Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Enjoy the retirement you want: How to build a SIPP portfolio

Most of us will be aware of the need to plan for our retirement, however far or otherwise we might have got with doing so. After all, when we stop working we all still want to enjoy a decent quality of life. In this article we will explore how much money you will need and the level of pension pot required to achieve it as well as providing some investment ideas for people at the start of the process, those nearing retirement and those who have already retired.

HOW MUCH DIFFERENT LIFESTYLES COST

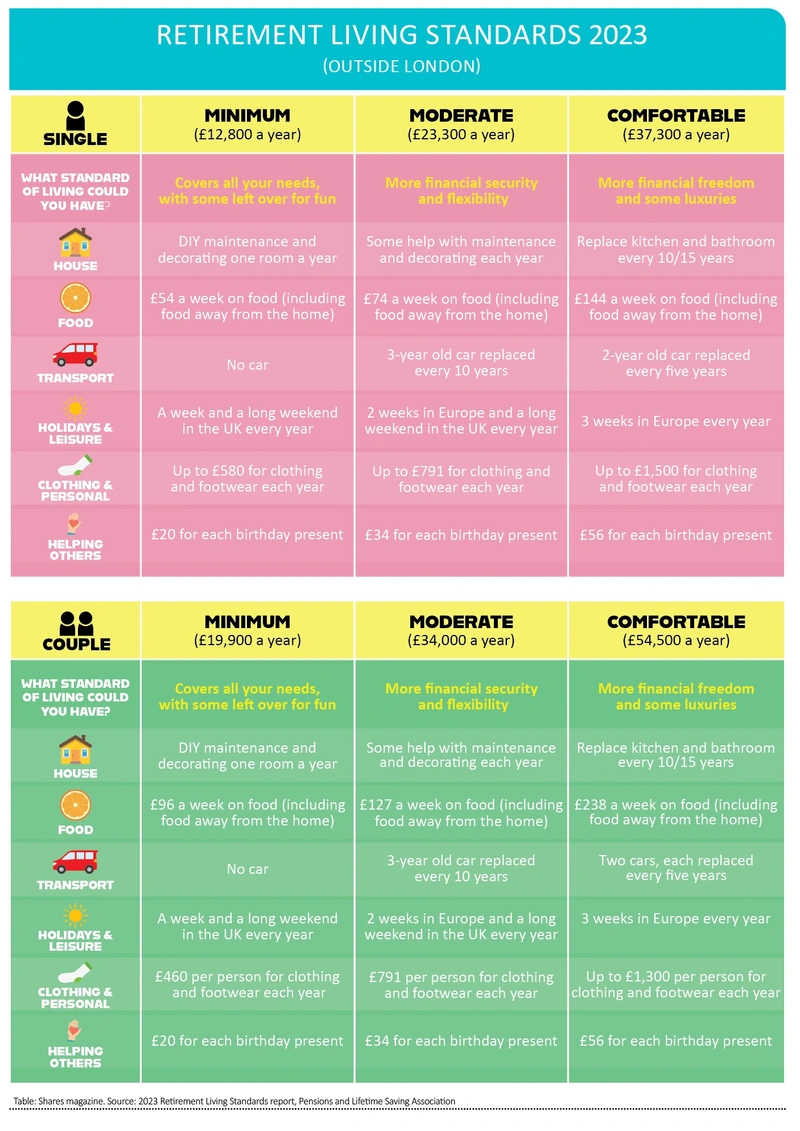

A 2023 Retirement Living Standards report produced by the PLSA (Pensions and Lifetime Saving Association), based on research by Loughborough University’s Centre for Research in Social Policy, calculated how much the average person needs to live a ‘minimum’, ‘moderate’ or ‘comfortable’ lifestyle.

After tax, the annual cost of a ‘minimum’ lifestyle is estimated at £12,800 for an individual and £19,900 for a couple. The state pension is currently £10,600.

For a couple, that figure is more than covered by the new full state pension, which stands at £10,600, while the PLSA believes £12,800 for a single person is ‘very achievable if they supplement the state pension with income from a workplace pension saved through automatic enrolment during their working life’.

The tables paint a picture of the kind of things you could expect to afford based on the different income levels.

When it comes to the level of pot required to achieve the income you want, the PLSA has had a stab at working out how much you might need to generate the different income tiers.

The results are based on buying an annuity after accumulating funds in a defined contribution pension and, while this is now a more viable option thanks to increased interest rates, the assumptions here were made at the peak of annuity rates seen in 2022.

They are just a rough guide. It does helps to have figures in your head to shape your goals and investment plan but a lot can change over time. The more you can put away and the longer you can put it to work in the markets the better as you benefit from the compounding effects. This describes the process whereby investment returns themselves generate future gains.

The value of an investment increases exponentially because growth is earned on the initial sum of money plus the accumulated wealth. The impact of compounding becomes immensely powerful if you invest over an extended period.

Whether you opt for an annuity or stay invested in retirement will depend on your risk appetite and personal circumstances. However, if you stay invested after you stop work, one advantage is the value of your investments and any income you derive from them can continue to grow and help beat inflation – whereas the income from an annuity is fixed (unless you buy an inflation-linked product which pays out a lower starting rate). Read on for portfolio ideas for someone in the initial stages of their career and getting started early with their planning, someone getting closer to the magic date and someone already in retirement.

SIPPS AND THE PENSIONS THE BASICS

A SIPP or self-invested personal pension is the most flexible type of personal pension. It allows you access to a wide range of different investment choices and gives you several options on how you draw your cash when you reach 55 (or 57 from 2028).

Pensions benefit from tax relief, so contributing to one can be an effective use of cash that isn’t needed to repay expensive debts or pay bills. Thanks to the generous tax relief on offer, £1,000 paid into a pension will automatically be topped up to £1,250 via 20% basic rate tax relief based on the total contribution.

Those who pay a higher rate of tax can claim an additional 20% through their self-assessment tax return or by contacting HMRC.

If your taxable income is over £150,000, you’ll pay a tax rate of 45% on everything over this threshold. You can claim additional tax relief on that amount – an extra 5%, to give you 45% tax relief in total on all pension contributions from your income over this threshold. In Scotland slightly different tax rates apply.

While SIPPs benefit from up-front tax relief, any income drawn from them is subject to taxation (unlike ISAs).

You have three main alternatives at retirement: buy an annuity (an insurance-like product providing an income for life); drawdown regular chunks or income from your pension pot as and when you wish; or take the lot in one go. Or you can opt for a mix of these options. Up to 25% of your pension can be taken tax-free with the rest taxed as normal income.

SCENARIO 1

Planning for retirement

Assuming you have a decade or more to go until you retire then your priority should be growing your retirement pot as much as possible. For this reason, it is worth taking on a little more risk in order to achieve a higher level of return. The selections below are intended to meet that objective without taking on disproportionate levels of risk.

Investment ideas

Fidelity UK Smaller Companies (B7VNMB1) 376.4p

Smaller companies typically have more scope for growth albeit with higher levels of volatility, which make them a good fit for someone with a lengthy time horizon. This is a diversified fund made up of around 100 small- and medium-sized UK firms. Manager Jonathan Winton looks for businesses which have slipped under the radar and which might have endured a difficult spell but where he can see scope for improvement. He does not invest in companies which are facing structural decline, and accounting and investigation of cash generation are a key part of his due diligence. Performance has been impressive on a three, five and 10-year view. Top holdings include defence contractor Babcock International (BAB) and support services outfit DCC (DCC). Ongoing charges are 0.92%

JPMorgan Emerging Markets (JEMI) 100.6p

Because they are at a different stage of their development, emerging markets have the potential for faster growth than developed economies, particularly when you consider they typically have more youthful populations. This investment trust is backed by a team of more than 90 research and investment specialists who conduct in excess of 3,000 company visits a year. A focus on quality should help limit some of the governance and financial issues which can dog emerging markets businesses and that is reflected in the trust’s performance. Ongoing charges of 0.84% compare favourably with the peer group. The trust is on a discount to NAV (net asset value) of 12.3%.

Schroder Global Healthcare (B76V7Q0) 257p

Investing in health care has two benefits. Demand is less closely correlated to fluctuations in the economy and, in the West, an ageing population is likely to be a significant driver of demand. This fund, which has an ongoing charge of 0.92%, has a very strong track record. Steered by John Bowler since 2004. It owns some of the names at the forefront of areas like obesity drugs including Eli Lilly (LLY:NYSE) and Novo Nordisk (NOVO-B:CPH).

SCENARIO 2

Nearing your retirement date

Whichever route you choose to draw on your defined contribution pension, it’s likely you’ll want to build up at least some cash in your pension by selling investments in what is sometimes called the ‘retirement runway’. That’s because most people take their 25% tax free cash at retirement, for obvious reasons.

To limit the risk of a big fall in the market just as you’re about to crystallise your investments to fund this withdrawal, you probably want to build this cash up incrementally. You may also want to dial down your risk, even if you are going to stay invested when you retire.

