Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Commercial property is looking interesting again

The gradual reopening of the UK economy has been matched in the property investment space by a similarly gradual reopening of open-ended real estate funds. This follows a long period when trading in numerous property funds was suspended due to the difficulty of valuing their holdings in the pandemic.

There are mounting arguments that these vehicles are becoming ‘uninvestable’ thanks to the mismatch between their structure and the difficulty in rapidly buying or selling their commercial property assets.

Fortunately for those looking to invest in UK property for income and inflation-busting credentials, as well to play a post-Covid rebound in the economy, there are plenty of closed-ended funds (investment trusts) which don’t suffer from the same structural problems.

In this article we’ll discuss how different parts of the property market are performing and highlight several options for investors.

Why the open-ended property fund structure is a problem

When an investor wants to sell their holding in an open-ended fund, the fund manager must pay the investor back by selling some of the assets in the portfolio or using any cash on hand – and the fund has to offer the ability for investors to buy and sell on a day-to-day basis.

The problem for fund managers holding commercial property assets is that they cannot be bought or sold in quick timeframe. This means they are under pressure to keep a large amount of cash on hand to meet investor redemptions which could act as a drag on returns.

LATEST TWIST FOR PROPERTY FUNDS

The property funds that had suspended dealing began reopening at the beginning of 2021 and have seen big outflows in the interim – figures from funds network Calastone showed that May saw the second-largest monthly outflow on record for UK real estate funds at £445 million.

Unsurprisingly against this backdrop Aegon and Aviva have announced their property funds are to be permanently closed. These two funds were the weakest in the space – with others benefiting from greater scale.

AJ Bell head of active portfolios Ryan Hughes doesn’t expect further closures in the short term, with open-ended property funds instead in a holding pattern while the regulator considers measures such as a 180-day notice period for exiting a property fund. However, he believes open-ended property funds are not ‘sensible investments’ at present.

He says: ‘The open-ended property fund market is uninvestable in my view right now because of the uncertainty over access. We know the structure is not right and you have this liquidity mismatch.’

This is not a problem with real estate investment trusts which are also known as REITs. These are closed-ended vehicles which are traded among investors on the stock market. When someone wants to sell their investment, they sell the shares on the market to another investor – which means the fund manager doesn’t have to deal with any cash outflows from their portfolio.

The share price is determined by investor demand and means REITs can trade at a premium or discount to the value of their underlying assets.

DIFFERENT TYPES OF PROPERTY

Traditionally there have been three main classes of commercial property – offices, retail and industrial – and the following section summarises the current market dynamics for each of them as well as the level of investor sentiment.

In addition to the mainstream property vehicles, there are also investment companies set up to put money into niche or alternative property assets including healthcare facilities, self-storage units and student accommodation.

The big winners among the REITs in the wake of coronavirus have been those which invest in logistics assets as stay-at-home restrictions have accelerated an existing trend towards shopping online, requiring retailers to have lots of warehouse space to sort and distribute orders.

Generic or diversified property REITs which hold a broad spectrum of assets, by contrast, have been out of favour with investors and have traded at large discounts to net asset value, although as Stifel notes they have recently ‘experienced a strong positive discount re-rating as investor fears about the impact of the pandemic abated and their inflation protection attributes became more relevant’.

UK property classes what’s hot and not

HOT

Industrial

There is huge demand for warehousing space. The penetration of online retail was accelerated by the pandemic and has driven up valuations for logistics assets and the vehicles which invest in them, even after a strong run pre-Covid.

LUKEWARM

Offices

The jury is still out on how the work from home trend will persist as we return to some form of normality and what implications this trend has for occupancy levels and demand for office assets. However, we note that some investors are starting to sniff around for bargains in this space.

COLD

Retail

The UK high street and shopping malls were struggling before coronavirus and the situation has only deteriorated since. Nonetheless, some parts of retail property have outperformed like supermarkets, convenience, value and DIY stores.

DIVERSIFIED REITS LAG SPECIALISTS

The table shows there is still a big disparity between these diversified products and some of the more popular niche plays.

We think there are two good options for investors depending on their appetite for risk and the time and inclination to do their own research.

One is to buy a diversified trust at a discount, but to conduct due diligence to see what types of retail or office assets they hold and whether the discount is warranted. It is also worth looking at the manager’s performance and track record and whether you would be comfortable relying on their expertise to pick the right assets.

