Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

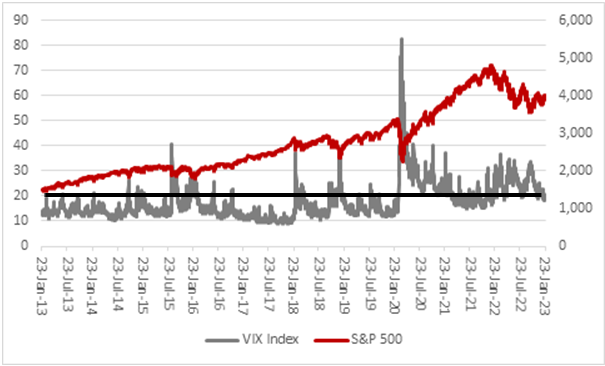

“America’s VIX, or ‘fear index,’ is dipping below 20, CNN’s Greed and Fear index is back into ‘greed’ territory at 65 and Bitcoin and meme stocks are leading a broad-based, ‘risk-on’ rally, as investors decide that inflation is peaking and global interest rates are set to do the same,” says AJ Bell investment director Russ Mould.

“However, mood follows price, as the old market saying goes, and investors must still coolly assess whether this really is the start of the next bull market or merely another wicked bear-market trap that will catch out the unwary and inflict more pain upon them.

Source: Refinitiv data

“Some investors may be understandably inclined to think that happy days are here again.

“Bitcoin is up 40% from its lows, even as auditors, investigators, lawyers and the courts pick over the bones of the collapsed FTX crypto empire. Meanwhile, the US-listed Valkyrie Bitcoin Miners Exchange-Traded Fund (ETF), which tracks a basket of 24 stocks, is up by more than 100% in January alone.

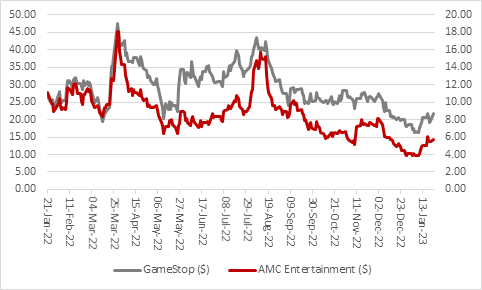

Source: Refinitiv data

“Reddit-crowd favourites GameStop and AMC Entertainment are up by 25% and 44% in 2023 to date.

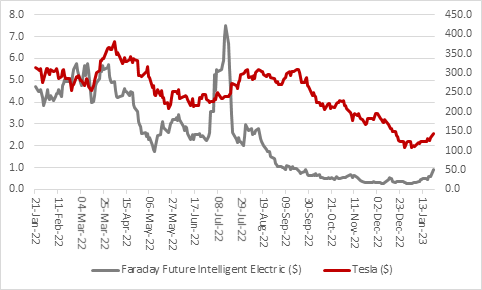

Source: Refinitiv data

“Electric vehicle stocks are buzzing again, too. Buoyed by promises that initial production of its FF91 car will begin in April of this year (subject to the availability of further funding), shares in Faraday Future Intelligent Electric have trebled in January, while industry heavyweight Tesla is up by a third.

Source: Refinitiv data

“However, even the most ardent fan of any of these assets or securities will have to acknowledge that none of these advances offset the declines registered in 2022. Nor do January’s gains necessarily break the depressing sequence of lower peaks and lower lows on the price charts that is so typical of an ongoing bear market.

“Caution may be needed for two further reasons.

“First, it is very unusual for the leaders in the previous bull market to be market darlings second time around (not least because so many people lose faith in them because they lose so much money in them).

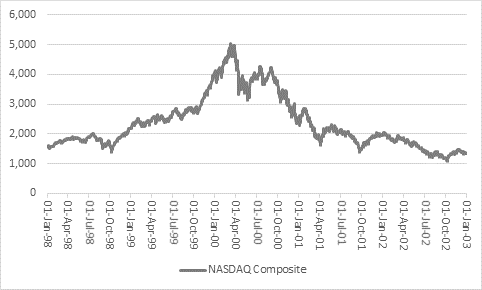

“Second, these rallies could just be the latest bear market trap – and bear market traps hurt. After the technology bubble of 1998-2000 burst there were no fewer than nine major rallies in the NASDAQ. They produced an average gain of 23% during technology stocks’ last major fall from grace and all they did was expose buyers to a fresh mauling from a bear market as the NASDAQ plunged by 78% from its March 2000 peak of 5,049 to its October 2002 low of 1,114.

| NASDAQ Index start |

NASDAQ Index finish |

Rally | Subsequent fall | ||

|---|---|---|---|---|---|

| Peak | 10-Mar-00 | 5,049 | |||

| Start of rally | End of rally | ||||

| 15-Mar-00 | 27-Mar-00 | 4,583 | 4,959 | 8% | (33.0%) |

| 14-Apr-00 | 01-May-00 | 3,321 | 3,958 | 19% | (20.0%) |

| 23-May-00 | 17-Jul-00 | 3,165 | 4,275 | 35% | (28.1%) |

| 12-Oct-00 | 23-Oct-00 | 3,075 | 3,469 | 13% | (25.1%) |

| 30-Nov-00 | 11-Dec-00 | 2,598 | 3,015 | 16% | (22.6%) |

| 20-Dec-00 | 24-Jan-01 | 2,333 | 2,859 | 23% | (42.7%) |

| 04-Apr-01 | 22-May-01 | 1,639 | 2,314 | 41% | (38.5%) |

| 21-Sep-01 | 04-Jan-02 | 1,423 | 2,059 | 45% | (41.4%) |

| 05-Aug-02 | 10-Sep-02 | 1,206 | 1,320 | 9% | (15.6%) |

| Bottom | 09-Oct-02 | 1,114 | |||

| Average | 23% |

Source: Refinitiv data

“Two rallies produced gains of more than 40% and one of more than 30%, but still buyers were lured to their doom as the combination of lofty valuations, high expectations and earnings disappointments proved too much for share prices to shake off.

Source: Refinitiv data

“Students of market history will also note how only one rally reached the previous peak and every subsequent retreat set a fresh low, to gradually beat any positive sentiment out of dip buyers.

“Right now, buyers are hoping for help from the US Federal Reserve, in the view that a peak in inflation will permit the American central bank to slow down the pace of interest rate increases, pause them and then finally pivot to rate cuts.

“A consensus is gathering that the Fed will only go for a quarter-point rate rise on 1 February, after December’s half-point increase ended a run of four consecutive 0.75% increases in June, July, September and November 2022.

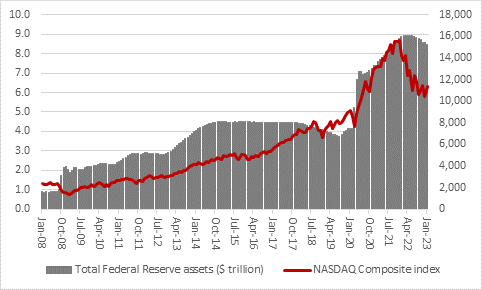

“That offers the prospect of the hoped-for slowdown, pause and pivot as well as, perhaps an end to the $95-billion-a-month Quantitative Tightening (QT) programme, which is also draining liquidity from financial markets.

Source: FRED – St. Louis Federal Reserve database, Refinitiv data

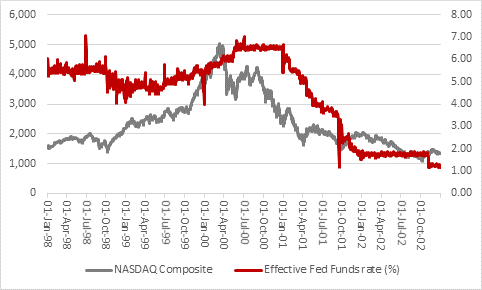

“But even then, investors must not forget that the NASDAQ’s 1998-2000 bubble collapsed in 2000-2002 even as the Fed was frantically cutting interest rates from 6% to 1.25%. The US central bank hiked rates from 4.50% to 6.00% in 1999 and 2000 and that had already helped to pull the rug and prompt a repricing of growth stocks. Moreover, the Fed changed course only because the markets and the economy had cracked, but necessarily because it was still in full control.

Source: FRED – St. Louis Federal Reserve database, Refinitiv data

“On that occasion bears did indeed decide to ‘fight the Fed’ – and they won, again because the NASDAQ’s gallop higher had left valuations so stretched, encouraged so many new firms to list and set expectations so high that eventually stocks could not sustain their price tags, new issuance swamped would-be buyers and earnings failed to live up to their billing.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05