Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Bank stocks: Can this year's rally continue?

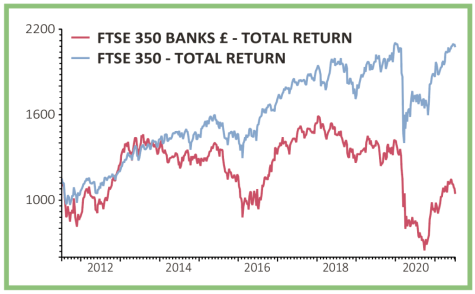

Having underperformed the FTSE 100 and the FTSE 350 for the best part of 10 years, September 2020 saw the FTSE 350 banks index stop making decade lows and start to make short-term highs, much to the excitement of analysts and investors.

As the market rotation towards value stocks took hold, the UK’s unloved banks jumped sharply in the final quarter of last year.

At the start of this year, the narrative shifted from banks being a pure value investment to being a play on the reopening of the UK economy, which in theory would lead to a recovery in loan demand and margins.

The narrative morphed again more recently, with analysts flagging the potential for large dividends and share buybacks as the banks unwind the excess loan loss provisions they took during the pandemic.

So, with the UK banking sector having rallied 50%, it’s stick or twist time. Is there more upside to come, and if so, what will drive it, or should investors bank their gains – assuming they were fleet-footed enough to buy at the bottom – and move on?

REASONS TO BE CHEERFUL

In their first-half investment report, the managers of Polar Capital Global Financials Trust (PCFT) – Nick Brind, John Yakas and George Barrow – describe the six-month period to the end of May as ‘an excellent one for financials in both absolute terms and relative to wider equity markets’.

A combination of the rapid rollout of vaccines, positive economic data, massive government and central bank stimulus, rising bond yields and inflation expectations sent financials in general and banks in particular soaring.

Being overweight banks, and especially US regional banks, saw the Polar trust’s net asset value jump 22.2%, while the MSCI All-Countries Financials index rose 21.5% and the broader MSCI Global index increase ‘just’ 9.3% over the period.

The managers say they are ‘constructive on the outlook for the sector as we believe the tailwinds remain very positive for the foreseeable future’.

They cite cheap valuations, takeover activity, a lower cost of capital, rising interest rate and inflation expectations, and the prospect of capital returns as the key drivers.

LESS RISKY?

The suggestion that banks are less risky – and therefore their cost of capital should be reduced – is an interesting one.

‘We have seen some indications that investment bank analysts are starting to consider that, as the sector is less risky today than it was previously, it deserves a lower cost of capital in their valuation models,’ say the Polar Capital managers. ‘This would justify higher share prices, all things being equal.’

They base their observation on the fall in yields on subordinated bank debt issued by European banks over the past five years, which they say suggests credit investors ‘are happy to be paid relatively little for the risk of owning bank bonds’.

The table speaks for itself in as much as the yield on banks’ subordinated debt has indeed come down in the last five years, but surely yields on everything have come down over that period.

In the US, yields on junk or sub investment-grade bonds are at their lowest level in history at 3.8% as the economic recovery and the Federal Reserve’s low interest-rate policy forces investors to double down on risky investments in the hunt for income.

In addition, the volume of junk bond issuance has hit new highs with even first-time issuers receiving a warm welcome from investors desperate for yield given the backdrop of negative real interest rates.

So, while yields on their subordinated bonds may have fallen, does that make the banks less risky? We would argue not.

BUMPER PAYOUTS?

Ironically, one of the things that makes them less risky is the large reserves of capital which they put aside in case the pandemic led to a flood of bad loans and corporate bankruptcies.

Those reserves are now being eyed by analysts and investors in the hope that, as the banks can’t lend the money out – because excluding mortgages there is almost zero demand for borrowing among consumers and corporates, despite the reopening of the economy – they will return it in the form of extra dividends or share buybacks.

The Financial Times reported earlier this month that the US banking sector would pay out an extra $2 billion in quarterly dividends after the Federal Reserve loosened restrictions on payouts, which would be good news for Polar Capital Global Financials Trust given its skew towards US financials.

After the Fed’s latest ‘stress test’ found the banks were healthy enough for it to ease its restrictions on dividends and buybacks, Morgan Stanley said it would double its quarterly dividend to 70 cents and raise its buyback from $10 billion to $12 billion.

While US investors are addicted to share buybacks, in the UK income and dividends are more highly prized. However, as it stands the banks are far from the biggest income payers.

According to AJ Bell investment director Russ Mould, who compiles the quarterly Dividend Dashboard report, overall FTSE 100 dividends are expected to grow by 25% or £15.2 billion this year to a total of £76.9 billion with Rio Tinto (RIO) leading the way, followed by British American Tobacco (BATS), Royal Dutch Shell (RDSB), BHP (BHP) and Unilever (ULVR).

None of the banking stocks feature on the list of the top 10 highest yielders in the FTSE, although non-bank financials such as insurers Admiral (ADM) and Phoenix Group (PHNX) and asset manager M&G (MNG) are present.

After the Prudential Regulatory Authority made them cancel all dividend payments last year, the UK banks have resumed distributions on a smaller scale (due to regulatory restrictions) this year. Even though they have all raised their payouts in sterling terms in total they account for less than a quarter of the £15.3 billion increase in FTSE dividends. Rio Tinto by itself accounts for 29% of the increase.

In fairness, Barclays (BARC) and Standard Chartered (STAN) have instituted share buybacks to raise their total shareholder returns, but even these don’t come close to making up for the lost dividends from 2019 and 2020.

