Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Reopening rally: is there more to go?

The opening of indoor hospitality on 17 May was the penultimate step on the Government’s roadmap towards the complete removal of restrictions on 21 June, notwithstanding the threat of new variants.

The UK’s successful vaccination programme and falling hospitalisations over recent months has spurred hopes for a strong second half economic rebound, with the Bank of England upgrading its 2021 growth forecast to 7.5% from 5% in February.

With the mid-cap FTSE 250 index hitting a new all-time high in early May investors are rightly asking if there is more to come, especially for the sectors worse hit by the pandemic, which have outperformed the market year to date.

A lot of stocks linked to the reopening trade have already rallied hard, implying that a lot of future good fortune is already priced in. That means you can no longer buy anything linked to the reopening and expect to profit.

In this article, we piece together recent trends and identify the stocks that could still see their share prices rise in the short term as well as the stocks to avoid.

HOT SUMMER FOR HOSPITALITY?

If the enthusiasm shown by consumers braving the cold April temperatures is any guide, pubs and restaurants could be in for a hot summer.

According to data consultancy CGA like-for-like drink sales were only down 21% in the first two weeks after opening outdoors on 12 April compared with the corresponding weeks in 2019, which represented a tough comparator given it included Easter.

Premium bar operator Revolution Bars (RBG:AIM) said that despite operating from only 15% of capacity and shorter than normal hours, sales hit 48% of the comparative four week period before the pandemic.

Managed pubs group Young’s & Co (YNGA:AIM) said it achieved 85% of normal trade for the 144 of its pubs with outdoor spaces in the five weeks since reopening.

Throw in the potential for a successful European football championship in June and it is easy to imagine exceptional summer trading for Young’s and the pub sector in general.

Speaking on Shares’ Money & Markets podcast, Young’s chief executive Patrick Dardis said: ‘It could be the best summer we’ve

ever had.’

Numerous retail stocks have seen their share prices bounce on the first trading update after reopening measures as sales have exceeded expectation. Shares believes there is a good chance that we could see the same result for several companies that haven’t yet had a chance to enjoy a bump in trading, such as some of the holiday and airline companies.

By taking a position now when there is still some uncertainty, you’re in position to benefit at the next trading update. However, you also run the risk that the update disappoints, so pick stocks carefully.

HAVE SHARES ALREADY PRICED IN GOOD NEWS?

The big question is how much of the potential good news has already been priced into shares, given how numerous leisure, retail and hospitality stocks have risen considerably year to date.

Shore Capital believes the risks and rewards are no longer favourable with several stocks already appearing to be pricing in a recovery in profitability back to pre-Covid levels.

For example, shares in cinema operator Cineworld (CINE) are up 32% year to date, despite an uninspiring near-term film release roster and increased streaming competition. Having run too far relative to the fundamentals, we would steer clear of its shares.

PUBS, RESTAURANTS AND CAFÉ COMPANIES

Around 7.5% of capacity has been removed from the pubs and restaurants industry since December 2019 according to Shore Capital, which means the supply-demand balance is favourable for the first time in decades. This may have the effect of creating a stronger pricing and margin environment.

A recent survey from the Morning Advertiser suggested that 58% of operators had increased prices while only 18% had no plans to increase prices.

In addition, a more ‘tenant friendly’ rental landscape could mean the survivors getting cheaper access to prime locations, particularly relevant to café and restaurant operators.

Higher margins and returns on capital could imply higher than historical valuations for the best positioned firms, suggesting more share price gains.

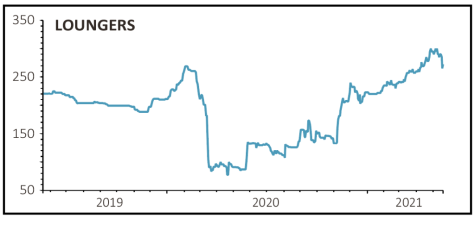

Loungers (LGRS:AIM)

Price: 270.2p. Market Cap: £293 million

All-day café and bar operator Loungers is well positioned for the post-pandemic world due to the position of its sites which are predominately located in small town centres and suburban high streets.

Chief executive Nick Collins told Shares that the company ‘felt more relevant’ to the communities it serves than ever before, suggesting its strategy has a long runway ahead.

The company’s flexible format provides a cheap workspace, a meeting spot for the local community and a place for friends to hang out from dawn to late, which seems to be a winning formula and a long-term solution to challenged high streets.

Spurred on by strong like-for-like trading last summer and an £8.3 million fundraise last spring, Loungers has upgraded its growth ambitions to open 25 sites a year.

The company already had one of the lowest rent expenses among peers, running around 5% of revenues, so the opportunity to open new sites on even more attractive rents suggests the business can eventually earn higher returns.