This diversified approach means you still get exposure to assets with strong market dynamics like warehouses but at the same time can benefit from a prospective recovery in office and retail assets.

The other is to create your own portfolio by buying several different specialist REITs, an approach AJ Bell’s Hughes thinks could increasingly represent the future of property investing.

‘One of the attractions of the closed-ended property space is you can cherry pick, if you want a mix of logistics, healthcare and supermarkets you can do that,’ he says.

To help generate some UK property investment ideas we’ve highlighted one generic REIT which we think is worth buying and three more specialised vehicles to create a mini portfolio.

A diversified REIT to buy

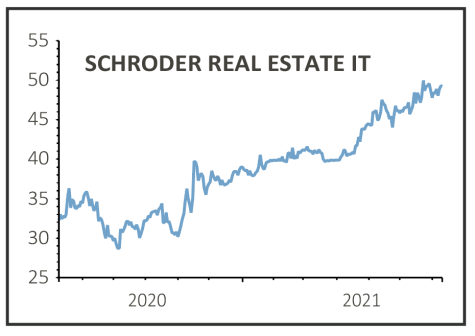

Schroder Real Estate Investment Trust (SREI) 48.9p

Discount to NAV: 18.2%

Dividend yield: 4.7%

Source: AIC, Winterflood

This diversified UK property investor still trades at a material discount to NAV which in our view is unjustified. Recent annual results (2 Jun) showed an improvement in performance and, encouragingly for its prospects, the vacancy rate.

We like the approach of focusing on so-called ‘Winning Cities’ – urban areas with characteristics that will make them attractive places to live and work in the long term.

The investment trust has 73% of its portfolio in industrial and office assets and its retail holdings include almost zero exposure to structurally challenged shopping centres.

Shares’ REIT portfolio

This selection captures an experienced asset manager in an attractive part of the UK commercial property market, a reliable income payer with inflation protection built in, and recovery potential through a London-focused vehicle.

Capital & Counties (CAPC) 168p

Discount to NAV: 12%

Dividend yield: 8.9%

Source: Berenberg

The REIT trades at a 12% discount to net asset value based on Berenberg’s 2021 forecast and offers a dividend yield of nearly 9%.

Management took action to weather the Covid storm, and the portfolio of prime West End real estate, including shops and leisure assets, should benefit as London returns to a new normal in the wake of the pandemic.

Capital & Counties has also taken a 25% stake in close peer Shaftesbury (SHB) which offers exposure to the latter’s own recovery as the capital reopens for business and may offer the potential for a transaction of assets or tie-up between the two in the future.

Target Healthcare REIT (THRL) 118.6p

Premium to NAV: 8.6%

Dividend yield: 5.7%

Source: AIC

While you must pay a premium to gain exposure to Target Healthcare REIT’s (THR) portfolio of care homes we think this is worth it given the quality of the assets and the inflation-linked and generous income reflected in a near 6% yield.

The sector has been heavily disrupted by coronavirus, but Target benefited from its focus on homes with single-occupancy rooms and en-suite wet rooms which supported infection control. This is likely to be an ongoing priority, while demographic trends provide strong long-term drivers for this space.

Urban Logistics REIT (SHED) 157.5p

Premium to NAV: 5.4%

Dividend yield: 4.8%

Source: AIC

Urban Logistics trades at a much more modest premium to NAV than other logistics-focused peers. It recently raised £108 million to invest in pipeline of assets at an attractive net initial yield of 6.1% with the majority of the deals likely to be completed off market.

It deliberately targets smaller assets under £10 million and 200,000 square feet where it feels it can create value by actively managing the assets and where it probably faces less competition – hence its ability to complete deals on properties which aren’t being marketed to other buyers.

DISCLAIMER: AJ Bell referenced in this article is the owner of Shares magazine. Tom Sieber (the author) and Daniel Coatsworth (who edited this article) own shares in AJ Bell.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Education

Feature

Great Ideas

News

- ECB makes first tweak to inflation target in two decades

- The small cap e-commerce play which could follow in THG’s footsteps

- Tate & Lyle could see higher share rating but lower dividends

- Tobacco companies make push into healthcare space

- Potential UK-listed takeover targets as the M&A frenzy heats up

- Admiral raises forecasts and dividends despite lower insurance rates

magazine

magazine