Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Latin America was a dog of a performer (again) in 2015, hampered by plunging commodity prices, sliding currencies and in some cases political uncertainty and poor policy response to the economic challenges.

At least markets may be nearing the point of maximum negativity toward the region, particularly in the case of Brazil, and this may tickle the interest of contrarian investors. But it is not immediately clear what catalyst could develop in 2016 to crystallise the value case for Latin American assets.

Commodity price strength could be one and political change another, while an end to the dollar’s rip-roaring upward run could potentially provide succour as well. Unfortunately, the markets do not appear to believe any of these three scenarios are too likely for 2016, judging by the continent’s dismal end to 2015.

Politics

Brazil’s President Dilma Rousseff is under threat of impeachment, as the multi-billion dollar graft scandal involving local oil giant Petrobras rumbles on and on and on. However, the next election is not due until 2017 and her opponents in Brasilia may prefer to let her suffer for two more years rather than take on the job of cleaning up the mess themselves.

Meanwhile Rousseff’s Mexican equivalent, Enrique Peña Nieto, is struggling to get his reform programme off the ground but markets may be about to embrace the potential for change in a different country.

New broom

Argentina has a new leader after October’s ballot and November’s subsequent run-off. The Conservative Mauricio Macri beat the incumbent Peronist party’s selected candidate, Daniel Scioli.

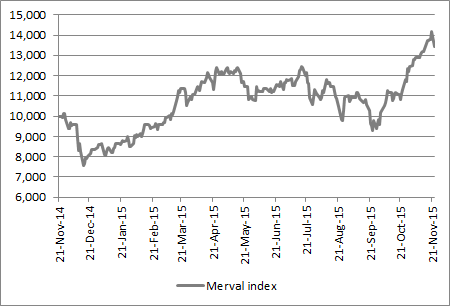

Macri has thus ended the 12-year reign of Nestor Kirchner and his wife Christina and the local Merval stock market index has already latched on to his pro-business, pro-reform agenda, although inflation of (at least) 14% and a slumping currency means he has a lot of work to do.

The Buenos Aires stock market is welcoming a new President ...

Source: Thomson Reuters Datastream

... even if a sliding peso means he has a tricky inheritance

Source: Thomson Reuters Datastream

The only general election slated for 2016 in the region will be held in Peru. Incumbent Ollanta Humala cannot run owing to constitutional term limits.

Several candidates are already jockeying for position, including two former Presidents, Alan Garcia and Alejandro Toledo.

Economics

Peru looks relatively stable politically and economically too – but the key word is relative. The sol slid against the dollar and inflation crept higher, forcing the central bank to hike interest rates for the first time in four years in September.

Brazil also jacked up borrowing costs as inflation reached a 12-year high of 10% and its currency plunged to an all-time low against the dollar, above R$4.00, even if its economy didn’t need higher rates just as commodity prices slumped – the result was two consecutive quarters of negative GDP growth and a technical recession.

Rising inflation forced Brazil to increase interest rates ....

Source: Thomson Reuters Datastream

... even as the economy tipped over into a technical recession after two quarters of falling GDP

Source: Thomson Reuters Datastream

Weak raw material prices also hurt Chile and Colombia. Their respective currencies, both called the peso, fell against the dollar as markets priced in the prospect of tighter US monetary policy and also economic weakness across the southern American region.

Markets

Latin America has underperformed global equities since 2009. This chart below divides the value of the MSCI Latin America index (in sterling terms) by the FTSE All-World benchmark (also in sterling terms). If the line rises, Latin America is outperforming and if it falls it is underperforming.

Latin America has been a poor performer since 2009

Source: Thomson Reuters Datastream

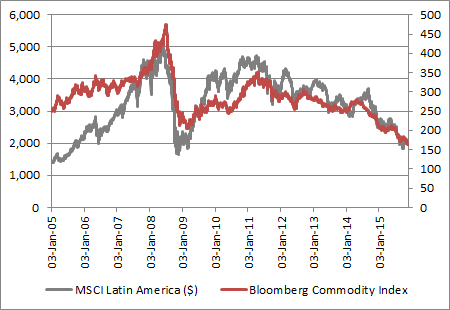

The trend is clear enough and as the next chart shows a lot of the blame for this lies with the commodities markets.

Any improvement in commodity prices could help Latin American stocks

Source: Thomson Reuters Datastream

Latin America has largely tracked the Bloomberg Commodity index, which itself follows the futures price of 22 raw materials.

The way ahead

Brazil and Peru are pro-actively tackling their inflation problems with interest rate rises and at least the region has underperformed horribly for several years, so perhaps markets are getting to the point where matters can hardly get any worse.

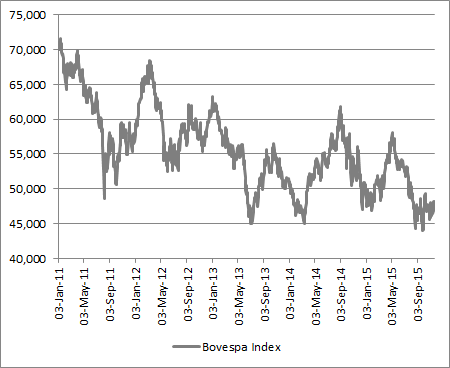

After all, Brazil’s debt was upgraded to investment grade when the BOVESPA index stood at 68,000 and downgraded in 2015 back to junk when the stock market stood at 46,000.

Brazil’s Bovespa index has slumped since Rouseff became President

Source: Thomson Reuters Datastream

Perhaps an impeachment of Brazil’s President Rousseff could even please the market, if the result is then a swing to the right and more market-facing reforms.

Investors are already warming to a similar shift on the Argentine stock exchange in Buenos Aires and Mexican stocks initially soared in response to the reforms offered by Enrique Peña Nieto in summer 2012.

Equally, a turnaround in the price of key commodities such as oil, copper and sugar would potentially be of great benefit to the region’s economies and corporations.

AJ Bell’s top tracker for Latin America

AJ Bell’s free investment guidance service is based on our list of sixteen Top Trackers. One of these covers Latin America, although not in a direct way.

The UBS Emerging Markets tracker has the EPIC code of UB32 and a SEDOL of B76HL88. It comes with a 13% weighting toward Latin America, although Asia is more heavily represented at 69% of the assets under management.

The tracker also provides exposure to Eastern Europe, Africa and the Middle East.

This tracker does not feature in the Cautious portfolio but represents 7% of the Balanced and 15% of the Adventurous portfolios.

These articles are for information purposes only and are not a personal recommendation or advice. All data shown is correct at the time of writing.

View all World Investment Outlook articles