Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Rethink your property investments

The property sector is facing its biggest test since the 2016 Brexit vote, with the coronavirus pandemic leading to a new wave of property fund suspensions, dividends being cut and a collapse in valuations.

People have been left to question if investing in commercial property is still a viable option and whether it can be relied on for income in the same way as before.

However, not all parts of this market have been affected equally, with certain areas like logistics, specialised residential and alternative assets holding up very well. Going forward it will become even more important to be very selective with exposure to property.

Read on to discover the risks facing various parts of the property space and three stocks which we think will provide a safe home for investors’ money.

WHERE SHOULD INVESTORS LOOK?

Tom Walker, fund manager of Schroder Global Cities Real Estate (B1VPTY7), recently told the Shares/AJ Bell Money & Markets podcast: ‘We see the traditional real estate portfolio that comprises of offices and retail and maybe a smattering of industrial or student housing as just being a complete anachronism. It really is not relevant anymore.’

Walker focuses his property fund on areas like healthcare, data centres, logistics and self-storage where it is possible to identify structural demand drivers, saying that coronavirus has really only accelerated trends which were already in progress.

Many investors may not have chosen to have exposure to these areas, instead they are likely to have followed the traditional route of putting money into skyscrapers and shopping centres.

If you want to understand what Covid-19 has meant for UK property in microcosm then the recent full year results statement from the large diversified real estate investment trust Land Securities (LAND) is a good starting point.

More than 80% of its assets are in offices and retail, traditionally the dominant sectors in commercial property. The value of its portfolio was down 8.8% year-on-year with the retail segment down 20.5%. Lockdown arguably accelerated the trend towards online retail which had already been hurting high streets and shopping malls for several years.

Just 63% of Land Securities’ rent had been collected within 10 days of being due in March and early April compared with 94% a year earlier; and it expects collection rates to get worse.

What was particularly telling was the revelation that only 10% of its office sites are currently being used as people have followed guidance to work from home if possible.

A key question is whether in the long term working from home will represent the same threat to offices as web-based shopping has

to retail property assets. This could hit the valuation of offices in a way which hasn’t come through yet.

Why some property funds have been suspended

Trading in upwards of 10 open-ended property funds remain suspended after going into hibernation in March. Volatile market conditions meant these funds’ assets became hard to value and this in turn

meant they couldn’t accurately give a price for what the units investors buy and sell should be worth.

In 2016, in the wake of the referendum vote, funds were forced to close as market panic caused a flood of redemptions and funds didn’t have sufficient cash on hand and were unable to sell assets quickly enough to pay back shareholders.

Investment trusts are often seen as a better vehicle for assets like property, which are harder to buy and sell in short order, because they are listed on the stock market and the fund managers don’t have to factor in redemptions to how they invest. However, they will typically trade at a discount to net asset value at times of stress.

Will working from home see offices go the same way as retail?

Working from home could become a hard habit to break. For employees it can mean greater flexibility, relief from the daily commute and more time with family. For employers it could mean a reduction in the amount of office space required and the costs this entails.

Barclays’ (BARC) CEO Jes Staley was one of several corporate leaders to question the need for the same office footprint post-corona. Staley said having thousands of workers in expensive city sites ‘may be a thing of a past’ adding that the company would introduce a ‘long-term adjustment to our location strategy’.

Worryingly for the owners of offices, comparisons are increasingly being drawn with the impact online retail has had on the valuation of high street shops and shopping malls.

An already ugly situation for retail now looks even worse in the wake of lockdown but the trend was clear heading into the crisis. The chart, comparing the share price performance of Amazon, the world’s largest online retailer, and shopping centre landlord Hammerson (HMSO), paints a picture of the internet taking sales from physical stores.

Hammerson’s more heavily indebted peer Intu Properties (INTU) faces a battle for its very survival, recently warning lenders it will default on its debt unless given some breathing room. A constituent of the FTSE 100 just three years ago, the company now has a market valuation of less than £100m.

There are certainly signs of stress in office real estate too. In New York, leasing of new office space has fallen to its lowest level since 2009 according to property services firm Newmark Knight Frank. However, the full impact is arguably yet to come through.

Chief executive of UK regional office investor Circle Property (CRC:AIM) John Arnold says: ‘We feel the concern is more going to arise from the June quarter than the March quarter. The March quarter rent was due at the beginning of lockdown when trading was pretty much as normal.’