On 13 July the Prudential Regulation Authority removed the remaining restrictions on dividends and share buybacks for UK banks imposed during the pandemic, paving the way for higher payouts.

MORTGAGES AND MARGINS

Bank of America analysts flagged strong mortgage demand during May, which they expect to continue into the third quarter, but at the same time they noted ‘intensified’ competitive pressures.

They estimate mortgage spreads have fallen by 45 basis points or 0.45% since the start of this year, with a marked acceleration in June.

‘Barclays, NatWest and HSBC consistently offer among the lowest rates and Virgin Money is more competitive in higher loan-to-value lending. Lloyds continues to adopt a multi brand approach, but with Halifax now generally in the middle of the pack and Lloyds among higher priced lenders,’ they observe.

Meanwhile, consumer credit demand – which fell off a cliff in April last year as people pulled in their horns in the face of the pandemic – continues to shrink as people reduce their borrowings thanks to cash amassed during lockdown.

The flip side is that deposits continue to grow, with recent inflows driven by instant-access offers. This is negative for the banks’ net interest margins as relatively speaking they are now paying out more than they were on deposits while generating less income on loans.

The only saving grace is that the interest cost of new time deposits is at least below the rate of existing balances.

The Bank of America analysts note that ‘pricing on deposits has been volatile but would be positive for smaller lenders like Virgin Money if sustained’.

It’s a similar picture in terms of corporate loans and deposits. While lending increased under the Government’s support scheme, deposits have ballooned as healthy companies have stockpiled cash.

INVESTMENT VIEW ON BANKING STOCKS

Overall, Shares remains lacklustre towards banking stocks. However, many readers may disagree with our cautious tone and instead share the more positive views expressed by various fund managers.

For example, in March, Temple Bar Investment Trust (TMPL) outlined reasons why it likes the banking sector, with its portfolio including positions in NatWest (NWG) and Standard Chartered.

It said: ‘Whilst the banks have been negatively impacted by ultra-low interest rates, they are still able to make a reasonable return on equity capital as lending spreads remain satisfactory.

‘They also are using technology to reengineer their cost bases for the world in which they now operate.

‘Whilst it is difficult to imagine that these companies will ever again make the mid-teens return on equity that they did pre the financial crisis, a high single digit return, as targeted by the management teams, will be possible in the medium term.’

Many of the funds run by Artemis invest in UK banks, with the Artemis Alpha Trust (ATS) having 10% of its portfolio invested in Barclays and Lloyds (LLOY).

The investment trust’s managers argue the sector sell-off during the pandemic was unwarranted as UK banks entered the crisis with much higher capital ratios, plus the problem didn’t originate in the financial sector as it did in 2008.

They also argue that loan impairment forecasts have been unrealistically high, and that the pandemic has shown people can bank without branches.

‘This, combined with cost savings from changing ways of working (e.g. lower office costs/automation), should provide a long-term cost opportunity,’ they say, adding that higher interest rates would be beneficial to a degree.

In contrast, the specialist Polar Capital Global Financials Trust only holds one of the big UK lenders. Its largest UK holding is specialist mortgage lender OSB (OSB) in 20th place with a 1.7% weighting, followed by HSBC in 27th place with a 1.6% weighting.

The trust’s other main UK holdings are insurers Beazley (BEZ), Direct Line (DLG), Lancashire (LRE) and Prudential (PRU), and stock market operator London Stock Exchange (LSE).

ARGUING THE CASE FOR BARCLAYS

Artemis Alpha co-manager Kartik Kumar is positive on Barclays. ‘The business has the benefits of diversification through having retail and investment banking operations. It was one of the few UK banks to be profitable in all four quarters of the year,’ he says.

‘The business also has several opportunities to improve returns, particularly by addressing the opportunities in payments and credit cards where its existing market positions seem under-appreciated.’

Meanwhile, analysts at Berenberg point to upside for Barclays’ investment bank, improving trends in credit cards in the UK and the US and the relative valuation gap with its European rivals as reasons to like the stock.

‘Barclays faces an easier year on year hurdle in its investment bank than peers and appears to be gaining further market share in its fee businesses. We believe this provides a highly supportive backdrop which can be bolstered further by clarity over Barclays’ cost reduction plans. Given this, and its attractive capital returns, we believe Barclays’ c20% discount to European banks is too wide.’

Coincidentally, Shares recently looked for stocks which had been derated by the market, but which are enjoying earnings upgrades, and Barclays screened well.

Coincidentally, Shares recently looked for stocks which had been derated by the market, but which are enjoying earnings upgrades, and Barclays screened well.

Its price to earnings multiple has shrunk from a five-year average of 12.3 times to just over seven times for 2023, despite average growth in earnings of more than 10% per year, and the stock is now experiencing 35% upgrades to current-year earnings forecasts, meaning it combines value and positive earnings momentum.

Disclaimer: AJ Bell referenced in this article is the owner of Shares magazine. Ian Conway (author) and Daniel Coatsworth (who edited this article) own shares in AJ Bell.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Education

Feature

Great Ideas

News

- ECB makes first tweak to inflation target in two decades

- The small cap e-commerce play which could follow in THG’s footsteps

- Tate & Lyle could see higher share rating but lower dividends

- Tobacco companies make push into healthcare space

- Potential UK-listed takeover targets as the M&A frenzy heats up

- Admiral raises forecasts and dividends despite lower insurance rates

magazine

magazine