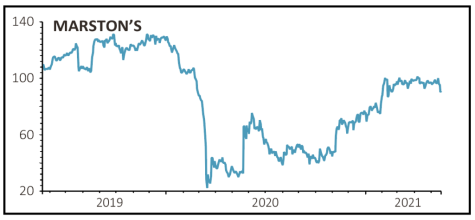

Marston’s (MARS)

Price: 91.1p. Market Cap: £604 million

Pubs operator Marston’s could perform well in the new post-pandemic world with its wet-led community and suburban pub exposure enabling it to exploit more flexible working patterns.

This positioning and investments made during lockdown in outdoor spaces allowed the company to open an impressive 80% of its estate in April, while pent-up demand drove trading to 80% of pre-Covid levels, despite indoor spaces remaining closed until very recently.

Last year’s brewing joint venture with Carlsberg netted the company approximately £230 million in cash and a 40% share of the enlarged beer company which is expected to generate £24 million of synergies.

Marston’s is now set on a path to providing the best customer experience and simplifying the business.

Reaching its goal of reducing net debt to below £1 billion by 2025 remains the financial priority. Dividends should be reinstated in due course and increased progressively as deleveraging continues.

The business is also a takeover target, as illustrated by an approach last year from US private equity firm Platinum Equity Advisors. Marston’s fought off that takeover interest, saying the various proposals undervalued the business. We wouldn’t be surprised to see someone else sniffing around.

RETAILERS AND DRINKS COMPANIES

A slew of retail and beverage businesses have upgraded guidance as the world reopens.

For instance, Next (NXT), Greggs (GRG) and Dunelm (DNLM) have scaled fresh share price highs after seeing strong trading post the reopening of non-essential stores (12 April).

Shares in Diageo (DGE) and Britvic (BVIC) have also fizzed up on signs of encouraging trading as the on-trade (pubs, restaurants and hotels) and other out-of-home channels spring back into life.

As the table shows, the likes of greetings card retailer Card Factory (CARD) and fashion brand Superdry (SDRY) are among the names to have served up spectacular year-to-date returns, leaving shares at levels which leave little room for disappointment if the reopening boom falls flat, and earnings come in shy of estimates.

Cards-to-gifts seller Card Factory says customers are spending more as they frequent its now-reopened shops but are visiting less often. We would urge caution over buying its shares given ongoing worries over high levels of debt and the fact it has flagged the need to raise more money.

Despite its rip-roaring rebound from the March 2020 lows, B&Q-to-Screwfix owner Kingfisher remains good value, based on around 14 times prospective earnings for the years to January 2022 and 2023.

The home improvement specialist reported bumper first quarter sales and raised first half earnings guidance as it continues to ride the DIY boom. Yet risk-averse investors should be aware of the demanding sales comparatives to come as well as the fact Kingfisher is now feeling the impact of supply chain challenges and inflationary pressures. We think the shares are due a pullback, so wait for a better entry point.

The same applies to bakery retailer Greggs. It is a fantastic business, but its stunning rally leaves the shares swapping hands for roughly 33 times forecast 2021 earnings. That’s too high, so put it on your watch list. We think investors stand a better chance of making money this year by buying another retailer – furniture specialist ScS (SCS), which we discuss in detail later in this article.

As for the beverage sector, the reopening of the on-trade across major markets is providing a major earnings tailwind for the likes of premium mixers brand Fevertree Drinks (FEVR:AIM), soft drinks groups Britvic (BVIC), A.G. Barr (BAG) and Coca-Cola HBC (CCH), and alcoholic drinks giant Diageo (DGE).

Britvic (BVIC)

Share price: 956p. Market Cap: £2.5 billion

Though the shares are up 18% year-to-date, we expect further upside from soft drinks group Britvic (BVIC) now that the on-trade has reopened, and the easing of restrictions is helping other out-of-home channels to rebound.

The maker of Britvic mixers as well as Robinsons, R Whites and Tango reported ‘encouraging’ trading in the first weeks of its second half as UK lockdown measures begin to ease. In a show of confidence, it reinstated the interim dividend.

Britvic, which also produces and sells Pepsi and 7UP in Britain and Ireland under a franchise bottling deal with PepsiCo, is optimistic as it enters the second half of its financial year and the key summer period, with vaccines being rolled out in the UK and across the European Union.

For the year to September 2021, J.P. Morgan Cazenove forecasts earnings per share of 46.8p, bubbling up to 56.9p for 2022.

J.P. Morgan Cazenove regards Britvic as ‘a relatively defensive play within beverages at an attractive valuation’. Based on next year’s estimate, Britvic trades on a forward multiple of 16.8 times.

ScS (ScS)

Price: 265p. Market Cap: £101 million

Demand for UK houses is buoyant post-pandemic and many consumers won’t be taking a foreign holiday this summer, which means demand for home-related big-ticket items such as sofas and carpets could prove stronger and more sustained than previously thought.

That augurs well for ScS, the purveyor of competitively priced upholstered furniture and floorings which reopened stores in April and should prove a beneficiary as pent-up demand is released over the months ahead.

Since ScS’ sofas offer good value, its stores and website should appeal to consumers on a budget. And alongside rival DFS Furniture (DFS), ScS has market share to chase following the demise of rival Harveys, and with Oak Furnitureland having emerged from administration last summer with a diminished store estate.

