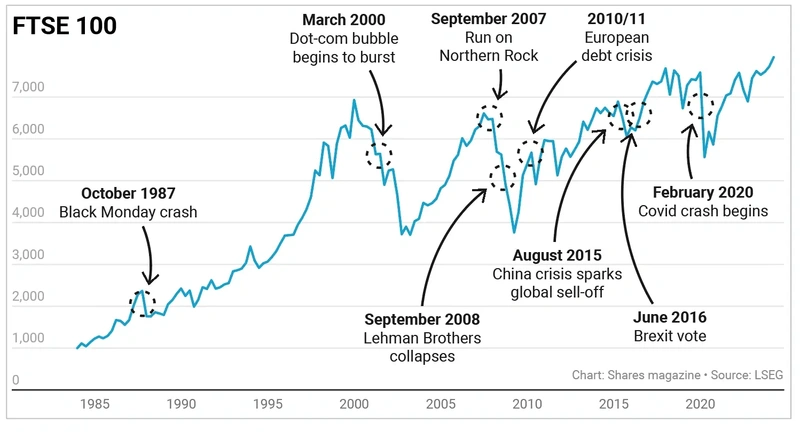

FTSE 100 finally joins the new-highs club despite being unloved for years

After almost closing at a new high in early April, the UK’s blue-chip FTSE 100 has finally made it into the ranks of indices hitting new all-time highs thanks to a 4.5% gain since the start of January.

On 22 April the index reached its highest ever close and on 23 April it moved through its previous intra-day high.

The UK clearly isn’t in the same league as the US, where the S&P 500 has notched up no fewer than 20 new life-highs so far in 2024, but it is still a notable achievement for a market which global investors have shunned pretty much since the Brexit vote in 2016.

In terms of sector contributions, banks and general financials have been a big support for the index this year with Barclays (BARC) and NatWest (NWG) among the top five performers up 24% and 29% respectively.

They are joined by investment firms Intermediate Capital (ICG) and 3i Group (III) with gains of 20% and 22%, and insurer Beazley (BEZ) whose shares are up 28% this year.

Also making a strong contribution are industrial stocks, in particular aerospace and defence companies, with engine-maker Rolls-Royce (RR.) extending 2023’s stellar run with a further 38% gain this year and BAE Systems (BA.) racking up a 19% gain as geopolitical tensions continue to unnerve investors.

Energy companies BP (BP.) and Shell (SHEL) are two of the more heavyweight contributors, both being top 10 stocks in the index, with gains of around 13% apiece thanks to higher oil prices, but selected consumer stocks have done well this year with Associated British Foods (ABF), Flutter Entertainment (FLTR), Intercontinental Hotels Group (IHG) and Next (NXT) all racking up double-digit increases.

This is clearly a stock-picker’s market, however, as not all financial, industrial, commodity or consumer stocks have done well – the bottom reaches of the index include Mondi (MNDI), Ocado (OCDO), Prudential (PRU), Reckitt Benckiser (RKT) and Rio Tinto (RIO).

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Daniel Coatsworth

Feature

- Tap into micro caps for a slice of UK innovation

- Chinese manufacturing PMI data needs to be closely watched

- Emerging markets: China rebound, Indian elections and valuations

- Small World: read about Gresham Technologies, T Clarke, REDX Pharma and more

- Are corporate spin-offs a good hunting ground for profitable investments?

- Dividend Machines

- Why Darktrace is getting exciting again

Great Ideas

Investment Trusts

News

- Ocado shares wobble after M&S relationship turns sour

- United Airlines soars on upgrades despite Boeing-related hit

- Retail sales not as bad as reported, while consumer confidence rises slowly

- Warnings from chip giants cast doubt over semiconductor optimism

- FTSE 100 finally joins the new-highs club despite being unloved for years

magazine

magazine