Longer term Arnold, perhaps unsurprisingly, expects office working to endure. He says: ‘I don’t think there will be a fundamental shift towards working from home, at some point people will crave a return to work – we’re social beings and I don’t think we work best in isolation.’

Investment bank UBS also believes offices will hold up better than retail assets. It highlights several reasons for holding this view.

They include a requirement for more space and less hot desking to facilitate social distancing and for hygiene reasons, the role of office locations in attracting and retaining talent, the fact that working from home will not be possible for everybody, the social benefits of working in an office and the possibility of alternate use for offices (such as conversion to residential).

UBS comments: ‘While we see some validity in the theme, we see a number of mitigating factors that will likely confine this to a marginal effect. We do not think this poses a threat near the same level as e-commerce did on retail, as some have claimed.‘

Supporting this view, Great Portland Estates (GPOR), a big owner of offices in the West End of London, maintained its full year dividend at 7.9p (20 May) and it said it would look for opportunities to buy assets at a discount. The company pursued a similar approach in the wake of the financial crisis.

Circle’s John Arnold says: ‘Regional offices are more robust than central London as rents in the regions are lower.’

Arnold adds that offices with good car parking facilities may be prized as people are more reluctant to use public transport.

Nevertheless we do think there is considerable uncertainty over even regional offices – a theme we previously saw as attractive thanks to solid demand and limited new supply coming on to the market. In our view it is too soon to be buying into any recovery in this space.

Taking advantage of logistics opportunities

While many property funds are on the back foot thanks to coronavirus, logistics specialist LondonMetric Property (LMP) recently completed a £120m fundraise to invest in a pipeline of opportunities.

Logistics assets, also known as warehouse assets, saw increased demand almost as soon as lockdown was introduced.

Key features of LondonMetric’s portfolio

• Occupancy increased over the year from 98% to 99%

• Average lease lengths of 11.2 years and only 7% of rent expiring within three years

• Contracted income increased from £90m to £123m per year

• Contractual rental uplifts on 53% of income, 60% of which is inflation linked

Source: LondonMetric, as at 30 March 2020

On 24 March property group Savills (SVS) noted it had recorded more than 3m square feet of new requirements for warehouse space in little over a week from major supermarkets, online retailers and pharmaceutical firms.

Growing demand from online grocery providers should be long-lasting as more people get used to doing a weekly shop over the internet and getting it delivered.

According to Savills, UK warehouse supply is just over 35m square feet and vacancy is 6.5% or less in many parts of the UK. There is also just 4.1m square feet of speculative development under construction due for delivery in 2020, with little expected beyond this amount for the foreseeable future.

Against this supportive backdrop, LondonMetric CEO Andrew Jones says ‘the pitch has become less crowded’ as competition for assets has fallen as a result of fewer large investors looking at opportunities in this space.

Jefferies analyst Mike Prew says: ‘The current market conditions are seeing increased opportunities to acquire assets let to high-quality tenants. Notably, Next (NXT) has been selling and leasing back distribution assets and its head office to create liquidity and cash to ride out the Covid-19 disruption.’

Jones at LondonMetric says these lease-back back arrangements are throwing up assets of a quality which wouldn’t typically be available and his company is wasting little time putting newly-raised capital to work. ‘We have agreements on roughly £70m out of the £120m we recently raised,’ he says.

‘I don’t need to predict with any great degree of accuracy how rapidly penetration of online retail in the UK will increase, I just know the trend is heading in that direction. That means less bricks and more clicks and we can play that through the warehousing space.’

London Metric’s shares may not be cheap trading on a 12.8% premium to net asset value but we think they are worth buying as it takes advantage of opportunities in the logistics sector from a position of strength.

A yield of 4.2% based on consensus forecasts looks attractive and sustainable.

Resilient residential

Regardless of the pandemic we will all need a place to live and certain categories of residential property including social housing are proving to be highly resilient in the crisis.

A running Shares Great Idea Civitas Social Housing (CSH) continues to collect rent on time as the Government effectively pays for tenants with learning disabilities and mental health problems.

The company recently increased its dividend target for 2021 to 5.4p, implying a yield upwards of 5% at the current 103.8p.

