Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

7% motor racing bond issue could spark investor interest

Investors looking for a better yield than cash and the UK equity market in general might be interested in a new retail bond launching in November with a 7% coupon, paid semi-annually.

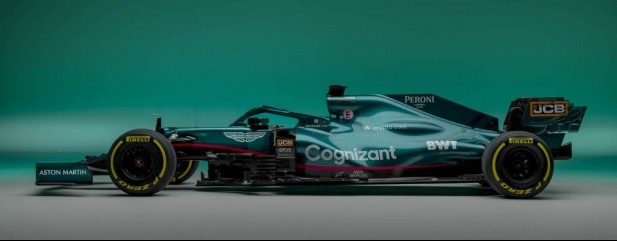

The bond will be issued by AMR GP Finance, a private company linked to the Aston Martin Cognizant F1 racing team.

AMR GP Finance is a special vehicle created to issue the bond and is ultimately controlled by the Aston Martin F1 team owner AMR GP, itself part owned by billionaire Lawrence Stroll who is executive chairman of car maker Aston Martin Lagonda (AML) and the F1 team operator.

The bond proceeds will fund the development of a new campus project and high-tech wind tunnel at Silverstone which is known as the Silicon Valley of the F1 world for engineers.

Two years’ worth of interest on the bond will be held in escrow to ensure coupons are paid for the first 24 months. After that point, it is hoped that the F1 team will have more money coming in from sponsorship deals and prize money to cover the remaining three years’ worth of coupons and repayment of the bond capital.

Bonds are a type of IOU or debt issued by companies looking to attract investment for various corporate purposes. They typically pay an annual coupon with a fixed term.

They tend to be less liquid than shares, so buying them usually involves calling up your investment platform provider to get an indication of price, although customers should pay the same transaction cost as online dealings. New issues on the other hand can be purchased electronically in a similar way to new issues in shares.

The AMR GP Finance bond has a five-year term and can be purchased with a minimum £1,000 then £100 increments thereafter. It will list on the London Stock Exchange’s ORB retail bond platform, which includes bonds from the likes of Prudential (PRU), Severn Trent (SVT) and Aviva (AV.).

Investors tempted by the generous coupon on the AMR GP Finance bond should note the phrase ‘fool’s yield’. Coined by bond hedge fund manager Dan Rasmussen, it refers to the fact that higher yielding bonds have historically given investors poorer returns than lower yielding, but better-quality bonds. That’s because poorer quality bonds are more likely to default than higher quality, and lower yielding investment grade bonds.

While the high yield on the AMR GP Finance bond suggests that some caution should be exercised, the F1 team owner appears to be seeing some momentum and was trading close to EBITDA (earnings before interest, tax, depreciation, and amortisation) break-even in the six months to 30 June.

The company has seen a 300% increase in sponsorship income to around $300 million demonstrating the pull of the Aston Martin brand.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine