Will the Reddit initial public offering live up to investors’ hopes?

After repeated delays due to stock market volatility, social media business Reddit will finally make its Wall Street debut some time later this month according to its Securities and Exchange Commission (SEC) filing on 22 February.

If the New York listing does go ahead it will be the first major technology IPO (initial public offer) of 2024 and the first social media float since Pinterest (PINS:NYSE) in 2019.

There has been a dearth of new tech companies coming to market with just Instacart (CART:NASDAQ) and ARM (ARM:NASDAQ) going public in the second half of 2023.

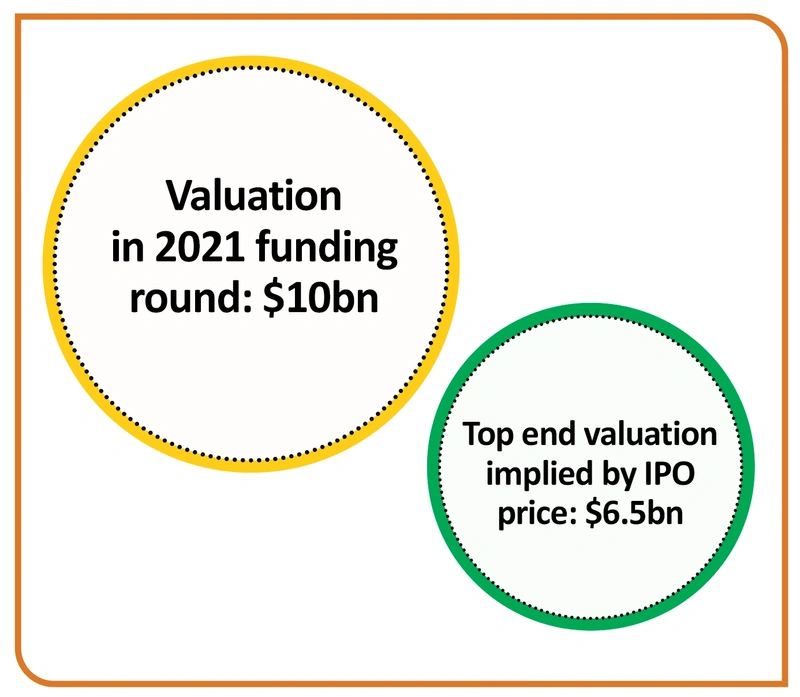

Having previously been valued at a fairly punchy $10 billion after its last private funding round in August 2021, the company is now looking at a more realistic valuation around the $6.5 billion mark.

The firm plans to offer its shares at between $31 to $34 apiece according to the Wall Street Journal, with the ticker RDDT.

In common with other US listings, there will be a number of share classes available: Class A, giving investors one vote per share; Class B, giving investors 10 votes per share; and Class C, which has no voting rights.

In its favour, the appeal of Reddit’s online community and discussion boards such as WallStreetBets means it has built a strong brand among the millennial demographic.

It is also investing in its advertising platform, after nearly a decade of neglect, while the acquisition of short-form video creation app Dubsmash in 2020 gives it a credible rival to TikTok.

In spring last year, it hired its first ever chief financial officer, Drew Vollero, previously chief financial officer of Snapchat (SNAP:NYSE).

However, unlike bigger social media firms, Reddit hasn’t made a profit since it was founded in 2005, with cumulative losses reaching $700 million to date.

Last year, Reddit posted a net loss of $90.8 million, which was an improvement on 2022’s $158.6 million loss, but the firm cautions in its prospectus it may never actually make a profit.

As well as not being profitable, Reddit’s strategy of not tracking the personal information of its users means it is missing out on valuable advertising revenue.

The decision to keep its users anonymous lays it open to claims of manipulation as bots and other ‘bad actors’ could drive their own agendas.

There have been calls for greater scrutiny of the firm’s rules and its user base after shares in US video entertainment firm GameStop (GME:NYSE) experienced wild price fluctuations due to posts on the WallStreetBets discussion board.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

Great Ideas

News

- Indivior enjoys a strong recovery as it targets primary US listing

- Halfords skids lower on weak demand and wet weather woe

- Is Adobe primed for an upside surprise?

- Competitive pressures are piling up for Pets at Home

- Will the Reddit initial public offering live up to investors’ hopes?

- Budget 2024: British ISA launched, booze duty freeze lifts pub stocks

magazine

magazine