Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Investing in life sciences through funds

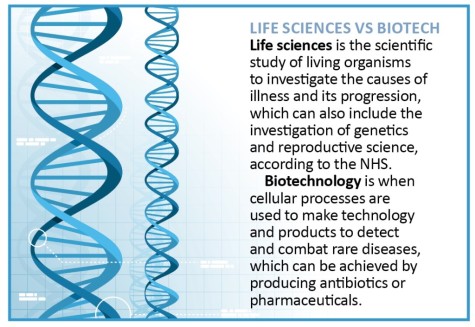

Despite the UK being a world leader in the life sciences sector it can be difficult to find London-listed companies which operate in this space compared with biotech or drug development specialists.

Investing via funds is an easier way to get exposure, particularly as you can access companies in the UK and overseas. We’ll talk you through some examples later in this article.

Life sciences can be applied in a number of areas, including the investigation of illnesses and their progression and the role of genetics in diseases.

Medical and scientific advances are expected to drive the life sciences industry forward, as well as a growing and ageing population and improved access to healthcare.

How valuable is the sector?

The life sciences sector is currently worth an estimated $1.2tn and is anticipated to hit $1.5tn by 2021.

Investment manager Downing believes the UK life sciences sector is booming with £1.13bn raised by names active in this area in 2016.

Elizabeth Klein, an investment consultant at BioScience Managers, says increasing healthcare demand and the drive to cure diseases with no diagnosis is pushing support for life sciences.

‘There are lots of incredibly innovative companies developing new technologies. However, there is a significant funding gap which prevents them progressing from start-up to the next level,’ says Klein.

We will now explore two funds which provide exposure to the life sciences sector. They are Syncona (SYNC) and Janus Global Life Sciences Fund (IE00BRJ9D748).

Commercialising life science

FTSE 250 constituent Syncona aims to deliver returns by maximising the value from the commercialisation of life science technology and treatments for patients.

The investment trust currently has seven life science companies in its portfolio and a stake in the CRT Pioneer Fund, but wants to extend this portfolio to 20 investments in the life sciences sector.

Syncona was originally set up by The Wellcome Trust which owned it until the end of 2016. It then merged with Battle Against Cancer Investment Trust (BACIT) last December.

Investors have access to a £553m investment portfolio and £292m life sciences portfolio. The fund uses money from the larger portfolio to generate returns and pour more into life sciences.

The fund is particularly focused on new areas such as cell and gene therapy as well as DNA sequencing. Growth in these areas offers the potential to address high unmet medical need and challenge traditional operating models.

According to Winterflood, the value of the life sciences portfolio increased by 12.4% to £226.6m in the quarter to 31 March 2017, driven by significant strategic and commercial progress at Blue Earth Diagnostics which is 90% owned by Syncona.

Blue Earth Diagnostics is a molecular imaging diagnostics company that has developed Axumin. This is a radioactive diagnostic agent that detects and localises prostate cancer if the blood level of prostate-specific toxins is suspected to have increased.

Axumin was launched in the US in May 2016 and Blue Earth wants to roll out sales of the product in Europe.

Syncona also has a 42.2% stake in clinical stage gene therapy firm Nightstar. The company is developing novel, one time treatments for patients with rare inherited retinal diseases.

One of the key milestones for Syncona is the start of Nightstar’s Phase III trial in the first half of 2018 for the rare inherited disease choroideremia that can lead to blindness.

Investing in growth companies

Another option for investors is to consider Janus Global Life Sciences. This fund aims to take advantage of long-term drivers of growth in the healthcare sector by investing in companies which are addressing unmet medical needs. It also looks for businesses that make the healthcare system more affordable and efficient.

Among its top holdings are established companies such as FTSE 100 pharmaceutical groups Shire (SHP) and AstraZeneca (AZN), as well as overseas-listed giants Eli Lilly and Sanofi.

In the second quarter of 2017, the fund benefited from strong gains in global healthcare stocks thanks to an uptick in new drug approvals and fewer concerns about healthcare reform in the US.

According to asset manager Janus Henderson, potential new product launches this year should help further drive growth in this sector.

Janus Global Life Sciences Fund has achieved 21.9% annualised returns over the past five years.

High risk route

BioPharma Credit (BPCR) is another way to invest in the life sciences sector, but we are cautious on the fund as it is too complicated for the average person to understand and is high risk.

It invests in debt associated with the life sciences sector and uses royalties as collateral, mostly linked to products whose patents expire in the very near future.

BioPharma Credit plans to reward investors handsomely as it targets an annual dividend yield of 7% and a net total return on its net asset value of 8% to 9% in the medium term.

Investors should always be prepared to take a long-term approach to investing in the life sciences sector. (LMJ)

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine