Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Cheap US stocks: How to find them and six to buy now

Last year was another good period for US stock markets, leading to decent returns and making the region a must-have for investors around the world.

A lot has been said about valuations being rich for US stocks following years of strong returns and that may be true in parts of the market. Yet often overlooked is the fact that you can still find US-listed companies at decent valuations if you dig deep, and that’s what we do in this article.

The S&P 500 index of US stocks gained 26.9% last year, recording its third best annual performance of the past two decades, pushing the forward price to earnings multiple to the current 21.25, above recent decade averages of about 18.

The cyclically adjusted PE ratio, which uses average net income of the previous 10 years, adjusted for inflation, rather than forecast earnings, was around 38 at end of 2021. For context, the FTSE 100 CAPE was 15.6 at the end of 2021, according to Siblis Research.

WHY IS THE US MARKET MORE EXPENSIVE?

The S&P 500 has typically traded at a premium to the UK and other major equity markets historically, a reflection of members offering greater levels of growth.

You can make a good argument that valuations are not yet at the eye-watering levels of 2000, especially when measured against the much more expensive bond market today, but it is inevitable that investors will wonder if US markets have anything left in the tank.

Shares firmly believes they do, and that US markets, and the S&P 500 especially, offer plenty of value too.

INFLATIONARY PRESSURES TRIGGER MARKET ROTATION

Inflation in the US hit 7% in December 2021, the fastest pace in 39 years. The inflation story is likely to remain front and centre in 2022 as central banks act on tightening monetary policy and global stock markets tremble amid the impending run of interest rate hikes anticipated this year.

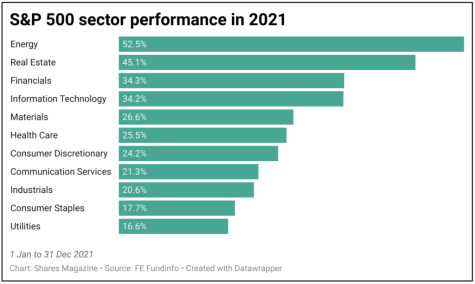

Market rotation was a hallmark of 2021 with the early part of last year seeing growth shunned for value, before whipsawing back again as the year progressed. Rotation can once again be seen this year, with technology stocks having come under heavy selling pressure as inflation builds and markets start to price in faster rate rises.

The Nasdaq Composite index lost nearly 7% in just a handful of trading sessions in early 2022. On the stocks front, drug maker Moderna and Covid test processor Quest Diagnostics, which fared well last year, are down 11% and 8.5% respectively year-to-date.

In comparison, some of the classic value sectors like banks and energy have done well.

FINDING OPPORTUNITIES

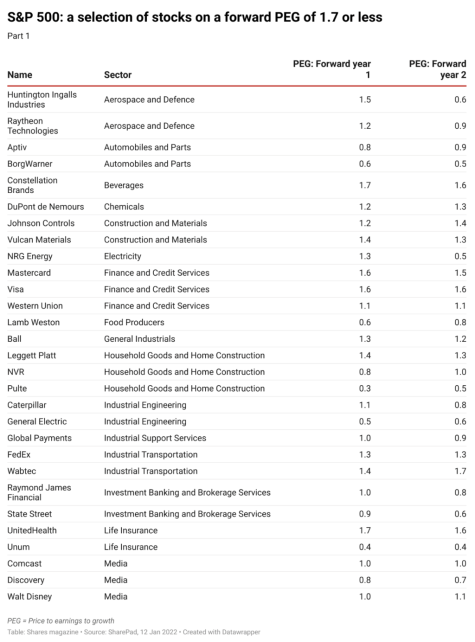

We have scanned the S&P 500 index and pulled together two lists of stocks that have price to earnings ratios of 15 or less, and price to earnings to growth multiples of 1.7 or less. A PE ratio below 20 is traditionally considered on the cheaper side, but note that different sectors trade on different PEs. Traditionally a stock with a PEG of 1 or less is considered really cheap.

Running such filters is a starting point for any investor seeking to reduce the investment universe to a more manageable size.

Our screen is even more relevant given the market is once again accepting that value-style shares are attractive in an environment where interest rates are set to rise to combat soaring inflation.

We’re seeing a rotation in the market away from expensive tech stocks and more towards lower valued names that are still capable of delivering low to medium levels of growth.

Put simply, many of the names on the two lists in this article are likely to be catching the eyes of investors in the current market. If you find a good company on the list, you’re currently able to buy it at an attractive price – but don’t hang around because the queue is growing for people wanting to buy value shares, which could force their prices up.

Please note that not all stocks trading on low valuations are worth buying. Some of them might be cheap for a reason such as intense competition or operating in a market in structural decline. Some sectors like banks and commodity producers have historically traded on lower valuations because of cyclical earnings. [SF]

SIX US SHARES TO BUY NOW

McKesson $255

Three firms – McKesson, AmerisourceBergen and Cardinal Health – control over 90% of the $500 billion annual US drug wholesale and distribution market, with each taking roughly a one third share.

Wholesalers play a crucial role in the supply chain linking over 1,200 drug companies with tens of thousands of pharmacies and healthcare providers.

