Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Why growth could be a hard slog for Morrisons

The UK’s fourth-largest supermarket chain can proudly trace its roots back to 1899 when William Morrison first set up his stall trading eggs and butter in Bradford Market.

Today the business operates from almost 500 stores across the country, most of which it owns freehold, and turns over more than £17bn a year.

On 7 January Morrisons (MRW) reported like-for-like sales for the 22 weeks to 5 January 2020 down 1.7%.

As well as the retail business, which sells groceries and petrol and makes up the vast majority of sales, the group also has a wholesale business providing products to other retail and wholesale customers.

It is unique among the Big Four supermarkets in being ‘vertically integrated’, with half of the fresh food it sells either prepared at its own manufacturing sites or in-store. Morrisons even has its own abattoir so that it can manage the whole meat-producing process ‘from field to fork’.

RETAIL CHALLENGES

The tough conditions facing UK supermarkets are well known, and the rapid expansion of limited-assortment retailers such as Aldi and Lidl has only made life harder for smaller chains like Morrisons.

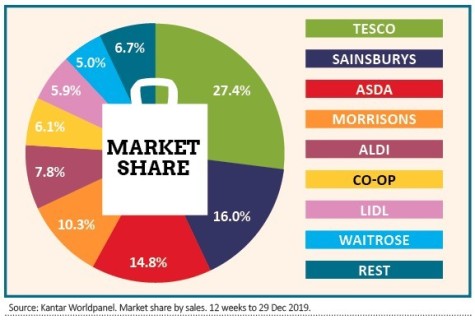

According to data from market research firm Kantar, in the last year Morrisons’ UK grocery market share has shrunk from 10.6% to 10.3% while Aldi and Lidl’s combined market share has gone from 12.4% to over 14%.

Four years ago the discount duo’s combined share wasn’t even 10%, but their relentless store-opening campaign has starved other retailers of growth.

If there is one saving grace for the supermarkets over the last year it’s that prices have been rising steadily which has largely offset flat-to-falling volumes. As a result, total UK grocery sales in pounds have only shrunk in absolute terms once in the last 12 months so the ‘pie’ has remained fairly stable.

WHOLESALE OPPORTUNITIES

The wholesale business, which sells Morrison’s products via Amazon and through petrol station forecourts thanks to deals with Harvest and Rontec, turned over more than £700m last year.

Given that group turnover was £17.7bn it is clearly a fledgling business but more deals with the forecourt firms and the nationwide roll-out of Amazon’s Prime Now delivery service are driving growth, as is a deal with convenience store operator McColl’s (MCLS). At the half-year stage the firm said it was ‘on track’ for £1bn of annual wholesale revenues.

Whereas like-for-like sales at the core retail business rose just 1.5% in 2018/19, and growth was actually negative in the first half of the current financial year (-1.1%), wholesale like-for-likes were up by 3.3% last year and 1.3% in the first half of this year.

Sales at McColl’s were below expectations in the most recent quarter but trial stores which have been converted to Morrisons Daily performed strongly and there are plans to extend the scheme to another 20 or more stores during January and February.

LOW GROWTH OUTLOOK

Selling groceries isn’t a growth business, unless like the discounters you can keep rolling out new stores every month and taking market share from your rivals.

Nor is it a high-margin activity. Morrisons’ operating margin has been 2.6% for the last couple of years although analysts have pencilled in an increase to 2.9% for the year to 31 January 2020 and 3% for the year after.

Even Tesco (TESCO), the market leader with almost three times Morrisons’ share, had sub-3% margins a couple of years ago but last year it managed to lift them to 3.5% and this year analysts are forecasting they will hit 4.5%.

LITTLE CHANCE OF A RE-RATING

At the current price of 192p the shares are trading on 14.5 times earnings for the current financial year and 13.8 times earnings for the year to January 2021.

Shore Capital forecasts 7.34p normal dividend and 6p special dividend next financial year, equating to a 6.9% yield. While the normal dividend is covered less than one and a half times by earnings, the firm generates significant cash flow meaning there is little chance of the pay-out being cut.

However you get very little growth in revenue or earnings. According to Reuters, the consensus sees revenue for the year to January 2021 growing by 1.8% and for the year to January 2022 by 1.9%.

Reported earnings per share are seen growing by 4.8% and 7.9% respectively, but a lot of the profit increase depends on margin gains and cost savings. In such a competitive market the likelihood is that margin gains get reinvested in (lower) prices to keep customers coming through the doors instead of defecting to the discounters.

The balance sheet is solid enough, with net debt of around £2.3bn, while the property estate is predominantly freehold and the pension fund is in surplus to the tune of more than £750m. Capital expenditure is half what it was at its peak and is sustainable at current levels so there isn’t much danger of a drain on capital.

Our feeling is that Morrisons is the kind of stock that is best suited to investors who are looking for income as earnings are unlikely to explode upwards in the near future and therefore neither is the valuation.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine