Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

I want my savings to go green – what are my options?

Interest rates on cash savings accounts have risen the past couple of years, as the Bank of England’s base rate has been hiked. But some people want their cash to be put to good causes, while also earning them a return on their money.

The ‘green’ savings market has emerged in recent years, with money saved put towards environmentally friendly projects. However, with all the options you’re not going to get a market-leading rate – so you need to sacrifice returns for your green intentions. You also need to do your own assessment of just how ‘green’ the savings products are, and which ones align with your motives.

THE GOVERNMENT-BACKED OPTION

NS&I launched its own product into the market in October 2021, called the Green Savings Bond. This three-year fixed-rate account raises money for use by the Government on specific projects. Current initiatives range from electrifying the rail network between Wigan and Bolton to incentives for households to install biomass boilers or solar water heating.

The Government savings provider has just launched its fifth issue of the bond, after increasing the interest rate to 5.7%. Savers must be over the age of 16, can put between £100 and £100,000 into the bonds, with all the interest paid out at the end of the three-year term.

The money is locked up for this time with no opportunity for an early exit. Three years is also a long term, so you need to be sure you’re comfortable with your money being tied up for this long.

WHERE TO FIND A HIGHER RATE

You can earn more than the NS&I rate with Gatehouse Bank’s one-year Woodland Saver. This fixed-term account pays interest of 5.9%, has a minimum deposit of £1,000 and also doesn’t allow withdrawals (but the term is shorter).

However, the money isn’t invested in green projects, instead a tree is planted for every account opened. The account is also Shariah compliant, which means it has an expected profit rate rather than a guaranteed interest rate.

Other ways to make your finances green

- Switch your investments. You can move your investments into ‘green’ or ESG funds. Each fund will have a different criteria of what it will and won’t invest in, so you need to do some digging to make sure it fits with your views. Or you can pick a tracker fund that excludes certain companies from the index, such as oil groups or gambling companies.

- Turn your current account green. Make your day-to-day banking more environmentally friendly by switching your current account to a greener bank. You could use one of the banks mentioned in this article, or something like The Co-operative Bank.

- Switch your pension. Lots of people will be invested in their ‘default’ fund through their company pension, but you could switch this to a ‘greener’ option. Most company pension providers will have an ESG or ethical fund option that you could move to. Alternatively, you could move to a SIPP (self-invested personal pension) and select the fund yourself.

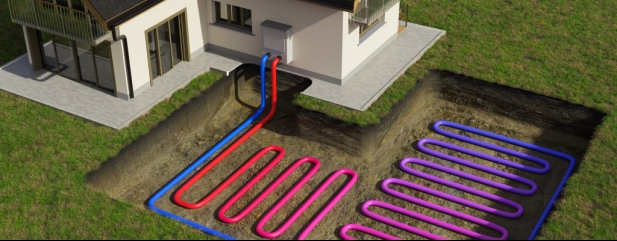

- Get a green mortgage. This isn’t a huge market, but a number of lenders offer green mortgages, which incentivise homeowners to make energy-efficient improvements to their properties. For example, NatWest offers a lower interest rate on mortgages for properties with an EPC rating of A or B, while Barclays offers a cash bonus for homeowners who carry out energy efficient home improvements, like installing a heat pump.

OTHER OPTIONS

If that feels a little light touch on the green credentials you could opt for an alternative account, but you will sacrifice more interest.

Paragon Bank’s green three-year fixed-rate account pays 5.4%, with savings between £1,000 and £500,000. It says money saved in the accounts will be leant out to people wanting buy-to-let mortgages where the properties have an Energy Performance Certificate rating of ‘C’ or above. Quite a narrow purpose for the savings, but one that might align with some savers.

Another option is Ecology Building Society, which offers a 90-day notice account that pays between 3.5% and 3.9% depending on the balance – a significant drop on the other options. But it does offer funding for a number of community and individual projects; recent ones include funding the building of housing in a cooperative in Brighton and an environmentally friendly conversion of a barn in Cornwall.

Away from fixed-term and notice accounts Tandem is one option – badging itself as the ‘greener’ digital bank. It uses money from savings accounts to lend out to individuals for areas like energy-efficient home improvements or buying hybrid cars. Its instant access saver account pays 4.65% interest with no minimum deposit and unlimited withdrawals.

Alternatively, Triodos is another option, with an easy-access account paying 3.45% or a one-year bond paying 4.25%. The winner of the Best Ethical Financial Provider award at the British Bank Awards, this bank publishes details of every organisation it lends to, so you can vet its borrowers. Previous projects include funding a hydropower scheme in Yorkshire and a dairy farm in Kent.

All rates in this article were accurate as of 12 September 2023.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

Investment Trusts

News

- TSMC spooks chip industry with slowdown threat

- Centrica share price rally has been ‘meteoric’, up 420% since 2020

- Frasers could be the key to Shein becoming a bigger player in the UK

- Drax shares tank on fears over new report on UK Government biomass strategy

- Bakkavor shares remain in the doldrums after workers vote to strike

magazine

magazine