They allow manufacturers to ship their products to centralised wholesaler locations rather than sending them direct to individual pharmacies or healthcare providers. They also use their scale and capital to negotiate better terms with manufacturers and supply drugs to pharmacies at a lower price than if the pharmacies bought them directly.

Operating in such a consolidated market means the risk of disruption from new entrants is very low, while the large amount of capital needed to compete is another major barrier to entry. McKesson also has exclusive supply agreements with CVS Health and Walmart which generate a significant amount of repeat and therefore predictable cash flows. [IC]

Ford Motor $24.88

Shares in US automaker Ford have motored since 2020 as investors warm to its opportunities in the electric vehicle market and car demand bounces back post-pandemic.

Even though Ford’s market value recently topped $100 billion for the first time, the shares continue to offer value on a two-year forward price to earnings multiple of 12.1.

Ford plans to increase production of electric vehicles including the Mustang Mach-E and F-150 Lightning pickup truck. The company might also get a potential windfall should it choose to sell its 11.4% stake in electric van and truck maker Rivian Automotive, the pair having last November cancelled plans to jointly develop an electric vehicle. The stake in Rivian is currently worth $8.2 billion.

Risks for investors to consider with Ford’s shares include a downturn in the cyclical auto industry, increased electric vehicle competition and the challenges of scaling EV production. [JC]

Ebay $63.28

There really isn’t another auction business with the global reach and product breadth as Ebay.

Having spun off Paypal in 2015, Ebay has subsequently spent time refining its proposition and slimming down further, including the sale of its online classified advertising business to Norway’s Adevinta last year.

There is a growing trend for people to buy and sell second-hand (or ‘pre-loved’) items rather than amass endless new products, possibly because of environmental concerns or simply a love of vintage. Either way, it provides a tailwind for Ebay.

It’s worth noting a decline in active users since the pandemic peak which might be down to fewer people stuck at home looking for ways to make money. It might also be down to fewer promotions on Ebay’s site, although the move has saved the company money on marketing spend.

Facebook Marketplace is a competitive threat to consider longer term, yet that platform is currently mired in controversy around many users being scammed.

Perhaps most importantly, last year Ebay increased the percentage it takes from every sale. It has also started to loan money to small business sellers on its platform, thereby adding another revenue stream and hopefully improving customer stickiness.

Expected pre-tax profit of $2.2 billion in 2021 is forecast to grow to $2.96 billion in 2022 and $3.29 billion in 2023, according to Refinitiv. [DC]

Walt Disney $155.44

Walt Disney admittedly endured an iffy 2021 when growth of its streaming platform stalled, and its theme parks continued to be affected by Covid restrictions. However, the resulting share price weakness has created an enticing buying opportunity in the world’s leading entertainment business.

Trading on a PEG ratio of 1, this stock is arguably a bargain when considering expected growth rates.

Yes, the streaming side has lost momentum, but Disney is investing heavily in new films and TV shows. From a standing start, the company has already delivered impressive growth based on its archive of outstanding content across the Marvel and Star Wars universes, Pixar and its eponymous animated features. This intellectual property can be milked for decades to come, via new productions and merchandise.

This year should see a return to foreign travel and revival of tourism, boosting visitor numbers at its theme parks. This, in turn, will reinforce the way its creations resonate with audiences. [TS]

Micron Technology $95.65

This complex memory microchip manufacturer is a good illustration that not all quality technology businesses trade on sky-high valuations.

Nasdaq-listed Micron Technology is one of the world’s top producers of DRAM and NAND flash memory chips.

DRAM is used in PCs, laptops, smartphones and servers to perform their various functions. NAND flash is what allows a memory stick to work, or you to store music on your phone.

Global industry is still reeling from microchip shortages so there is plenty of pent-up demand, while analysts believe that the DRAM chip industry has become less cyclical than in the past thanks to better industry discipline after sector consolidation.

Little of this seems to have been priced in, with the stock still trading in line with its five-year average and on a discounted PE of 10.6 and PEG of just 0.3. This is surprising considering Micron’s pristine balance sheet, stellar free cash flow generating abilities, and promising growth outlook supported by secular growth tailwinds. [SF]

Autodesk $255.81

The cloud engineering software company might not look great value on immediate PE terms – it trades on a next 12-months ratio of about 40, but it has been growing earnings at 20%-plus for years, a pace that is even picking up. Analysts forecast 25% growth in 2022 and 36% in 2023.

Investors have come to rely of these impressive earnings that imply an undemanding PEG ratio of 1.5, and means that the PE will fall sharply ahead, or more likely, power the share price to new records. The stock has increased by nearly 130% in five years.

This is a company firmly entrenched in its many markets – architecture, construction, media, manufacturing and more – making it almost impossible for clients to switch elsewhere.

That creates high levels of subscription-based income visibility every year and has allowed Autodesk to beat the last 10 quarterly earnings forecasts. [SF]

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Danni Hewson

Editor's View

Feature

Great Ideas

News

- THG’s shares take another hit on growth and margin setback

- Why China has bucked a global trend by cutting rates

- Oil hitting $100 could take the FTSE 100 to new record highs

- The trusts trading well below their 10-year average valuation

- Unilever’s food arm could be sold amid shift in strategy

- Wage inflation could hurt many shares

- Billions wiped off the value of construction stocks

magazine

magazine