Why Darktrace is getting exciting again

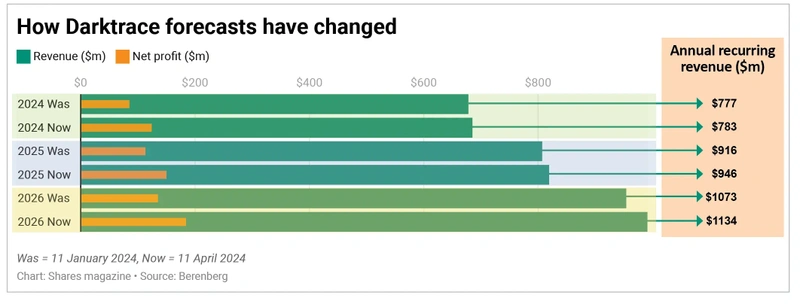

It must be maddening for analysts that every time they’ve put forecasts for Darktrace (DARK) into the market, they’re forced to tear them up and start again.

It happened for the third time already this year earlier this month (11 April), in the wake of a surprisingly strong third fiscal quarter update (to 31 March) that the company predicts will mean an extra $2.4 million of ARR, or annual recurring revenue, this year, with sales and margin guidance also raised.

Investors typically like stability and predictability yet you’ll find no one complaining. It means that while 2024 revenue projections have been increased by around 1% this year, the subsequent hike to net income margins, from 12.6% to 18.2%, means net profit is now forecast to be 46% higher ($124 million versus $85 million) this year than anticipated in January, based on Berenberg forecasts.

Against a backcloth of intense geopolitical tension, governments and corporate clients are becoming increasingly wary of the threat of hacking attacks. At the same time, AI (artificial intelligence) tools are making it easier for hostile actors to carry out phishing attacks.

‘We are preparing to roll out enhanced market and product positioning to better demonstrate how our unique AI can help organisations to address novel threats across their entire technology footprint,’ said Darktrace chief executive Poppy Gustafsson.

Founded in Cambridge in 2013, Darktrace’s core cybersecurity solution is its Enterprise Immune System, a IT system-agnostic platform that uses behavioural analysis to detect the early signs of a cyberattack on a network. EIS creates a model of users, devices, and network behaviours in normal conditions, and, through real-time analytics and AI pattern recognition, alerts IT teams on activities outside of the norm.

Darktrace shares, in the relative doldrums for 18 months or so, jumped 6% on the update and surged again following Israel’s recent retaliatory strike against Iran.

‘We believe that the demand backdrop remains positive, driven by the incidence of attacks and regulation,’ Liberum analysts said on the outlook for Darktrace.

Analysts continue to claim that Darktrace stock is being undervalued compared to US peers, partly due to concern in recent years over shareholder and founding investor Mike Lynch, who faces fraud charges in the US over his former company Autonomy. Lynch has denied the charges.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Daniel Coatsworth

Feature

- Tap into micro caps for a slice of UK innovation

- Chinese manufacturing PMI data needs to be closely watched

- Emerging markets: China rebound, Indian elections and valuations

- Small World: read about Gresham Technologies, T Clarke, REDX Pharma and more

- Are corporate spin-offs a good hunting ground for profitable investments?

- Dividend Machines

- Why Darktrace is getting exciting again

Great Ideas

Investment Trusts

News

- Ocado shares wobble after M&S relationship turns sour

- United Airlines soars on upgrades despite Boeing-related hit

- Retail sales not as bad as reported, while consumer confidence rises slowly

- Warnings from chip giants cast doubt over semiconductor optimism

- FTSE 100 finally joins the new-highs club despite being unloved for years

magazine

magazine