It’s not just social housing, investors in the private rental space are also doing well. First-half results from Grainger (GRI), the UK’s largest listed residential landlord, were in line with expectations and its own progressive dividend policy was maintained, with the dividend increased 6% to 1.83p.

Chief executive Helen Gordon says the company’s mid-market positioning helps as demand lost at the bottom end of this segment can be replaced by people stepping down from the top end. She adds that the pandemic ‘has reinforced our original strategy’.

‘People rent for a variety of reasons,’ remarks Gordon. ‘They want good quality homes and they don’t want to pay too much for them. We are also focused on things like technology for our residents – including super-fast broadband into each individual apartment.

‘We’ve even had people who were due to leave in August saying please can they stay as they appreciate what they’ve got.’

Around 27% of Grainger’s portfolio is accounted for by regulated tenants who pay below-market level of rents and live in the properties for the rest of their lives. Once a property is returned to the company it is sold at market prices, thereby unlocking the capital value. This cash can then be recycled into higher yielding private rental assets.

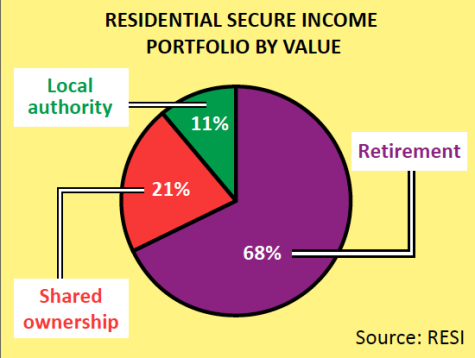

Investment trust Residential Secure Income (RESI) is focused on three classes of tenant which should be less sensitive to what is happening in the wider economy, according to portfolio manager Ben Fry.

This encompasses retirees paying rent out of their pension, people in shared ownership schemes, where their agreement would be void if they don’t pay rent, and tenants backed by local authorities trying to meet statutory requirements for housing in their areas.

Fry says: ‘With these things considered we’re very comfortable with a 5p per share dividend.’ Residential Secure Income currently trades at 88p, so a 5p dividend equates to a 5.6% yield.

The investment trust is also looking to add to its portfolio. ‘We’ve got around £36m left to deploy and we’re seeing some very interesting opportunities,’ Fry comments.

Beyond that he says the company will only raise more cash if its shares are trading at a premium to net asset value (NAV). They are presently trading at a 17.7% discount to NAV.

While Grainger looks well positioned, a yield of a little more than 2% is not particularly compelling. The size of the company does offer some reassurance but we think Residential Secure Income’s more generous yield and well-positioned portfolio is the way to play this theme.

Turning to healthier alternatives

As traditional forms of property lose their appeal there is likely to be increased focus on so-called ‘alternative’ property assets. This includes things like healthcare facilities, self-storage units or even data centres which Schroders’ Tom Walker describes as ‘the new beachfront property’.

Demand for data centres was already increasing ahead of Covid-19 and a likely boost to digitalisation across a variety of sectors, linked to the pandemic, is likely to accelerate this trend.

Jonathan Murphy, the chief executive of GP surgeries and primary care centre investor Assura (AGR), tells Shares the business has largely been unaffected by coronavirus to date in financial terms.

‘Rent collection is as normal and while we have seen some delays on development, these are delays, nothing has been lost,’ he says.

The company has been looking to support the NHS where it can by offering vacant space for nothing, giving over car parking facilities to testing and offering free legal services.

The intention to be a good corporate citizen is also illustrated by the launch of a community fund worth £2.5m aimed at improving health in communities around its buildings.

The impact of coronavirus is likely to create even greater need for healthcare facilities. ‘We are looking at a massive ramp up in acute capacity within hospitals and the only way to achieve that is to move a greater amount of other services out of hospitals and into medical centres,’ Murphy adds.

Against that backdrop, the company continues to invest for growth with a £77m development pipeline, £67m worth of acquisitions in the legal stage, and asset improvement projects worth £17m. A £185m fundraise, which completed on 7 April, gives the business plenty of financial headroom.

JP Morgan Cazenove comments: ‘The shares are trading at a 23% premium to estimated adjusted NAV in 2021, but we believe the positive sector dynamics and 4% dividend yield should help bolster the shares.

‘The market is paying a premium on Assura’s defensive characteristics and we would expect it to continue to do so while interest rates remain low and recession risk remains high.’

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine