Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

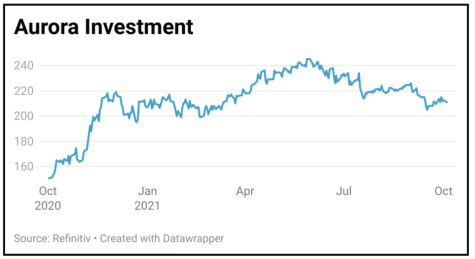

Aurora should benefit if value comes back into fashion again

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

A rotation out of value and back into growth saw our gains on Aurora Investment Trust (ARR) eroded in recent months but signs that bargain stocks are back in favour could help reverse this trend.

The first half results revealed an 8.5% increase in its net asset value, lagging the FTSE All-Share’s commensurate 11.1% return.

However, with a shift in sentiment potentially helping Aurora, this underperformance could well be turned on its head in the second half.

Post the period end shareholders approved Aurora’s investment in sister fund Castelnau, an investment trust which will also be run by Phoenix Asset Management.

Castelnau is set to account for 15% of Aurora’s holdings and it will hold a mixture of quoted and unquoted businesses, some of which are currently held directly by Aurora but those positions will be exchanged for shares in the new vehicle.

The new investment trust’s strategy is to revamp old-fashioned British businesses, including names such as toy train outfit Hornby (HRN:AIM) and stamp dealer Stanley Gibbons (SGI:AIM). Read more about Castelnau, which floats on 18 October, here.

SHARES SAYS: We remain fans of Aurora’s approach of buying solid, undervalued businesses. Buy.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine