Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Can emerging markets make the transition away from fossil fuels?

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Emerging markets are more reliant on fossil fuels than the developed world with developing countries lagging in terms of the transition to greener forms of energy.

In research published earlier in 2023 the World Economic Forum observed: ‘By 2030, annual renewable energy investment in emerging countries needs to be multiplied by more than seven – from less than $150 billion to over $1 trillion – to put the world on track to reach net-zero emissions by 2050 and meet these countries’ energy needs.’

While this is a sobering thought, it also suggests there could be significant opportunities in emerging markets as governments and other participants look to shift the dial on renewables and clean energy. Significantly, the World Economic Forum notes avoiding one tonne of CO2 emissions in emerging markets costs around 50% as much as it does in advanced economies.

Beyond environmental considerations there could be significant benefits in terms of energy cost and energy security for the developing world if it can advance its renewable sector. Particularly for those countries which are currently significant net energy importers.

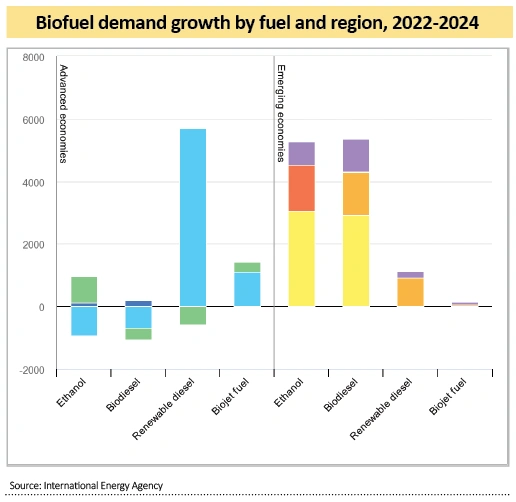

One area where emerging markets are expected to be at the forefront is biofuels. According to the IEA (International Energy Agency), domestic production of biofuels in emerging markets avoided $38 billion worth of oil import costs in 2022. In 2023 and 2024 the IEA expects two-thirds of biofuel demand growth to come from developing economies.

This outlook is part of a series being sponsored by Templeton Emerging Markets Investment Trust. For more information on the trust, visit here

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine