Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Hipgnosis Songs Fund is sounding the right notes

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

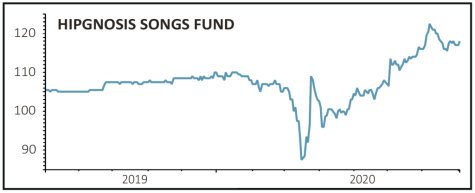

HIPGNOSIS SONGS FUND (SONG) 116.75p

Gain to date: 1.1%

Original entry point: Buy at 115.5p, 18 June 2020

Having reached 122.5p in July, Hipgnosis Songs Fund (SONG) has settled back to 116.75p with additional shares hitting the market through a successful July fundraise. Yet our ‘buy’ call on the music royalties specialist remains in positive territory and Hipgnosis continues to bolster an impressive catalogue of winning songs.

Among the more noteworthy is the acquisition of song writing legend Barry Manilow’s music royalty catalogue, for an undisclosed sum.

Hipgnosis Songs Fund buys and owns the rights to certain pieces of music and receives a royalty payment each time they are played on the radio, streamed online, feature in adverts, films, TV programmes or computer games, or are bought on CDs or vinyl.

This helps to fund an attractive stream of dividends and makes the music royalty fund attractive in an environment where dividends are being cut by many companies.

Investors are enthusiastic about the proposition, with Hipgnosis having raised more than £860 million through its summer 2018 IPO and subsequent issues in April 2019, August 2019, October 2019 and this July, when it raked in £236.4 million by issuing new shares at 100p per share.

Following this impressive spate of acquisitions and capital raises, other music royalty firms are thought to be considering IPOs, which could increase competition for assets in the future and is one risk factor to monitor.

SHARES SAYS: Keep buying.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine