Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Selling by insiders raises new questions for NMC Health

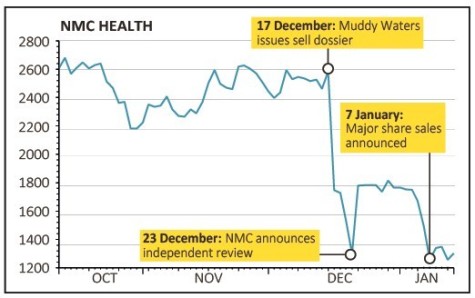

United Arab Emirates-based private healthcare provider NMC Health (NMC) faces mounting pressure amid short selling and as major shareholders ditch hundreds of millions of pounds worth of stock.

The business first came under fire from short seller Muddy Waters on 17 December when it published a dossier which accused the firm of overstating its asset values, cash and reported debt levels. The shares plunged as much as 42% at one point before recovering to close 27% down on the day.

One would normally expect a strong rebuttal of the claims and a management team expressing ‘confidence’ in the business by committing to buying shares at depressed levels.

However, in a dramatic turn of events the company’s largest shareholder Saeed Mohamed Al Qebaisi has off loaded £375m worth of shares, while relative Khalifa Butti Al Muhairi sold shares worth £55.8m.

The company released a statement saying both shareholders remained supportive and long-term investors in the business.

However, the wording used, which explains that the motivation of the sale ‘pertains only to the means of financing the investors’ shareholdings’ suggests that they had pledged their NMC shares against loans as a means of ‘cashing-out’ without formally selling shares.

This is supported by the announcement on 7 January that investment bank Credit Suisse had conducted an accelerated book-build to place $490m shares in NMC, owned by Saeed Mohamed Al Qebaisi and Khalifa Butti Al Muhairi, in order to reduce their indebtedness.

Institutional shareholders Capital Group and Goldman Sachs were two institutions that participated in the placing, increasing their shareholdings in NMC.

These recent events do not make for happy reading and raise more questions than answers for shareholders and onlookers alike.

It was all very different back in 2012 when the company floated in London at 210p per share. Spurred on by acquisitive growth, the shares quickly became one of the darlings of the market, reaching £40 in 2018, generating an 18-fold return for early investors.

Doubts first started to be raised by analysts and investors at the start of 2019 regarding the use of funding which wasn’t recorded in the company’s accounts. This is called off-balance sheet debt and while the company claimed that it made ‘limited use’ of this type of funding, investors took a less sanguine view.

However the current situation plays out, there are already a few lessons for investors to learn from this debacle. Extra scrutiny is required of companies operating in foreign lands, but quoted on the London market, especially if growth is driven by acquisitions funded by large amounts of debt.

And high and/or increasing executive pay combined with inadequate corporate governance should be treated as a significant red flag.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine