“Cocoa’s meteoric rise may be dominating the attentions of commodity traders, as will renewed gains in copper, oil and gold, but silver may also start to creep onto their radar, as the precious metal nears a five-year high,” says AJ Bell investment director Russ Mould.

“This could yet capture the imagination of stock market investors, too, at least if they are inclined to be contrarian, as shares in FTSE 100 silver miner Fresnillo and FTSE 250 counterpart Hochschild Mining trade no higher now than they did in 2008, when silver was less than half its current price.

Source: LSEG Datastream data

“Silver started to move in earnest last autumn, rather like gold, just as financial markets started to wonder whether the US economy was running hotter than expected, with the result that inflation could run higher for longer than expected, a view which gained further currency last week with the strong American non-farm payrolls numbers. Throw in rampant US government spending, and how inflation on the other side of the Atlantic seems to be reaccelerating, and investors and traders may be on the hunt for stores of value once more.

Source: FRED – St. Louis Federal Reserve database, US Bureau of Labor Statistics, LSEG Datastream data

“Silver may catch the eye of contrarians even more than gold, as it trades way below the $48-an-ounce peak reached in 2011 (and before that in 1980, when the Bunker Hunt brothers’ attempts to corner the silver market came badly unstuck). This is a contrast to gold, which stands at new all-time highs, north of $2,300 an ounce.

Source: LSEG Datastream data

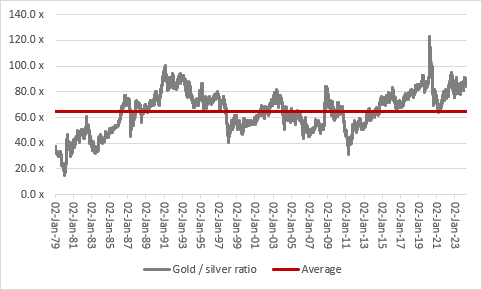

“As a result, the gold price currently trades at nearly 85 times that of silver, whereas the long-term average is a multiple nearer to 65 times. That may be enough to persuade some investors and traders that silver is ‘cheap’ relative to gold.

Source: LSEG Datastream data

“Sceptics will be less interested. They will argue that physical silver offers no yield and comes with a cost of ownership, such as storage and insurance, which means there is a negative carry relative to cash. They will add that the lack of yield means valuing the metal is nigh-on impossible and thus argue its intrinsic value can only be measured relative to the all-in sustained cost (AISC) of producing it. In the case of Fresnillo, the world’s largest silver miner with 56 million ounces produced in 2023, this lies between $20 and $22 an ounce at its Fresnillo and Saucito mines in Mexico, below the current spot price for the metal.

“Bulls will counter that this means silver miners’ profits could start to surge, all other things being equal, although 12% input cost inflation in 2023, plus currency movements and even theft, resulted in lower profits and a dividend cut at Fresnillo last year, to suggest that sitting on a silver mine is not the easy source to riches that many would assume.

“Such missteps help to explain why Fresnillo’s shares trade at levels no higher than those seen in 2008, while a proposed ban on new open-pit mining permits in its home country of Mexico is a further dampener to sentiment. Even so, patient contrarians could be tempted to take a second look, given the apparent disconnect between the share price and the silver price.

Source: LSEG Datastream data

“Shares in FTSE 250 index member Hochschild Mining are showing a little more life, perhaps due to how its operations are based in Peru and Brazil and an AISC that is lower than Fresnillo’s, at around $18 an ounce.

Source: LSEG Datastream data

“Again, both shares really need the silver price to shine if they are to do the same, and that may need markets to decide that inflation could turn out to run higher for longer. The US government bond, or Treasury, market looks to be pricing this in, as expectations for rate cuts from the US Federal Reserve recede to two or three from January’s estimate of six, according to the CME Fedwatch service and a rising benchmark ten-year yield both suggest.”

Source: LSEG Datastream data

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30