piles whose shares are chased higher.

Another provocative prediction sees a criminal group developing the most deceptive generative AI ‘deepfake’ in history, phishing a high-ranking government official from a developed country to hand over top-secret information.

In its wake, the EU and US introduce new regulation which kills the generative AI hype, causing investment to dry up, and Adobe (ADBE:NASDAQ) shares collapse after it is discovered the deepfake was made using the company’s software.

Meanwhile, with social unrest in Europe rarely far from the surface and household bills soaring due to the cost of the energy transformation, the wealth inequality becomes a polemic, and the EU introduces a ‘Robin Hood’ tax sending shock waves through the luxury goods industry.

Earnings expectations for firms like Ferrari (RACE:NYSE), LVMH (MC:EPA) and Porsche (PAH3:ETR) collapse, as do their share prices.

Finally, with attention turning back to the US election, a recession takes hold bringing with it ‘greater potential for a sea change in political attitudes’.

Seeking alternatives to the ‘geriatric’ Biden and the ‘narcissistic’ Trump, voters from both sides warm to Robert F Kennedy, Jr, whose ‘third way’ shatters the old psychology of either being fervently for or against one of the traditional two parties’ and sweeps him into the White House.

In response to his promise to ‘end the abuses of the healthcare system and break up excess corporate power’, defense, drug and healthcare shares nosedive while technology stocks languish.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

News

- Why economists are adamant China does not face Japan-style stagnation

- Alphabet’s Gemini AI launch has Wall Street in raptures

- Has British American Tobacco’s future gone up in smoke?

- Artisanal Spirits’ down 50% in six months following profit warning dram-a

- Climate change and geopolitics could force transport costs higher again

magazine

magazine