Investment ideas

Allianz Strategic Bond (B06T9362) 139.1p

This fund provides a decent stream of income and has historically done a decent job of protecting investors against stock market volatility. An unconstrained mandate means the portfolio can differ significantly from the benchmark. Lead manager Mike Riddell and his team have the flexibility to look at the parts of the global bond market which look most attractive. This can include everything from government bonds to corporate bonds, inflation-linked bonds and emerging markets debt. What also helps is Allianz is the largest investor in bonds in Europe so the fund is backed by significant resources and expertise. The ongoing charge is a reasonable 0.44% a year.

Brunner (BUT) £11.35

We think this trust’s balanced approach makes it a sensible option for someone looking to reduce their risk profile in the run-up to retirement while still benefiting from some of the growth potential offered by the stock market. Investing in global stocks, Brunner has a record of delivering consistent returns across market cycles. The shares currently trade at an 11.9% discount to NAV. The ongoing charge is 0.63%. The focus is on attractively-valued quality companies which enjoy big market shares, pricing power, strong balance sheets and a sustainable competitive advantage. There is also a focus on tapping into structural growth trends.

VT Argonaut Absolute Return (B7FT1K7) 275.9p

Run by Barry Norris, well-known in investment circles as taking a contrarian view, the fund has a strong track record. Norris employs an ‘earnings surprise’ stock picking method which, as its moniker suggests, looks to identify companies which can deliver positive surprises on earnings. Norris has the flexibility to go short (bet against) stocks he thinks will fail as the fund aims to provide positive absolute returns over a three-year rolling period regardless of market conditions. The portfolio has 51 long holdings and 33 short holdings and the ongoing charge is 0.81%.

SCENARIO 3

Staying invested in retirement

If you opt to go into drawdown rather than purchasing an annuity, providing a guaranteed income for life, then it makes sense to have an eye towards growth as well as income.

Current UK life expectancies mean a 65-year-old man could expect to enjoy nearly 20 years of retirement and a woman of the same age a little more than two decades.

We have therefore created this hypothetical portfolio with a look towards regular income (including an instrument which pays monthly income) alongside the potential for capital appreciation. At the same time, we have avoided investments at the higher-risk end of the spectrum.

Investment ideas

Jupiter Monthly Income Bond (B1XG8Y1) 98p

A fund offering monthly income is useful as it can provide you with means to meet at least some of your regular outgoings in retirement. The fund employs a balanced approach to a portfolio of largely (more than 90%) corporate bonds. It has delivered a solid performance over the medium to long term, achieving top quartile performance over three, five and 10 years, and has an ongoing charge of 0.65%. The yield is more than 6%.

STS Global Income & Growth (STS) 215p

Manager, adopts an inherently cautious approach to markets and this is reflected in the way it seeks to achieve income and growth from global stocks.

A concentrated portfolio of 31 names, made up of solid corporate citizens which do not require huge amounts of capital to grow and, as a result, have the capacity to pay out generous dividends.

Steered by James Harries and Tomasz Boniek, the managers are on the lookout for businesses with robust balance sheets and clear competitive advantages. Holdings include US payroll services firm Paychex (PAYX:NASDAQ) and consumer goods company Reckitt Benckiser (RKT). The ongoing charge is 0.94% and the trust trades at a modest discount to NAV of 3.2%.

Royal London Global Equity Income (BL6V111) 152p

This fund employs the same well-tested investment approach of Royal London’s other global funds. This involves a ‘Corporate Life Cycle’ framework, built on the assumption corporate returns on productive capital and growth tend to progress along a life cycle and every company can be located economically in one of five corporate life cycle categories.

These include early-stage accelerators and growth compounders as well as more mature returners and turnarounds. This helps it to perform well across different market backdrops. Holdings include North Carolina-headquartered trucking outfit Steel Dynamics (STLD:NASDAQ) and European aircraft engine maker UnitedHealth (UNH:NYSE). The ongoing charge is 0.7%.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Case study

Feature

- As BRICS grouping grows find out which of the original members has done best

- Emerging markets: positive 2024 outlook for stocks and earnings as voters go to the polls

- Why falling interest rates could be a ‘harbinger of boom’ for commercial property

- Enjoy the retirement you want: How to build a SIPP portfolio

Great Ideas

Investment Trusts

News

- How Advanced Micro Devices has surfed AI wave

- Birkenstock under pressure after disappointing post-IPO earnings

- US stocks hit new high buoyed by biggest jump in consumer confidence in 33 years

- Finsbury Growth & Income marks three years of underperformance

- Under the radar tech star Super Micro Computer surges as earnings set to smash forecasts

- UK core dividend payments rose 5.4% to £88.5 billion last year

magazine

magazine