Blessed with a strong balance sheet and a cash generative business model, ScS is also committed to restarting dividends when appropriate in the future.

TRAVEL AND HOLIDAY COMPANIES

The to-ing and fro-ing over whether summer holidays abroad will be allowed and where people will be able to travel have dominated media headlines.

When the pandemic first hit and companies scrambled to raise cash, the consensus was that one lost summer is bad but not a disaster. Two lost summers was deemed unthinkable.

With most of Europe’s population now vaccinated and the vaccines seeming to hold up well against variants, it appears that 2021 may not be another lost summer after all.

Consensus analyst forecasts compiled by Refinitiv show most airlines staging a near full recovery by the end of 2023, with a modest bounce back in revenue and earnings this year before a meaningful jump next year, with sales and profit getting back to pre-pandemic levels during 2023.

However, there are some stocks which analysts think will exceed pre-pandemic earnings levels by then, one of which is budget airline Wizz Air (WIZZ).

In the year to 31 March 2020, before the impact of the pandemic was really felt, Wizz Air recorded revenue of £2.7 billion, but by 2023 analysts see this heading to £3.3 billion, with earnings before interest, tax, depreciation, and amortisation rising from £783 million in 2020 to over £1 billion by 2023.

This strong earnings outlook has already been reflected by a jump in its share price above pre-pandemic levels to reach all-time highs, but the company is seen as considerably more resilient than its competitors with €1.6 billion in cash as of 31 March, and quarterly cash burn of €87 million.

In theory it is in a strong position to hoover up market share from failed competitors once travel recovers. Unlike its London-listed peers it also has a much bigger focus on Central and Eastern Europe, seen as a higher growth market than Western Europe.

Not all stocks have fully recovered however, with Wizz Air’s rival EasyJet (EZJ) still a third below its pre-pandemic level.

British Airways owner International Consolidated Airlines (IAG) is still more than 50% down, with analysts only expecting the firm to recover 40% of its 2019 revenue in 2021.

The firm is more exposed than its rivals to some of the structural changes that could occur post-pandemic, with its lucrative ‘billion-dollar route’ between London and New York for example under threat from what could be a permanent decline in business travel. However, with its shares depressed analysts at Berenberg see a buying opportunity now.

There are reasons that stocks like IAG and EasyJet have been left behind by the market, such as their higher debt levels which could hinder growth once the sector recovers. Berenberg says EasyJet’s cash breakeven ‘still appears a distant goal’ as bookings remain volatile and at low levels.

We believe Jet2 (JET2:AIM) could be a good stock to own, as it has a stronger balance sheet and could be primed for significant growth as travel recovers. We also see merit in backing holiday seller On The Beach (OTB). Read on to discover why.

JET2 (JET2:AIM)

Price: £14.46. Market Cap: £2.9 billion

With a prudent approach to ramping up capacity, a stronger balance sheet than most of its rivals and plenty of growth ahead of it, now could be the time to buy Jet2.

Unlike its peers, Jet2 has postponed restarting flights and holidays until 24 June, noting ongoing uncertainty and weaker demand for summer 2021 bookings.

But with £1 billion in cash and half-yearly net operating expenses of £411 million, the firm is in a much better position than a lot of rivals and doesn’t need to take the risk of unprofitable flying, unlike others such as EasyJet (EZJ) and TUI (TUI).

With the ability to sit tight until it can focus on cash generative flying, the good reputation it enjoys among consumers thanks to its approach to refunds, and the extra capacity it already has after the failure of Thomas Cook, Jet2 is in a better position than most for when holidays really get going again.

ON THE BEACH (OTB)

Price: 377p. Market Cap: £588 million

Seemingly unrewarded by the market for its prudent approach, now is the time to buy holiday provider On The Beach (OTB).

The firm has extended the off-sale period for its holidays from 30 June to 31 August. The decision is based upon booking/search reaction to the small green list, as well as the likely risk to customer goodwill for holidays that might be cancelled or rearranged.

While this could impact the firm’s 2021 financial forecasts, analysts covering the stock are confident its earnings will quickly recover and ultimately be in a better relative position than pre-Covid.

Analysts at Numis highlight its strong balance sheet with £2 million monthly cash burn yet £115 million in available cash, allowing it to sit tight before ‘tailwinds aplenty’ in 2022. Next year is likely to see very strong demand for going abroad and more confidence among consumers to book well in advance.

Numis says: ‘We would use the recent share price correction (-25% versus recent highs) as an attractive entry point.’

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

Great Ideas

- It could be takeover time again for Premier Foods

- Why it is not too late to profit from the SDI growth story

- Gamma Communications to hit top of range forecasts in 2021

- Walmart delivers with upgrade to forecasts as it gains market share

- Ford accelerates electrification drive with new battery plant and latest F-150 truck

- Supreme is a super-charged growth and income play

magazine

magazine